We are in the process of selling our holiday home - we are U.K. resident. The Notaire has asked us to submit/complete either form A1 or S1. However, HMRC in the U.K. do not understand why - we have also asked the Notaire but are awaiting the reply. Could anyone help with this query please?

Ask notaire on telephone, get immediate answer.

I’ve just been through the process selling my SIL’s holiday home, I dont know what these forms are but the notaire didn’t ask for them (unless it’s a code for bank details)

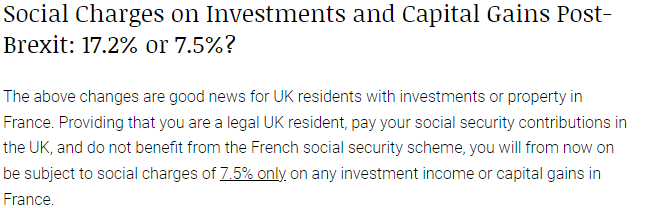

This may help explain why >>

Get the S1 swiftly… to prove you have health cover in UK…

This is to do with health insurance, not tax. Things changed on 14th Jan and if you can prove to the notaire that your health cover is provided by the United Kingdom then you are exempt from two of the social charges and just pay the 7.5% prélèvement sociale.

However there is no agreed standard as to how you can prove it, and many people are struggling with this! And as a UK resident you are not eligible for an A1 or an S1 (unless you are a frontalier?). You need something from the DWP that shows you are part of the NHS, or local health trust perhaps.

I don’t think they are given to people resident in the UK unless they are a frontalier.

Fair enough… then the Seller obviously needs to explain this to the Notaire and ask what other proof will be acceptable… perhaps the EHIC (or whatever it’s now called).

Must be upsetting for a Seller to suddenly get an unexpected request like this…

Yes, pre-UK state retirement age I believe you csn only now get an S1 if you are a cross-border worker. There are only two types:

A ‘posted worker’ would live in UK but work in France.

A ‘frontier worker’ would live in France but work in the UK.

The expected pattern to qualify is a normal weekly commuting pattern, but there is some flexibility on this. And during Covid there has been much more flexibility which currently, I think, extends to June.

Pre-retirement S1’s are issued by HMRC. Retirement S1’s are issued by DWP.

We provided an attestation sur l’honneur which the notaire accepted.

Jane - I was hoping you’d reply as you always seem to be very well-informed. We’ve rang HMRC again today and as before they cannot understand why these forms are needed. As we are non-resident and pay our NI in another country we have benefitted from this reduction in social tax (now 7.5%). I presume if we cannot prove that we are in another country’s tax system etc. then we must pay the higher rate (17%). I am still waiting to hear back from the Notaire - over a week now. I’m going to suggest if we can use our P60 end of year statement as it shows our tax and states our NI number. I will also ask if we can give a Sworn Statement. Thanks to everyone for their help - I’ll let you know how we go on!

Vero - do you not think the Notaire would be my first port of call? Also, although I do speak a very good level of French, speaking/understanding via the ‘phone is probably the most difficult way to ask anything. The Notaire speaks no English at all.

For this issue the notaire will take instruction from the fiscal representative too. Are they more approachable?

We have been battling a very similar issue since January, when sale of our second home was agreed. (In our case the problem was the fiscal rep ‘tho). However persistance has paid off and last night notaire finally agreed. So keep telling them the you are British residents , and the United Kingdom is your competent State. This is a model attestation, omit the bits you can’t provide (no 4 could be P60). Or phone DWP overseas team and ask them

ATTESTATION SUR L’HONNEUR

(Articles L. 136-7 du code de la sécurité sociale, l’article 16 de l’ordonnance n° 96-50 du 24 janvier 1996 relative au remboursement de la dette sociale, et D. 136-1 du code de la sécurité sociale)

Je soussigné

demeurant xxxxxxxxxxx

Demande à être dispensé du prélèvement de la contribution sociale généralisée (CSG) prévue à l’article L. 136-7 du code de la sécurité sociale et de la contribution au remboursement de la dette sociale (CRDS) prévue par l’article 16 de l’ordonnance n° 96-50 du 24 janvier 1996 relative au remboursement de la dette sociale.

