Sarah… the query comes from folk who have received a paper declaration… 2042K… from their Tax Folk along with a 2047K…(.they have not got a 2042C)…

Hi Stella, I appreciate that and also wanted to flag up the boxes re: health care and social tax so that folks are aware.

Even the french find them difficult unless they have a contract and it’s normally already filled in for them when they go on line.

The French? All of them?

An English friend living in the wilds of the Massive Centrale has informed me that 8TK on form 2042K has been transferred to Item 6 on the last page of 2047K.

I checked and it’s there. C’est la vie

Stella -

1AL =pensions percuis oar les non-residents et pensions de source etrangere avec credit d’impot egal a l’impot francaise. (minus acute and grave signs).

1TL = I cannot see a 1TL - do you mean 1AL (above) ?

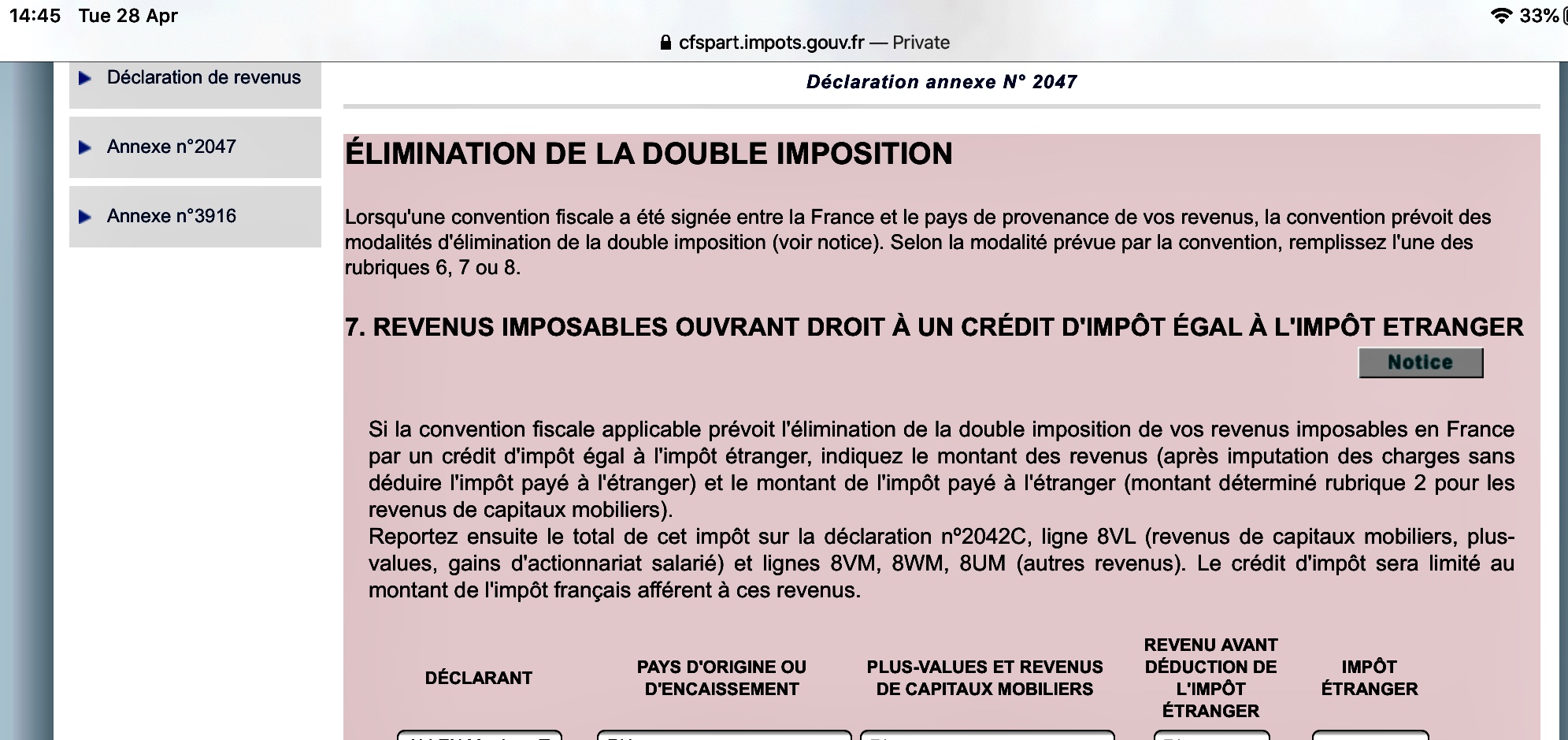

Jack - Your friend is wrong. in section 6 on 2047K it states “Report 2042” at the top on the right hand side and at the bottom is says 8TK. (box 8TK would logically be in section 8, n’est-ce pas ?)This is not a fillable box - it is a reference to form 2042 which this thread has been ranting on about. Now we know that 8TK is on 2042C which you must download (using your non-existent internet connection  ). I haven’t been through 2042C in detail yet - saving it for a rainy afternoon but I believe there are also sections for those who have an S1 and are thus exempt from social charges. I can’t help feeling this is a cunning plan to identify those with internet connections (rather necessary to get 2042C) and who are still using the paper forms - but maybe I’m, being paranoid.

