I’m sure l’ve seen this subject discussed previously but l cannot find what l need. As usual we visited the local tax office today to ensure our declarations d’impot were correct only to be told that we will be liable to 1347 euros in prelevement sociaux, which is 6.6% of our pension, in addition to our income tax liability. We have previously been exempt from these charges.

We are a retired couple in receipt of UK state pensions and a few small UK private pensions and are both in possession of Form S1. The tax offcial told us that the regulations are being more rigorously applied and that we are now liable to pay these charges. He even provided me with a copy of the regulations entitled ‘Document pour remplir la declaration de revenus de 2017’ subheaded

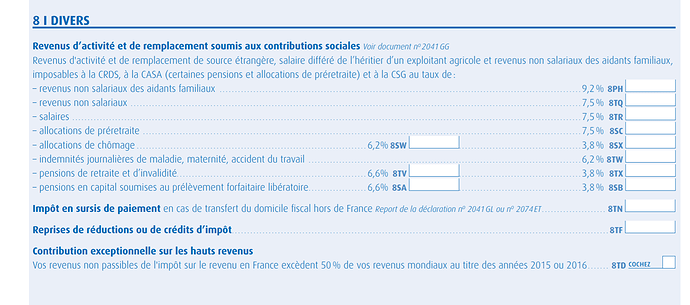

REVENUS D’ACTIVITE ET DE REMPLACEMENT DE SOURCE ETRANGERE’ it is a complicated six sided document which we found very confusing.

Has anybody had the same problem or can anyone tell us if the S1 exemption rules still apply,and if so where will we find the regulations so that we can take them back to the tax office and discuss the matter further.

Any assistance would be gratefully received

Le circulaire DSS/SDFSS/5B No2001-350, 17 juillet 2001: ‘Sont exemptés du paiement de la CSG, les titulaires de revenus de remplacement visés à l’article L. 136-2 du code de la sécurité sociale résidant en France et qui ne sont pas à la charge, à quelque titre que ce soit, d’un régime obligatoire français d’assurance maladie.’

Our accountant has assessed our tax and social charge liability for 2017 and she hasn’t included social charges on any of our private/state pensions but has calculated them ISA’s, bank interest and dividends.

1 Like

Hi Simon and thanks for the reference although it is from 2001. I have found another document a little more recent: Circular 2017-34 from Cnav, the pensions authority, also states: ‘La contribution sociale généralisée (CSG), la contribution pour le remboursement de la dette sociale (CRDS) et la contribution additionnelle de solidarité à l’autonomie (Casa) sont prélevées sur le montant brut des avantages de vieillesse (sauf la majoration tierce personne), pour les assurés domiciliés fiscalement en France et à la charge d’un régime obligatoire d’assurance maladie français.’

The rules do not explicitly state that if you are on an S1 you are exempt from the payment of social charges on your pension income, but this is what they mean. An ‘S’ form is a certificate of entitlement to health cover elsewhere in the EU granted by your home country.

I also have references to a ruling in the European Court in 2015 (Rutter) which stated that France unlawfully imposed social charges on pensions which led to rebates being awarded for charges wrongly imposed from 2013? 2014 & 2015.

I’m not sure this will be enough to persuade our ‘helpful’ tax official, we will find out on Monday.

Dan - the thing is you’re NOT à la charge - you’ve got an S1 and the UK pick up your tab! The document you quote is not relevant to you. Your tax office is wrong.

Hi everyone… I’m just wondering if Dan’s Pension information has been put into the wrong box ???

Hi Stella - it’s not really a ‘wrong box’ issue. The tax guys need to put a CSG exemption flag (for pension income) against Dan’s tax account. It’s manual intervention thing - so may be causing a bit of ‘confusion’.

I used to write in clear letters… the equivalent of… “CSG charges are not applicable for my Pension”, on every paper declaration… but have never bothered to do it when on-line and never had a problem…but, I am prepared to deal with it, should the need arise…

Le’s hope Dan’s folk see sense…

1 Like

Hi Stella and Simon - thank you so much for your kind advice/support. We get our forms checked at the local office every year - normally no problem. This year however, l was given a Form 2042C revenus 2017 COMPLEMENTAIRE to complete and told that even though l have an S1 and Madame Wood has a E121 and accompanying attestations we would be subject to a variety of social charges of 1350 euros.

All of the boxes were correctly filled in BUT this is the first tie l have been asked to complete a 2042C - Section 8TV.

As the office ins normally closed on Mondays and Wednesdays and next Tuesday and Thursday are bank holidays we will use the intervening week to gather as much information/evidence of our friendly tax officials confusion/misunderstanding of the regulations. Will keep you informed - Have a nice Week-end.

Dan - box 8TV is for retirement and invalidity pensions subject to social charges. You hold an S1 therefore your pension revenue (state or private) is NOT subject to social charges. Whoever you are dealing with has simply got it wrong - the info on help sheet 2041 GG does not apply to you as a holder of an S1. The circular / regs I linked to in my first post has not, as far as I am aware, been superseded.

Hi Dan… what does it say beside 8TV (ie explanation of what goes in that box) ?

There used to be a box… in which I always wrote “zero”… and in the comments box, I explained why we should NOT be charged CSG CRDS or whatever it was… )

Hi

I’m not sure if this needs a seperate question, or if someone here can answer?

My wife now receives a UK teacher’s pension, which is paid gross in the UK.

We are both self-employed in France, so not S1. Of course we pay plenty of charges etc on our earned income. So I guess this means social charges will apply to her pension??

Any advice appreciated

JW

Not sure I understand why you would think this… has your local office said something like that… ??

My UK pension is not subject to Social Charges but my rental earnings here in France (and all other income in France) have been/are subject to Social Charges… your situation may be different, who knows…

Why not contact our Pensions Expert: @Brian_Furzer you could always send him a message… or else go to your local Tax Office and ask them face-to-face.

Hi Stella - We went back to our tax office today and presented the friendly tax official with copies of my S1 and Janine’s E121 as well as attestations showing our Code Gestion, which is 70, and relates to our status as persons exempt from social charges. ALL OF OUR BOXES ON THE FORMS WERE AND ALWAYS ARE CORRECTLY FILLED IN (Madame Wood is French) After some lengthy debate and a number of telephone calls our helpful tax official who had 1 week ago said we would have to pay 13OO+ euros in social charges reluctantly agreed that perhaps we were exonerated. I pressed him on the word ‘perhaps’ and he finally agreed that he had been mistaken and that we would not be charged.

I have been talking to tax officials every year for the past nearly 20 years here in france at various offices both in the Pyrenees Orientales and Gironde - Some have been excellent whilst others would have made us wrongly pay charges and impots because of their lack of knowledge.

My best advice has always come from fellow members on sites such as this.

So a big thank you - keep up the good work.

3 Likes