Anyone having trouble completing this years tax form 3916?

Hi @sash and welcome to SF

Have you looked at the guide I posted here

There are known issues with completing cerfa 3916 & 3916bis on line. What issues are you facing and does the guide help?

Hi Graham I’ve entered all the necessary bank accounts plus 1 assurance vie on 3916 completed 2047 but when I try to move to the end process and signature on 2042 a message comes up that 3916 is not completed. Going back to 3916 I see the accounts listed but on pressing suivant it just seems to be asking for more accounts to be added. Pressing précedent leads to a run through of existing accounts. I can’t find any way to if you like close 3916. I shall download your guide thanks

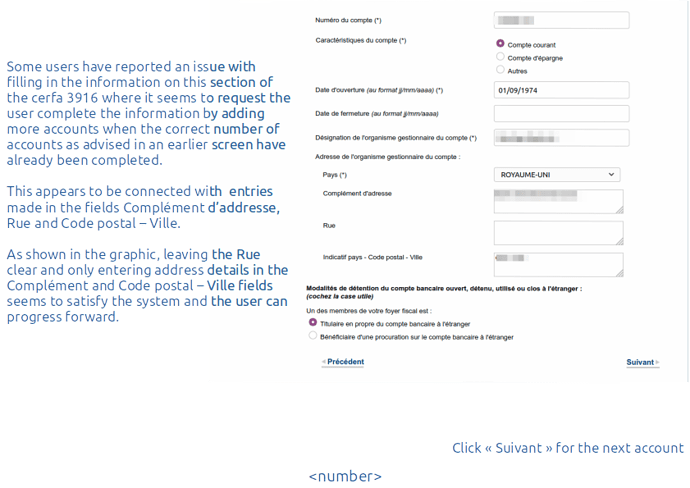

I don’t know if this is your issue but someone else reported to me

There’s a known glitch with form 3916, where you declare foreign bank accounts. It won’t let you move to the next page unless you delete the data from last year and enter it again. Once that’s done it works properly

I have to say, in my case, the data from last year was deleted (a so called non documented software event ![]() ) so I haven’t faced that except to say that annoyingly - even though I said I have 4 accounts to report - it persisted in asking me to enter more accounts!

) so I haven’t faced that except to say that annoyingly - even though I said I have 4 accounts to report - it persisted in asking me to enter more accounts!

I overcame that by clicking on the left panel and selecting a different annexe and that seemed to work.

Are you certain that it it is not throwing an error elsewhere on the 3916 such as in respect of address fields (which occurred last year) preventing you from moving on?

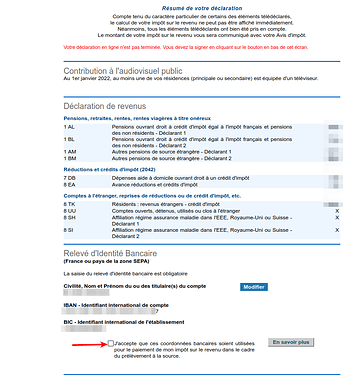

This is the page from my guide:

I had exacty the same - I managed to crash out on my partners and it accepted it as complete.

I have absolutely no idea how - but on mine it kept insisting I had a new account to enter and somehow it deleted everything even though I’d already “reported” everything from before - okay I probably pressed the wrong thing. Threw a wobbly and took the dog for a walk.

No at all… it’s a bug - same thing happened to me (and others). Fortunately I had the details from the previous declaration to hand so didn’t have to scrabble around too much to re-enter from scratch. Lesson learned for next year… have the details already printed and to hand next time.

Hi I know its not a contiuation of subjet but is tax related. Its our 1st time so on paper form 3916 its asking when we opened our UK accounts . Does anyone know where we might find this information ?

Hi kazz welcome back to SF

I doubt it really matters to the Fisc to be honest. A couple of our UK accounts were opened in the 70’s so I just made up a date that was reasonably representative of when they were opened from memory.

Don’t be unduly concerned. The fact you are reporting the accounts is the important thing and the account number/branch detail is the bit from which they can make any search - if they are minded to do so.

From an International money laundering perspective, when you declare to HMRC that you are resident in France, they will report any account activity as required.

As to completion of the 3916, the guide I provided for online submission covers what to put on the form and where. It applies for the paper version too.

I had to do the same thing last year. I was able to contact the bank (in our case Lloyds) and they had the information to hand.