). I haven’t been through 2042C in detail yet - saving it for a rainy afternoon but I believe there are also sections for those who have an S1 and are thus exempt from social charges. I can’t help feeling this is a cunning plan to identify those with internet connections (rather necessary to get 2042C) and who are still using the paper forms - but maybe I’m, being paranoid.

Now I’m going to hit the bottle.

As it was about the 150th time I had asked for someone to explain… it is hardly surprising that I hit the wrong keys… 1AL… of course… not a bad record though

149 times I got it right = 1AL

1 time I got it wrong = 1TL

I can live with that…

Thank you for this Stella - l have been trying to get through to our office all morning to ask the same question without success.

Pleased to be able to say it “from the horse’s mouth”.

did you check my link for the full conversation. I had my list of questions and the Tax lady was charming (as always)

In 2042C box 8SH and/or 8SI are titled “Vous relevez d’un régime d’assurance maladie d’un État de l’Espace économique européen déclarant 1 déclarant 2

ou de la Suisse et vous n’êtes pas à la charge d’un régime obligatoire de sécurité sociale français…”

The UK is no longer in the EU or EEA even though our S1 does mean that our health cover is dealt with by the UK in perpetuity (or until some smart-aleck politico decided to renege on it). Presumably the Withdrawal Agreement deals with this.

Stella,

Could I ask 1 final question?

I’m back… been listening to the PM…

what is your question ???

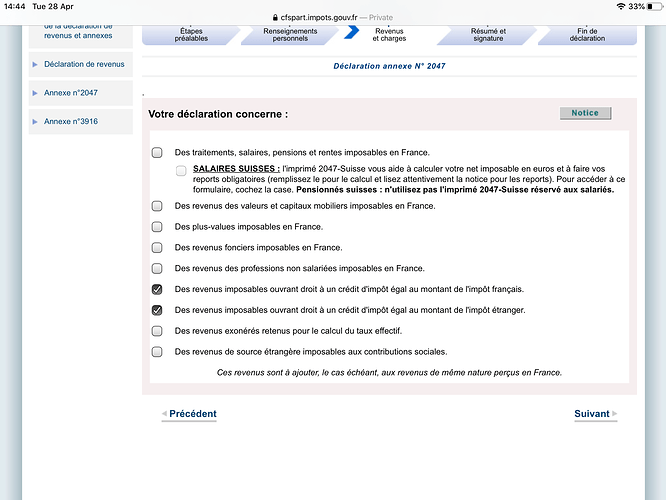

I’ve got an issue entering Online the €71 I earned in interest on my UK savings account. I selected the required input boxes for the 2047 for our pensions and savings, using the heading that it was entered under last year. The pensions entered with no problem. However the next section asks for the amount earned in interest on our savings before tax, and then the nest box asks for Government Tax. The Halifax have stopped taxing at source and therefore only give gross tax. I’ve tried entering 0 and leaving the box blank. This results in the input not showing on the summary sheet when you come to sign off.

Stella - thanks for info on paper tax returns (13 days ago); extremely helpful, grateful thanks.

Have a bit of a techie problem - I wanted to ‘copy and paste’ your post to keep when completing forms - for some odd reason can’t do 'copy ‘n paste’ - normal highlighting in blue - hit cooy - but when trying to put into Open Office doc - it hasn’t ‘copied’. Shame because your advice is so useful - any ideas on this techie problem ?

@TigerLily

I’m sending you a private message…

Stella - thank you - aren’t you clever - and very helpful - thank you so much.

Madame Dubois spent 10 minutes on the phone this morning with Monsieur Teston from the tax office in Bordeaux asking where the 8TK figure shown on the 2047 should be shown on the 2042 as the Box 8TK is no longer on the form. He was adamant that it should now be shown in Box 8HV. Under the heading Prelevement a la source deja Paye.-retenue a la source usr les salaries et pensions.

Just to be sure l telephoned our local tax office to speak with an official who has helped us in the past… The Office is closed to the public due to Covid but he is taking telephonic appointments and will speak to me on the 25th May at 10.30H.

Watch this space

Dan, is there any follow up to your post on the 8TK. Do you still think the figure is to go into box 8HV? I sometimes find it hard to follow the threads in this forum so apologies if you’ve already followed up on it.