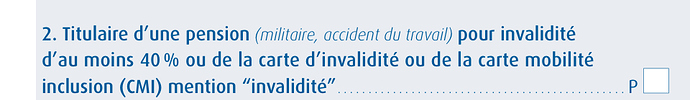

I am just struggling through my tax form and came across a box to tick if my pension is military: I am ex RAF and have treated my pension as civil service but am I entitled to an extra concession?

Are you talking about the 2042 Declaration… and if so… which box are you looking at?? can you identify it please…

No, 2017 preamble “situation du foyer fiscal en 2017” tick box P or is it just if one is an invalid and also ex military?

Surely it’s for an invalid ‘s pension. You’ve picked up on the word militaire but it also says accident de travail. Your military pension, a Government pension is declared on form 2047 section 6.

Yes but “militaire” and “accident de travail” are separate : it is open to interpretation like many things French! If I don’t get a definitive answer, I will have to go to the tax office

I think you are looking for something that does not exist.

Hi Raymond…

Mmm… I think that you are perhaps misinterpreting the military/work invalidity aspect… although I can’t blame you for trying…

Do you actually have an Invalidity Pension from the Army for at least 40% Disability ???

or simply a Pension from your Army Service… which is quite different.

If you are not sure which sort of Pension you have… or where to put it on the form… I do think your best bet is to go and talk with the Tax Office face to face.

Royal Air Force, not Army!

No disability , so I guess that I will have to get an interpretation from the local tax office although they are not always correct, in 1999, Gaillac swore blind that I had to pay French tax on my Govtpension!

As you say, no harm in trying😉

So sorry Raymond… no offence meant…  been eating in between answering, and almost lost the plot… (that’s what one glass of wine does to me)

been eating in between answering, and almost lost the plot… (that’s what one glass of wine does to me)

Anyway, although you have to declare all Income to France… you will not necessarily be paying tax on it… all depends on the French accounting and any settlements between UK and France…

How has it gone in previous years… has anything changed this year ??

Box P is for invalidity. Blue, green or whatever, all Government pensions are treated the same.

No offence taken, I am always one lookout for an extra sou, I have had no trouble with tax since 1999- long may it continue

that’s good news… I don’t blame you for keeping your eyes peeled, you are not alone…

that’s good news… I don’t blame you for keeping your eyes peeled, you are not alone…

Except that “Civil Service” pensions are taxed in UK and State pensions are taxed in either U.K. or France.

Hi Raymond…

David’s point is that everyone has to declare in France… the Civil Service Pension along with every other Pension … plus any Income from wherever, of course, … so that France can look at the Total Income in order to calculate if any French Tax is applicable…

I did not mention state pensions, I mentioned Government pensions as paid to servicepeople, civil servants, teachers etc, etc, etc. They are always taxed in the UK but taken into consideration in France.

While we’re at it, state pensions AKA the OAP is always taxed in France.

No, the OAP can be taxed in either country

No, if you are a French resident it should be taxed in France. If you will provide a link to say I’m wrong I will be glad to be put right.

I regret that I do not agree, having gone to great lengths to get this aspect of French living right

Impots .gouv.fr is the place to start, followed by the “bible” at the local tax office but be warned that different départements interpret the rules differently . I had my oapension taxed in U.K. until it was more advantageous to be taxed in France.

Oh the joys of living in France, if only we knew (as the French do) which rules to ignore and which to follow to the letter!

I started this thread because I read somewhere that military pensions are taxed differently, after all, have you seen what train drivers get!!!

Sorry you are wrong. Whatever might have happened in the past it certainly is black and white now.

Just out of interest do ex British Rail employees resident in France get the same perks as ex SNCF?