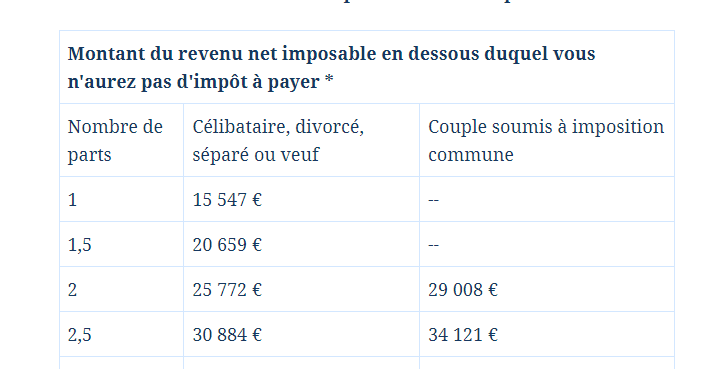

Can anyone please confirm the amount of the revenue de fiscal reference before any tax is due. I thought it was €10,225 per adult part so a couple would be €20,450 but maybe I am wrong on that Our fiscal reference is below that but we are being charged tax. Am I reading it incorrectly? Like everyone else, I do not want to be paying tax if I don’t have to but I am pretty sure all the correct boxes have been filled or crossed with the correct information.

I’m sure someone will have the figures… but you might be being charged “a tax” which is not actually “income tax” but arises due to investments etc… just an idea.

Hi Elizabeth.

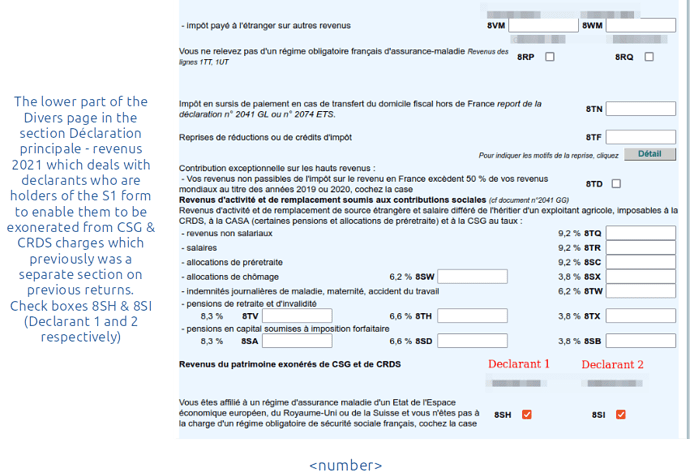

Are you S1 holders and did you find the boxes 8SH & 8SI on the lower part of the « Divers » page and tick them? (Page 25 of my Guide)

If not, that could explain your unexpected charge…

Hi Graham,

Yes I did. Maybe it is not income tax as Stella has suggested but social tax on bank interest but I ticked 2OP so that should have covered it. I seem to remember something about a reduced social tax of something like 7½% which would be about right for the amount they have charged. I’ve never paid itbefore though.

Thanks Stella, I think you may have answered my question, see my reply to Graham.

This is where sharing a concern with others, helps.

Curious - page 52 of my Guide:

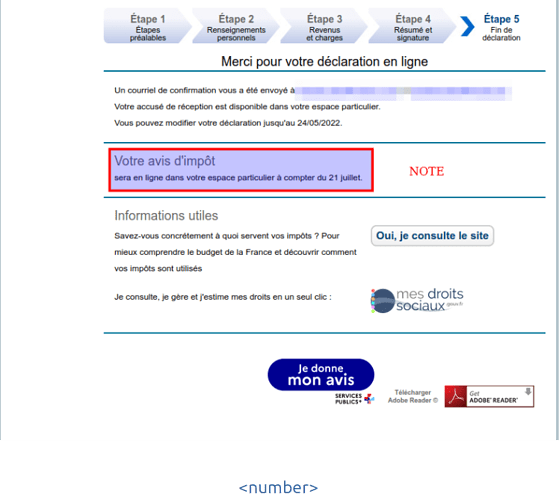

This suggests you don’t get the avis until 21st July. How do you know you’ve received a charge? I completed my return and haven’t had any notifications (yet).

It was on the résumé de déclaration after all the details of the boxes I had filled or ticked, which were 1AM and 1BM, Private pensions, 2TR for bank interest, 2 OP, 8UU, 8SH and 8SI.

Immediately below that was Estimation de votre impôt and the amount

.

I haven’t yet signed it off, so maybe that is the difference between my sheet and yours.

didn’t get that on our submission… perhaps as ours was complicated by having pensions exonerated from French tax under the DTT?

You could also use the impôts simulator to test out your expectations. Just click on accéder au simulateur before you sign it off.

I have just looked up the social taxes for S1 holders and it is 7½ % which has not been paid by us before as I always claimed it all back until last year when I ticked the 2OP box and no tax was due but this year the reduced amount is payable. So problem solved and I can now finish it all off. Great relief.

Thanks your your help and to Stella too.