Hi folks. I sold an ISA last year. I know I probably should have filled in a form at the time to declare it, but I didn’t. Now I must declare the capital gain. But where is really the right place? is it ok in 2TS or should it be in 3VG? Or elsewhere? Any help would be grateful please…thanks so much.

This reference from 2011 helps explain.

I think the basic tenor of those posts persists today - the advice then was not to cash them in after leaving the UK to live in France.

There is a further reference here which offers further explanation - you may already have researched this.

Are you filing online or on paper and was the sale of the ISA between January 2020 and December 2020 (in which case, the first time to declare it is in the current declaration cycle).

If online, when you log in to your account with the Fisc, there is a place to ask a question and further towards the end of the return, a further opportunity to do so see my guide here

I believe that this is treated as dividends.

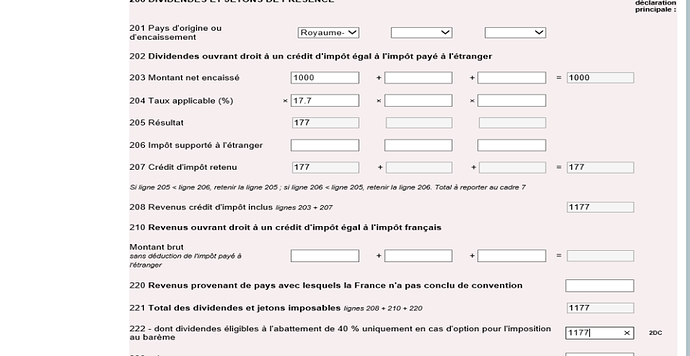

You will need to select the Country (Royaume-Uni) then enter the amount and 17.7% below as shown in the following graphic.

Then you need to manually enter the amount again on line 2DC. And remember to enter the tax credit of 17,7% on section 7

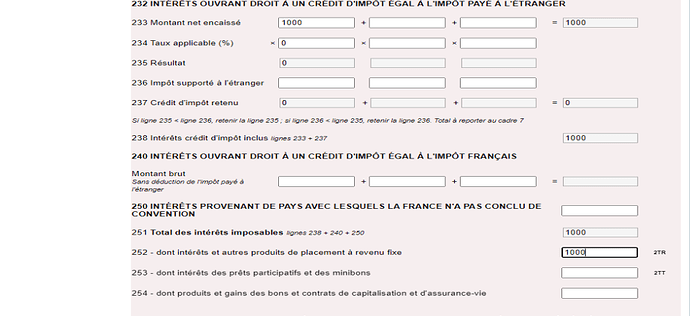

To fill in the interest (premium bonds , ISA, interests,etc). See next graphic.

Select the country, then enter the amount in box 233, 0 below and again in box 2TR.

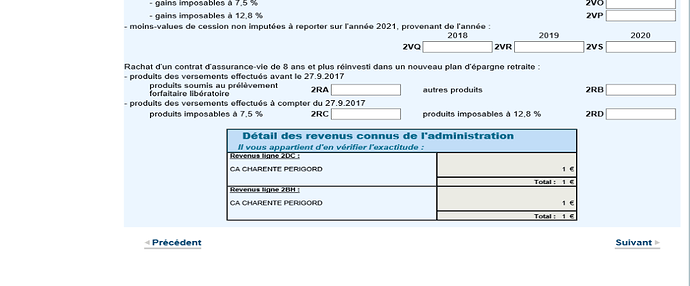

If you already have an amount written on box 2TR for interest, it is written in a box like this below. So you need to add this number to whatever number you have reported from form 2047. Those are interests from French bank accounts.

Lots of references but I hope that they help.

If you are a year late declaring it… just grovel

Better for you to admit it than let them find out for themselves…

You should also know that you should have declared any foreign accounts on cerfa 3916 - either held, opened or closed in a year of declaration. I do think that an ISA falls into that category alongside any UK bank accounts you have retained.

Hi Graham, many, many thanks.

Tomorrow I will study everything you have just told me, but I’ll just answer your questions first in case you’ve got anything to add.

The ISA was a stocks and shares ISA dating from well before I became a French resident. (Yes, I know I should have sold it before becoming a French resident, but I wasn’t aware and when I learnt it, it was too late so I kept it).

I sold the ISA last year in June (2021), I already declared the existence of the account in 3916 last year. It is capital gain rather than interest or dividends.

On line declaration.

Why 17.7%?

Yes, I have 1 other figure in 2TR (foreign bank interest). 204, taux applicable % for this interest is simply the bank interest rate?

Thanks in advance.

