Good evening all, please forgive me for what I’m sure for many of you will have you shaking your head saying “idiot”, but I hope someone may offer help.

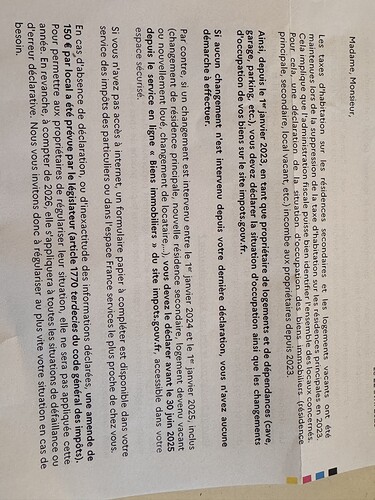

I received a general letter today ( enclosed) from the Public Finance Department.

I have paid Taxe Foncere through the impots app since my wife and I bought our home in Charente (16) in June 2020. I’ve never received a bill for the Taxe Dhabitation however nor any reminder to pay it in that time. I’m aware that for primary residences that in many places it doesn’t exist but for secondary homes ( ours is a secondary home, we don’t rent it at all, purely a secondary home for the 2 of us) it does but as I said, I’ve received nothing in the mail suggesting or demanding payment.

Now, I’m happy to pay whatever I owe in back remittance plus fine if this is solely on me and my responsibility to proactively pay the Taxe dhabitation rather than receive a bill, but it’s the general nature of the letter that I’d like help with if someone could?

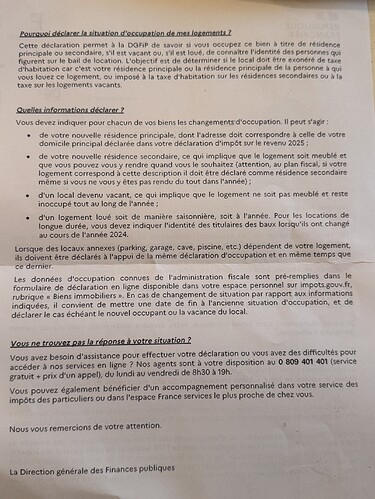

My French is poor but it doesn’t “feel” like a demand and if I’m right it’s suggesting to register second home status via the website using the 13 letter numero fiscal which I can do fairly easily. However beyond that, to be honest I’m not convinced my French is good enough to offer what is needed through the difficulties of portals in a foreign language (my bad but i understand it’s on me).

Also it mentions 2023 and 2024, in what context? I’ve tried translating the text but it’s still not making much sense to me so any steer would be gratefully received.

As I said, if I haven’t done something I should have by way of letting the authorities know it’s a second home then I will of course pay whatever is owed but I’d like to know whether that’s from 2020 purchase date or whether there’s a relevance in the years 2023/24 in the letter, and also why I receive a Taxe Foncere in letter form but not Taxe dhabitation nor had any reminder on the 5 years we’ve been here.

Thanks in advance for any help.