After being fortunate enough to have benefitted from a group health insurance through my ex, I am now confronted with an urgency to find a mutuelle or complementaire sante for the first time in France. It is indeed very confusing especially for seniors who will pay much more. I know I will be reimbursed a lot less than I was before but I am trying to get some objective opinions about which mutuelle or complementaire sante worked out well, especially if you got it on an individual basis and not from an employer. I have been reading reviews and most are dismal. Either they are misleading about what they are going to reimburse and how much, or they have impossible customer service where you can never contact them to solve an issue, etc. I realize its difficult to evaluate because obviously its like comparing apples and oranges. Impossible for me to understand all the language written in the contract about how much will be out of pocket. Once you sign up you are stuck for a year so I would like to make a good choice. Anybody have experiences to share, good or bad?

Susan…

Go in and talk with Insurers personally… face to face is often easier, (especially for anyone with limited French)…

Hi Susan

You absolutely need to use this guy Fabien - he is a broker who has saved us a fortune and gone on to become a good friend. I cannot recommend his services highly enough. He will explain everything (in perfect English!) and make sure you don’t get ‘diddled’ - tell him I sent you!

Good luck!

Catharine x

http://www.survivefrance.com/t/insurance-brokerage-services-from-fabien-pelissier/13734

Yes, highly recommend Fabien to get your Mutuelle sorted out

Thank you all for your help. I did see one of them face to face. It was helpful because I understood a lot better how that works, what 100 percent means (not much) etc. I do not have a language problem, I speak very good French. I suppose now I should compare with another. Where I live there is Maaf, Matmut and AXA practically next to each other. It is a slight advantage to be able to walk into the office if I enroll instead of waiting on the phone all the time if I had an eventual question. I was hoping for names of insurers that people were pleased with. I don’t really know what a broker is. That is an English word. Is that the same thing as a “courtier” in French? I am just a bit skeptical because how do they get paid? Do I have to pay them a fee or are they paid a commission? If that is the case, how can they be neutral?

A broker is a ‘courtier’ and if you read the article you will see that Fabien is independent and thus provides impartial advice. Brokers (in any sector) will be paid commission on any policies sold (whether life insurance or pensions/ loans etc) - the key is finding one who is good at his job. In this case with @fabien we have done this for you!

Susan Ehrlich

The “proof” of a good Broker is clear… when the Clients recommend that Broker again and again…

A Broker who has not done the best for his Clients, will soon be found out… and will lose out on the “word of mouth” …

Fabien has been recommended and used by many folk on this Forum… Why not contact him and discuss your needs… you have nothing to lose but the cost of a telephone call…

Why not contact him and discuss your needs… you have nothing to lose but the cost of a telephone call…

Hi Susan, I’m jumping in the conversation as Catharine mentioned me (thx by the way ;)). I can understand that it’s easier to walk into an office (especially if your French is pretty good) but it’s important to understand that the job of a broker is mostly to compare policies… in the end you’d be insured (and managed if you prefer) by the insurer advised by the broker (assuming you follow his/her advise of course ;)). Of course it is also possible to be managed by the broker so in the end it’s up to you to decide the kind of relationship you’d like to have or the kind of intermediary you’d like to go with (a broker, a local agent or the company directly). Happy to have a chat if you’d like, (services are for free that goes without saying),

Thank you for your help but I don’t understand the differences you are mentioning and also how the broker gets paid and by whom.

Hi Susan

Why not send a message to Fabien… so that you can arrange to chat with him… talk things through… ask him your questions…free advice… and all it will cost is your time and the phone call…

Your original post said the matter was urgent… so if you don’t want to talk with Fabien… you will need to visit your local agencies…

The broker gets paid by the companies (each companies he has a contract with… in my case we are working with 80+ companies in France) for each policy sent to the company we get a commission (the final price is the same whatever you go to a local agent / agency, a broker or the company directly). To take an example, if I do a comparative analysis an advise to go with SWISSLIFE, say you agree with that, then SWISSLIFE would be paying me for the contract and you would pay your policy directly to SWISSLIFE as usual.

As @Stella said, happy to talk about that on the phone if you’d like a more in-depth explanation (05 35 65 97 42) or go to your local agent whoever suits you the best

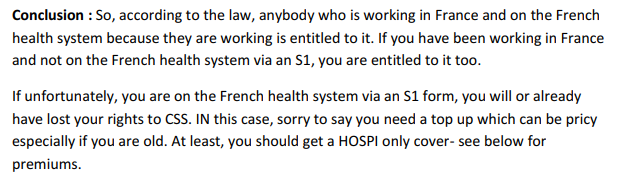

A recent article from Isabelle Want BH Assurances on changes to the law in May 2022 which (amongst others) impacts S1 holders:

complementaire sante solidaire.pdf (53.4 KB)

If I understand things correctly… those of us on S1 are NOT entitled to the CSS and should provide our own Mutuelle…

That’s my understanding too and why I thought it might help information wise.

Some may of course be impacted by this without necessarily realising it.

This came up last year when the tightening first started to be implemented. As ever it wasn’t well publicised so caused confusion. So good that this is now clarified