I still have one Assurance Vie contract. Prudential wrote to me this year to tell me that I now need to report the surrender value of foreign life assurance policies on my annual income tax return. They provide the 1 Jan 2022 surrender value for inclusion in my 2021 annual income tax return via form 3916, if required.

I have looked at the form 3916, and all the details have been correctly carried over from last year, but I see no appropriate place to record the surrender value, given that I have not touched the contract since my initial investment, and there has certainly been no partial surrender.

Was the important wording of the Prudential letter “if required”? And it isn’t??

My take on this:

If you are not actually surrendering the Assurance Vie or drawing down any income from it but merely leaving it “dormant” or accumulating further value over time, then I would venture to suggest that you have complied with the French tax requirements currently.

You have notified them of it’s existence on cerfa 3916 but you have derived no declarable income from it which you would otherwise declare elsewhere on the tax return.

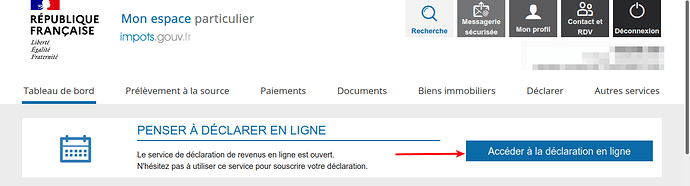

If you are all uncertain about your obligations, seek professional tax help or stick your head in the lion’s mouth and ask the fisc in your secure messagerie in the log on page to confirm the position.

Note: The graphic is borrowed from elsewhere, so no need to click on Accéder (as arrowed) to use the messagerie

thanks