Thank you Helen. I actually feel a lot happier now. I hope things work out for you also.

Stella, anytime you need help with that difficult “American” you’re welcome to call on me, as I’m a native speaker.

Hi Katherine… the difficulty (if any) with American… is that many words are exactly the same as English…but do not mean exactly the same…(thanks for the offer though)…and then they use words which mean nothing like…

come to think of it… French language … is like that too…

I plan to visit my friend and explain the basics… while we both inspect the car together… It’s so much easier to explain visually…how things work… and what to do…phew… then I’ll probably do him what I call “A fool’s guide.” for the basics (maintenance etc)… That will keep him happy… and let me off the hook.

Best of luck with it!

My husband and I are in a similar situation. It appears we apply and prove we have sufficient income and they will accept us. We are just filling the last bit of paperwork in now and have a “temporary number” already. Fingers crossed

Joining this conversation late - sorry. I was retired when we came to France but my husband was a (very) early retiree. I got a carte vitale entitling me to join the French health system and he was also accepted as my dependent. Some people told us that he should not have been accepted but he was and that was it - and it worked fine for us. However, could what is happening now be because the UK is leaving the EU and, of course, very soon UK passports holders will no longer be entitled to the same rights as EU citizens? France could just be getting ready for the exit.

Although evidently the EU rules as they stand will change, but I will be very surprised if there is not some compromise offered to current residents - although possibly not to new ones.

This is not evidence based as the UK still has not laid out what they want - other than ‘everything without contributing’, but unlike the virulence directed against Europe generally and often France particularly by the majority of the UK Press, I don’t see the reverse here in France at all.

French bureaucracy is a pain, no-one can deny that, but I honestly don’t think it is vindictive.

My overall guess will be that the British will probably get a ‘no deal’ which they seem to be working for, and then they can blame the recalcitrant EU for the net result.

From that point France and Spain (the main expat residents countries) will almost certainly offer ‘deals’ either governmentally or commercially for health cover. The insurance business is not stupid, they will not walk away from servicing a potential market of what - three million expats?

The Carte Vitale will almost certainly remain available to residents for some basic level of coverage, and top-ups from Mutelles for other stuff - not so very different from today in reality. Why should it be otherwise? The French don’t hate the British, least of all those who live here.

Why? Most people in that position would join the health system through PUMA. Why work or pay for expensive private cover?

Hi, we are a couple 52 and 54,no s1 form, do not work but have savings approx 180,000,no income. Can we be classed as inacif? And get PUMA? We have been resident over 3 months but were too late to fill in a tax form=have to wait until this may.

Hi Karen… the whole Health Care and Tax can be a minefield.

Personally, I recommend these two gentlemen: @fabien to offer excellent advice re Health Insurance and @Brian_Furzer for all things Financial…

Simply click on each link and Message them… you have nothing to lose

Just for information you have to be into the system to be eligible for a mutuelle or a top-up health insurance. And to be into the system you have to either pay the 8% (social taxes) or be exempted but registered with the administration (French). In order to know if you’ll be exempted or not it follows that logic, are liable for the CSM (the tax):

- Persons with no professional activity (business or salaried), or those who have a professional activity, but whose income from this activity is no greater than €3,862pa,

AND

- Whose income from their revenus de patrimoine is greater than €9,654pa.

In short, those liable for the CSM are persons not exempt on grounds of low income or because they are insured on some other basis.

On the other hand, exempt households are:

- Those who obtain health cover in France via an S1 certificate of exemption, who are insured for health from their home country. This mainly affects EEA nationals on a State retirement pension, but it also includes anyone else who holds a S1 certificate;

- Economically inactive households with an income less than a minimum threshold, which in 2017 is €9,654pa (2016 income);

- Business owners and salaried employees with a professional income greater than €3,862 a year (2016 income), as they pay their usual social security contributions;

- Households in receipt of a retirement pension, annuity, widow’s pension or disability pension.

I’ve copy / pasted the list from an article about that found here if you’d like to get more details (it was already posted before on that thread for information).

You can apply for healthcare through PUMA. If you are below retirement age living off savings they have a formula to give an income from your capital. If that is sufficient you will be accepted. Health care and tax are two different things. You complete your first tax return in the April/ May of the year after you arrive in France.

You are inactifs…whether you like it or not. After three months’ residence you can apply to join the health PUMA system. The question that you will have to answer successfully is whether your savings provide sufficient income so that you are not a potential drain on social services. Someone will no doubt pop up soon with the exact figure, but it’s around 9,000€ a year.

Filling in tax form for 2017 doesn’t happen until May anyway…

Karen - stick with the advice from Fabien

That’s a slightly confusing post as his advice is exactly the same as she has already been given.

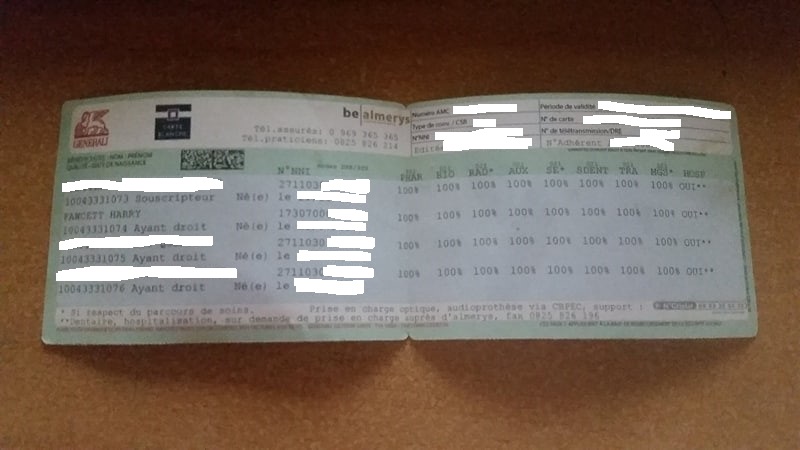

how did you get on with all this and what was the result? I applied for PUMa but was refused as my income was not enough but ended up being covered by my wife through GENERALI and my kids as well.

bit edited but you can see 100% of everything. No longer valid as im now covered in France.