As far as I can see, that puts it to focus in the current tax round. If you declare these as “shares”, IIRC there would have been a need to declare it within specified time limits and pay some of the tax in advance. I see that you indicate a stocks and shares ISA but the ISA itself is just a wrapper AFAIK and that might impact the treatment of it for French Income Tax purposes so may be regarded as different in that respect.

You should declare it as closed on cerfa 3916 this current tax round.

This is the difficult bit. The French tax system does not really understand the concept of a UK ISA and it’s treatment in France is subject to much discussion. ie Is it a capital gain or is it interest for example.

I’ve no personal experience of this aspect and your position is now somewhat fait accompli. I’ll look to se if there are any other references on which to draw… how much time have you before your submission must be completed?

Why, indeed. The graphics I posted in this Topic for you were from another source which mentioned ISAs and how they are treated in France (from someone with experience in this field). There may well have been other more tax efficient ways to have handled this, but that is now seemingly gone unfortunately.

For the moment, unless I can find something more relevant or someone else chips in who has addressed this issue with the Fisc, I think your best course of action is to ask them the question directly through the online Messagerie sécurisée on the page after you log in to your account at the impôts site (page 6 of my guide has a graphic of this page).

As outlined, you need to amend that figure to reflect the additional interest (assuming that everything else outlined is correct).

Two other questions…

- are you in possession of an S1 (or private Health Insurance)

- have you completed the France-Individual Double Taxation Treaty forms

The answers to these questions may also impact the rate and amount of any tax due. For example, tax credit dividends 17.7% comes in to focus. A change has taken place in that no tax credit should now be due. There is no tax deducted at source from UK dividends - they are paid gross and you cannot claim a French tax credit in respect of UK dividend income.

Complicated, isn’t it…

Indeed, it is complicated.

To answer your questions:

I have carte vitale + mutuelle.

No I haven’t completed a Taxation Treaty form, never heard of it.

I have until 8 June to declare.

There are 2 reasons I asked the question here and not directly to the fisc. Firstly, I believe perhaps I should have declared the capital gain at the time of sale of the ISA, which I didn’t do, so I don’t want to make any problems for myself, better keep a low profile for this. Secondly, as you said it is complicated, and I believe matters concerning foreign income from unusual policies is probably complicated for them too and I’m not sure that even they would give me the right answer. The people who answer the messages are probably low ranking officials.

The main thing is to get the capital gain declared somewhere to avoid any trouble if it gets looked into. And obviously in a way that costs the minimum tax. Thats why I was thinking of putting it in 2TS.

And yes, I’ve already declared the account closed in 3916.

I hope this further information helps, and thanks so much again Graham.

Frankly, I would take the plunge and speak face-to-face with your local Tax folk. As I keep mentioning… Tax Folk are not Ogres!

People make mistakes with their Declarations, that is an accepted fact.

Getting things back on the straight and narrow asap is the important bit.

Your Tax Office should have a “walk-in” facility (might well be a long queue) and/or an appointment facility. Check it out.

I and many others have found that a brief face-to-face works wonders.

Prepare your discussion beforehand, with it written down if your language is iffy.

Many Tax Officers do understand some English and will be as helpful as possible.

They’ll agree/decide just where your sold ISA should be entered and on what form and should be able to discuss the implications re tax/charges.

best of luck, whatever you decide to do.

It’s an important step to ensure you are not taxed twice. For example, if you are a pensioner and are in receipt of a UK Government Service Pension (such as Police, Teacher, Local Authority etc) under the treaty, those pensions can only be taxed in the UK so, whilst you must still declare them in France, you are basically credited for them by filling in the correct boxes on the French return.

On the other hand, if you are a pensioner and in receipt of the State Pension or other income (not income from UK rental property - also only taxed in the UK) that income can not be taxed at source and instead is taxed in France.

This is the link to the France-Individual form and the instructions on how to use it.

Of course, and that’s where the confusion arises as to the treatment of it as I outlined in my second post. If it is to be treated simply as the selling of shares then indeed, you should have declared it within the specified time limits from my understanding. However, I cannot be certain that selling a UK ISA whilst French resident - irrespective of its structure - falls in to that category but is more akin to taking the proceeds of a pension in cash or selling an insurance policy, for example and I think that you should explore that avenue rather than stocks and shares, to overcome any apparent concern that you have not fulfilled your obligations.

Belvins Franks are known as leading tax and wealth management advisers to UK Nationals living in Europe. There is a contact page on the website which you might wish to consider completing in search of more definitive, professional advice on what you should do.

This may of course be at their busiest time but perhaps worth a shot.

Other than that, since there is no central reference as is the case with HMRC in the UK, (each tax office seems semi autonomous in France) it may be suitable to book an appointment at your local office, take all the papers with you and be guided by them. From what others have said, they will go through the process of declaring on line with you present to complete the process.

