There seems to be an implication of being able to draw two FULL State Pensions, which I don’t think is possible. Pensions are based on contribution which would seem to work against the proposition. My wife receives essentially two part-pensions from France and the UK but as I understand it there is a EU agreement on what is an OAP amount and as others have pointed out they ‘talk to each other’. I know her Pensions combined make up one Full French one.

Will this change after Brexit?

It depends on the pension rules for the country involved. An Irish full pension was/is attainable in fewer years than a uk pension. And much more generous.

We’re just starting to do some retirement planning. I know we will need specific expert advice – but I want to get a rough grasp before seeking this.

I am straightforward – UK state plus private pension.

My wife is 58 and has worked as an auto-entrepreneur and paid into her state pension in France for just over 8 years, prior to which she worked in the UK.

My current understanding is that for her French pension entitlement she will be able to count her French and UK contribution trimestres, which would enable her to start drawing her basic French pension if she has a combined total of at least 168 trimestres at age 62 – which she will have – or she could retire later for a higher pension.

What I don’t understand is the effect of the different retirement age in the UK on her French pension – presumably, as she is using her UK trimestres in France, there is a payment from the UK to France in respect of the UK entitlement – but does this mean her pension will only be partial between the French and UK retirement ages?

Alternatively, there seems to be some suggestion that it’s possible to take the two pensions separately – one in the UK and one in France? And if so, is this preferable?

Hi Geoff, big subject.

I actually receive five different pensions (no, I’m not rich !!) three in the UK paid into a UK bank which could equally be paid into a French account, and two from France. You need to go to your local CARSAT office to get the French info.

Mine are as follows

UK

Merchant Navy Pension at 62 years

Private Works Pension at 65 years

UK State Pension at 65 years 7 months

French State Pension and the Complimentary pensions (Caisses) at 62 years and seven months.

Such a big subject so either ask specific questions on here or by ‘pms’ if you wish.

Yes you can have both pensions.

They can be each taken at different times ie when the law of each country says you have reached the required age.

As you say for France you have to have sufficient trimestres to qualify and if you dont you can top up by using your accrued pension rights from the UK but of course when you come to take your UK pension it will be lower.

In my case even with a top up from my my UK entitlement it still left sufficient years for full UK pension so win win.

I should add that the application process takes a long time and a lot of paperwork involved. I employed someone to sort thinks out and pleased I did. It cost me about 300 euros but well worth it as now get around 2000 euros per year in addition to full uk pension.

I was micro enterprise rather than auto entrepreneur which meant my cotisations were much higher which might be reflected in my French pension income?

Sometimes getting old has its bonuses!

Before leaving the UK permanently in the 80 s I was self employed and kept on paying my second class stamp when in France. This allowed me to get almost the fulll UK pension.

So, one receives a UK State Pension and then (finally) receives a very small French State Pension. I understand that one will no longer be entitled to a form S1 from the UK as France will be responsible for providing health care? If this is the case then what implications does this have on having to pay social contributions on the UK State Pension?

I guess one of the things I need to work out about the ‘both pensions’ option is whether it’s better to have a full UK pension and small French one, or use the UK trimestres to get a full French pension - leaving a very small UK one.

And this question will be affected by future exchange rates! Yikes!

And then, even if the full UK pension + small French one is better in the long run, the possible 5 years extra due the lower French retirement age might make the full French pension + small UK one better.

Be careful Geoff, each case is different. I didn’t have a choice of which trimestres went where. I was told that I had earned so many in the UK system and the rest in France. It worked to be about 60France so about 40% UK. This determined my French pension. The UK pension was related only to my NI contributions in the UK.As I said, I topped up my UK State pension by paying a second class stamp for the duration even though I was living and working in France.

The CARSAT will tell you more about your situation.

It doesn’t work like that in that you can’t choose where to have your full pension. If you are british then that is your starter for your pension.

You can only get a French pension if you have accumulated the minimum trimestres to qualify, nor sure but I think it is 10 years worth?

If you have accumulated more then fine you get a pension based on that number of trimestres and chances are that this means you have not worked enough years in UK to get a full pension there, unless you have topped up.

I was 4 trimestres short of the minimum to qualify here so a small part of my UK entitlement was used to top up and as I said earlier, more by luck than judgement, I still had enough qualifying years in UK for full state pension there.

Joyce, have you worked in France?

No French pension if you haven’t.

You mention form S1 which suggests to me that it is the UK who supports your health and not France.

You can get an idea of how much your French pension will be here -

https://www.info-retraite.fr/portail-services/#/login#header

I have a uk pension and a french pension for having worked 5 winters in thé vines. Remember you only Get a French pension if you paid into à french pension. For exemple if you worked for yourself by letting properties or rooms for exemple and never paid pension contributions in France you wont get a french pension. If you are employed then your pay slip will show your pension contributions.

Getting my uk pension took 1mth the french one took 13 mths. My french one is 35 euros à month.

Anne - I will be in a similar situation as yourself having accumulated about 20 trimesters towards my french State Pension having worked and paid into the french system. My question is:- Are social contributions, ie CSG, CRDS etc, payable on the UK State Pension because I will not be eligible to have a form S1 from the UK having worked in France? (I know that social contributions are payable on other unearned income like premium bond wins and interest from investments.) Thank you.

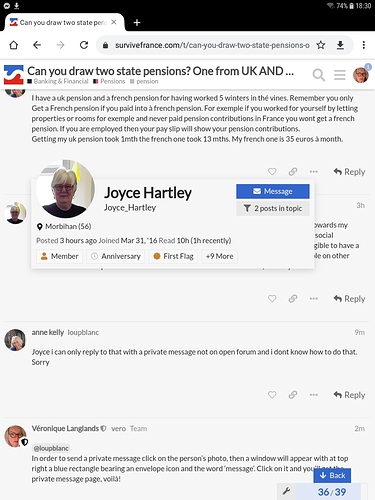

Joyce i can only reply to that with a private message not on open forum and i dont know how to do that. Sorry

@loupblanc

In order to send a private message click on the person’s photo, then a window will appear with at top right a blue rectangle bearing an envelope icon and the word ‘message’. Click on it and you’ll get the private message page, voilà!

See below for a picture

But if you have the minimum trimestres of contributions in France - which I think is 40 (10 years) - and apply for your pension in France before the UK retirement age - which for my wife will be between 62 and 67 - the natural arrangement would be to use some of the UK trimestres for the French pension? Although you don’t have a direct choice, the timing in effect implies a choice?