Hello, my stepdaughter, British but with French residency, is back in the UK for a few months as a student. She is still fiscally resident in France. While in the UK she receives Universal Credit. I wonder how she should declare this on her French tax form… does anyone know which form it should be included on?

with thanks in advance for any help

Roger

Interesting question.

a few questions for clarity…

- were these payments made in the 2020 tax year now in view for reporting in 2021?

- as she (presumably) has her own French tax account with the French fisc, does she have the ability to access her account online?

- are the payments taxed in the UK?

If she has access to her own account, she could ask the fisc the question (in French) when she logs in using the Messagerie sécurisée facility to get a more definitive answer as it seems she is responsible for her own tax affairs.

Universal Credit isn’t a taxable benefit in the UK. See list of taxable and non-taxable benefits, in case you (anyone) is interested.

1 Like

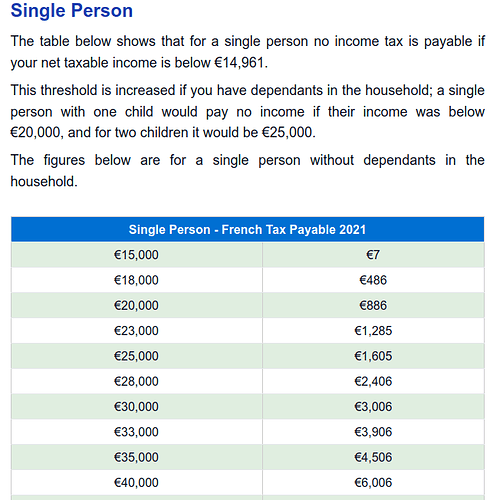

Thanks for that Izzy. That seems to solve one issue then about the possibility of double taxation but I wonder if the amounts paid, which will need to be reported to the fisc as income from the UK, may still then be subject to French tax if the amount paid exceeds the level before tax becomes due for a single person in the French taxation system and whether being a student impacts on the amount allowed. Perhaps some research for tomorrow but the fisc are going to be the arbiters of what’s allowed and that will still need an approach to them (electronically) as suggested in my earlier response to the OP.

You’ve got to be pretty poor to receive Universal Credit and it certainly wouldn’t take you above the personal allowance level in the UK of £12,500 (for last tax year). Will be interesting to get a definitive answer on the French tax position though, I’m curious now!!

Izzy x

Does this table help Izzy?

Don’t forget one set of figures is Sterling and the other Euro. So at an exchange rate of 1.12 the £12,500 equates to approx 14,000€

1 Like

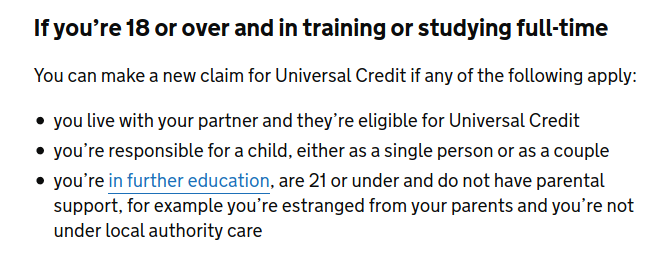

@harry6 I wonder if this reference in English helps explain?

I guess that the UC received in the UK is regarded by France as income and should simply be reported on the Form 2047 but as @IzzyM suggests, the income received may not attract a tax liability against her world wide income declaration.

Yes I would have thought no different from other income that is not taxable in UK, but needs to be reported here.

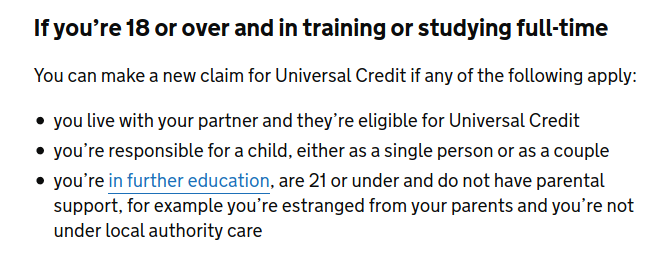

My difficulty is that UC is a benefit that I thought was restricted to UK residents? Remember all the xenophobic fuss about benefits being given to “foreigners”? So not sure how you can be resident in UK for purposes of getting UK, but remaining resident in France to complete tax return.

Obviously it’s possible as this example shows, but demonstrates importance of getting professional advice specific to the exact scenario.

@JaneJones Perhaps it’s explained here

I asked to OP the question about what period she is making the return for as the UC payments may be being made in 2021 but her declaration will be for income in 2020 so adds to the confusion. If she is a British national, repatriated to UK for further education, then perhaps sh is eligible for UC and the French return for 2021 income (if she subsequently moves back to France) will require some thought - there is a section for returnees IIRC - perhaps further complicated by the differerence in fiscal tax years between the administrations (but can be overcome).

I guess it depends on what the criteria that you should “live in the UK” actually means…

thanks to all for your thoughts. I’ll look into it further

Roger

1 Like