You should not worry unduly about the Fisc. They understand well the complexities of such foreign structures and France respects that people can make genuine mistakes whilst at the same time welcoming their openness in putting things right before the Fisc find out for themselves with a concern that it was not genuine but an attempt at fraudulent non-disclosure. or worse - tax evasion. They will come down very heavily on such activity.

If a tax official in France gives you a ruling, they will honour it. Always best to obtain it in writing of course for later reference if challenged. Further, if you have declared something in a particular way from a source of reference (the exchange rate used is a good example) keep that source in paper form with the annual tax details/notes you used for your submission as justification. If challenged and you were found to be mistaken, they will correct it of course but very unlikely issue any penalty if they believe it was a genuine mistake. Word of mouth is very difficult to prove your case.

You’re welcome. I hope that you manage to get things sorted. Let us know how you get on - it will help with next year’s guide perhaps to include this aspect since others may encounter similar in the future.

For straightforward questions I totally agree Stella, but for complicated situations like the one we’re discussing, I have my doubts that I would get a good answer.

I’m not scared of them and I have no problem about discussing in French, but I also believe that they are humans and capable of being wrong too.

I did once go to the tax office a long time ago and expected to be sat down to discuss with an expert, but I only got to ask my questions to a young girl at a reception desk. Her replies were very hurried and I got the impression that for some of my more difficult questions she didn’t really know and was guessing a bit.

Probably triaging or filtering at their busiest time. Don’t be disheartened or misled by that experience.

Fair point… no receptionist knows all.

The lady who answered my questions the other week… was upfront and said if it was anything complicated she might have to refer me to the person “upstairs”.

I was number 2 in the queue and she had taken No1 and No 2 (me) inside (leaving everyone else outside) and was, in fact, able to point me in the right direction.

Over the years, on my own behalf and on behalf of others, I have raised many complicated questions with the Tax Folk themselves. Always face-to-face and always speaking with the folk who DO know what they are talking about.

Each of us has our own experiences and they will (and do) vary enormously.

The ISA is just treated as any other capital gain on shares, unit trusts, etc.

You don’t say whether your stocks and shares ISA was a one off purchase or was one where you traded at various times.

You need to declare your capital gain. So you need to work out the cost in euro at the time of purchase (so a lot more complicated is there was trading) and the value in euro at time of sale to determine the capital gain.

Then you need to declare that total gain in 3VG and then any reduction due for the length of ownership in 3SG (50% for a holding of 2-8 years and 65% if more than 8 years).

For further information see also page 141 of the brochure for 3VG and 143/4 for 3SG pratique 2022 déclaration des revenus 2021

It has also been suggested you should complete 2074 for the calculation of the gains, especially as you won’t have any French account statements. However that is probably not needed as this is probably not complex. However, you might want to do it for your own purposes as a justification of your declared figures, if asked.

Interesting - this what I alluded to without direct experience of it.

Worth investigating further and adding this to my (simple) guide for next year perhaps. Is this from your own experience? (to be clear, not doubting your reasoning, just looking for useful content).

Thanks.

Thanks Elsie,

It was a one-off purchase 20 years ago. It just sat untouched all that time until I sold it last year. I have been a French tax resident for 11 years.

Not personal experience but I’d previously made a note of it from mentions in a 2016 Connexion guide, a past Blevins Franks guide and checking by reading the official Brochure pratique 2022 déclaration des revenus 2021

There was mention of some here (incl. DrMarkH) having bought the current Connexion Guide so perhaps they could confirm it is still the case? I have only bought the Connexion Guide once. I wanted another opinion on a relatively uncommon tax query I had on another forum which no one could answer other than speculatively. I did also end up checking with the tax office.

It might also be sensible for PBS to buy a copy for this particular case where the tax might be significant in comparison to the guide cost.

remarkable that you weren’t aware of the France-Individual DTT arrangements. I am almost certain that there are many more equally unaware too and/or misinformed about their rights.

Have you paid tax in the UK which you might now be in a position to recover once the forms are completed and lodged with HMRC? In which event, you may also have paid tax twice…

There’s a chap I meet usually once a year at a car meet. He’s been in France longer than we have and enjoys a brisk conversation about declaring Income. He still does not see the need to declare ALL his pensions on his French Declaration.

Last spoke before covid hit… so I’ve no idea if he ever did get around to correcting things and, quite frankly, I’m past caring now…

I reckon each of us has our “blind spots”…

until they are sharply brought into focus by the Fisc ![]()

Thanks again @anon37731102 I’ll use that reference for preparing next years guide and look out for the 2023 version. I’ll also include a link in the guide to it.

Do you recall when it is normally released?