J’atteste sur l’honneur que, par application des dispositions du règlement (CE) n° 883/2004 du Parlement européen et du Conseil du 29 avril 2004 sur la coordination des systèmes de sécurité sociale, je relève d’une législation soumise à ces dispositions, et que je ne suis pas à la charge d’un régime obligatoire de sécurité sociale français.

Je relève, depuis le …/…/ (date d’ouverture des droits), dans l’Etat de (préciser l’Etat d’affiliation ou adhésion au Régime commun de l’Union européenne), de la caisse de protection sociale (préciser l’organisme d’affiliation), en qualité de (rayer les mentions inutiles) : Travailleur salarié / travailleur non-salarié / titulaire d’une pension ou d’une rente (retraite, invalidité, accident du travail et maladie professionnelle) / autre (préciser)

J’atteste être en possession de l’une des pièces suivantes, en cours de validité à ce jour et m’engage à la produire à toute demande de l’administration :

1° Le formulaire S1 « Inscription en vue de bénéficier de prestations de l’assurance maladie » délivré en application des règlements européens (CE) n° 883/04 et (CE) n° 987/09 et mentionnant l’affiliation de la personne auprès de l’un des États membres de l’Union européenne, de l’Espace économique européen ou en Suisse ;

2° Le formulaire A1 « Certificat concernant la législation de sécurité sociale applicable au titulaire » délivré en application des règlements européens (CE) n° 883/04 et (CE) n° 987/09 ;

3° Une attestation d’affiliation équivalente aux formulaires visés aux 1° et 2°, délivrée par l’institution auprès de laquelle la personne est affiliée ;

4° Une attestation d’affiliation au régime commun de sécurité sociale des institutions de l’Union.

Je m’engage à signaler à l’établissement payeur tout changement dans ma situation en matière de sécurité sociale, dans le mois suivant celui-ci, et à régulariser spontanément, en tant que de besoin, ma situation en matière de prélèvements sociaux dans le cadre de ma déclaration de revenus.

Je m’engage également à tenir à la disposition de l’administration toute pièce justificative visée ci-dessus, en cours de validité pour la période au titre de laquelle je demande à être dispensé des contributions susmentionnées.

J’ai conscience que la présente attestation est valable pour une durée maximale de trois ans et qu’à l’issue de cette période, le maintien de la dispense des contributions susmentionnées est conditionné à la transmission d’une nouvelle attestation, toutes conditions de fond par ailleurs remplies.

Je certifie l’exactitude des informations portées sur ce document.

J’ai conscience que cette déclaration m’engage et que toute fausse déclaration, ou tout manquement à l’obligation de signaler un changement de situation, est susceptible de m’exposer, outre le paiement des impositions éludées, à des majorations fiscales et, le cas échéant, à des sanctions pénales.

Fait à xxx, le (Signature)

Jane,

Thank you so much for this. Re the date since which we have been part of the U.K. system - what do I put? I know it may seem a stupid question but is it literally since birth or since I started work and started paying contributions?

I will certainly try this although the Fiscal can be very temperamental re their decisions. We had a significant amount to offset but they have been very “picky” - eg we had a English project manager who sent us the invoices written in English and requesting payment in euros, stating his tax number etc but the Fiscal would not accept it as it was written in English. I thought the language of the EU was English? I supplied all invoices supported by the bank statements showing the cheques leaving the bank - one of the invoices was for a deposit paid upfront and they needed confirmation that it was linked/connected to the final bill even though the letterheads were the same and it stated it was for a deposit . The estate agents involved in the original sale were English (based in France) and issued our bill was in sterling. For this reason the Fiscal would not accept it.

