Absolutely

Sending anything document-wise by post should go by LRAR so you have a receipt and a signed return docket. Don’t forget to take copies too but normally in France unless absolutely specified to do so, copies of personal documents are usually accepted and the norm. Currently the post is being hit by the strikes so anything urgent might take longer unless you opt to pay for a courier service which is expensive but would get there.

I think there are a range of views on this forum (judging by the reaction to the situation experienced by Geoffrey). My own view is that a translation of an official UK marriage certificate is absolutely not required for this type of CdS.

The EU definitely doesn’t require a translation for its CdS. The rules (ie regulations) are set by the EU and individual countries have, in theory, very limited discretion. However the ‘wild card’ as always, is the interpretation of the particular person you’re facing in the Préfecture ! Personally I would be polite but very firm if anyone in the Préfecture tried to state this was necessary. I’d invite them to show me where in the EU regs it requires this. It worked for me when the Préfecture lady tried to argue my (EU) wife’s attendance was a requirement. She backed down immediately when I pointed out it’s not a requirement. Others may prefer to play safe!

George, I’m working hard on my French but I wouldn’t be brave enough to argue with an official. It is however very good to know what they should be doing.

I’ve just gone through the next stage of the admin settling in trail, so as before I’ll put down the details in the hope someone will find it helpful. Last Tuesday May 16th I posted my tax return by courier so hopefully it should arrive by the deadline of May 22nd. I followed the advice given in the French govt website to submit a paper application for the first submission.

I downloaded forms 3916, 2042 and 2047

2024 was just general information. 2027 was to avoid double taxation and 3094 was to give foreign accounts bank details. Since between us we have three UK bank accounts I had to complete this form three times!I. As our income is from a foreign source there was another form to fill in but I ignored this as I couldn’t understand what information was required or where to put it . I took my completed forms to the nearest tt in the hope that they would check it and accept trésorerie but basically they said it was nothing to do with them but gave me the correct address for posting which was the central finance department in Angoulême

I feel I made two bad mistakes. I should have at least attempted to request a tax number which I could have used to complete my property declaration which needs to be done by June 30 th. Also I should have tried to arrange a rdv at the central finance department in Angoulême which I shall now have to do if I am not informed of my tax number before June 30 th.

My next task for which I again need my tax number is to see about exchanging my UK driving licence for a french one. Having read some of the comments in other threads I am not sure I even have to do this. I am in my mid 70s my UK driving licence has an English address I am able to use. It is due for renewal at the end of next year. I have a five year carte de séjour which started Dec 2022. So I shall go back and check these other threads. Hope these comments are of some use to someone

For your driving licence you apply to exchange it six months before it expires. It’s quite straightforward now. You should not renew it in the Uk using an english address as the terms and conditions of doing so are that you are a UK resident.

For the tax number there is a way of getting it that I’ll try to link.

Thanks Jane that could be very useful. I also understand that I need to exchange my license within a year of becoming resident so the sooner I do it the better.

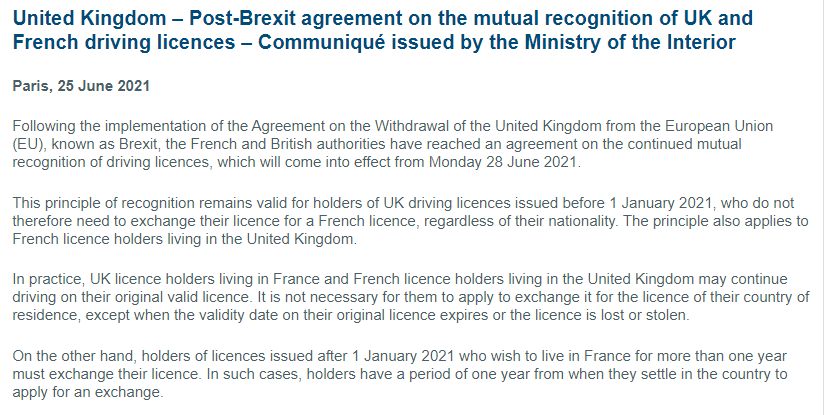

Not if it’s a UK licence. You only need to exchange it when it, or the photo card, is about to expire. You also need to apply for a French license if your UK licence is lost or stolen, or if you commit a traffic offence that results in a loss of points.

Not quite right, that applies to those with WARP CdS. Newer French residents have one year to exchange it (AFAIK🤔)

I forgot that - you are right! Geoffrey needs to exchange within 12 months. But it is pretty easy now as long as you don’t select “retraité”

retraité ??

![]()

![]() in the context of one’s Driving Licence… "retraité " might well mean you’ve been a bad-boy

in the context of one’s Driving Licence… "retraité " might well mean you’ve been a bad-boy ![]()

![]()

When you start theapplicstion to exchange your licence you have to select a category for yourself from a drop down list. One of these categories is “retraité” as in retired. But this only applies to people in receipt of a French pension. If anyone else selects it then the application willbe reje ted.

I still have my UK licence. I should have lost 4 points in the past few months due to 2 speeding offences (it was my car but not me driving… honest, guv!) . In both cases I received the amande which I paid, but it’s been ages now and I’ve yet to receive the follow-up letter telling me to send off my licence.

The funny thing is that I wouldn’t have minded too much… My licence isn’t due for renewal until next year. I’ve been toying with the idea of learning to ride a motorbike but the local auto ecole insists I can’t do it without a French licence (I’ve been advised by several different people that’s incorrect but trying to convince someone in deepest, darkest Medoc that they’re wrong and I’m right is a futile exercise). I’d have happily sent my UK licence off and taken the points if they’d returned a French one in its place ![]()

If you live here you need to change your UK license for a French license….no ?

And if you did not do it by a certain date you have retake your test in France ?

I thought that was the rule since Brexit.

Or have the rules changed ?

No need to exchange it if it was issued prior to Jan 2021 as the UK & France eventually agreed to recognise each country’s licences.

We arrived pre-Brexit. Back in 2020 ANTS refused to swap over our licences pending the outcome of the Withdrawal Agreement discussions.

But you can change your license if you want to ? So you can do your motorbike test.

Nope, tried that. ANTS refused our applications.

You cant get banned from driving then. Thats not fair ![]()

Before, if you had a speeding ticket you had to get a French license so they could nick your points. Which is obviously not the case now.

But if you comitted a serious offense ?

What happens ?

Haha… I’ve already told all my French mates that if they get any speeding fines to just pay the fine but say it was me driving ![]()

I’m really not sure what they’d do if it was more serious than getting flashed doing 95 in an 80 zone. Perhaps I’d get a visit from the Gendarmerie. Not too keen on finding out though.