It seems that we have done our neighbour a favour by not involving an estate agent but it’s ourselves who have taken the brunt - it would have been so much easier if an estate agent would have been involved - especially as we live in the U.K. and are limited to time spent in France now.

Once again, thank you - I’ll either contact the Notaire via mail today or wait until we go on Friday.

The fiscal reps have to justify their stupid fees somehow, so are renowned for being picky.

If you have always been UK residents then put 18th birthday date I guess.

It is a back covering exercise, so if you can deluge them with paper that should help them to justify their decsion

Jane,

I did say I would get back to you re any developments. We submitted the declaration re National Insurance statement - the Fiscal have told the Notaire they will only accept the forms A1 and S1 which the U.K. Tax Office have no knowledge of - in fact they have said that they think they are forms that France have literally put together themselves so the U.K. can do nothing.

France has a mind of it’s own………they were told that non-residents should not pay the Social Tax on any income here (ie on income from our gite) but……France found a loophole and we had to pay it. Now, they say non-residents should not pay the higher rate of Social Tax on the sale of a second home but……France has now found another way to get around this by demanding proof which is impossible to provide.

All I can say is……when the funds from the sale go into our French account they will be leaving it within the hour. I would not trust any of my money to stay in France - I have no trust in them at all. How can this be a reliable and trustworthy system. The U.K. is not perfect but I truly cannot see this situation occurring there.

Thanks, it’s always good to get the next chapter!

But whoever you spoke to at HMRC was talking out of their backside. To put it politely!! Yes the fiscal rep is being dim, but so is HMRC.

A1 and S1’s exist!! In fact A1’s are issued by HMRC! But you are not eligible for one. You need an S1, which you might be able to persuade the DWP overseas team to give you.

This is a quote from this bit of UK gov’t guidance

Which states “You may also need a UK-issued A1 certificate to show that you pay national insurance in the UK. You can get this from HMRC.”

You could also insist the notaire gives you an indemnity letter, saying that if at a later date they are proved wrong they will repay your money…

I will tey to look up the higher authority you can appeal to.

You can try this on your team as well, which is from the French government…

Be properly informed, take advice from people who actually know what they are talking about.

If you earn money in France you will probably pay tax on it in France.

Expect tax people to be picky. There are a lot of chancers about trying to weasel out of their obligations.

We don’t do things the way they do in the UK.

If you speak French properly it is easier.

![]() Good luck.

Good luck.

Jane - many thanks for that - I’ll have a read later - just about to eat!

Vero - I am very aware that if I earn income in France I have to pay tax on it. This is not the issue here. I do not object to paying the tax but not when I should be paying less - in our case it makes a difference of nearly 15000€ - which, to us, anyway, is a lot. I am also aware of the fact that France does things differently and I do speak a good level of French - probably far better than a lot of the English people who actually live here. I am also quite well-informed re declaring/paying tax on income here as I have done this for 18 years on our holiday home. Yes - our next step will be to use a qualified tax adviser or similar. I simply wanted to know if anyone else had encountered this as, at present, there are many second home owners selling.

In this instance Polly is correct, and this has been to the European courts and back. Non-residents europeans and British only pay the 7.5% prélèvement sociale, not CDS and CRDG. In January 2021 many notaires and fiscal representatives followed guidance that the exemption was only for europeans and imposed it on British people as no longer European. Many arguments later the French government agreed that the exemption did include British people and issued a statement to this effect earlier this year which I can’t now find.

So sadly it is her notaire and fiscal representative who don’t know what they are talking about. Not surprising really unless they deal with lots of British clients.

We had a major battle with our notaire this year, and finally managed to get him and fiscal representative to agree we were only subject to 7.5%. Took a lot of work!

Exactly, she needs people who actually know what they are talking about. The notaire obviously doesn’t and the fisc or conseiller fiscal don’t seem to either ![]()