Amen to that, he may not claim to be a tax expert but to me he seems very knowledgable and on top of everything.

Thanks guys…

which makes it even more remarkable given that @strudball mentions

and, going back to the first post which created this topic, it does seem remarkable that the OP has to ask this question in the first place when surely one would expect his “expert” to know where to place the UK rental income on the French tax return to ensure that he is not taxed twice.

I was not offering advise and agree with @graham nor was he or indeed anybody else doing that.

My question fundamentally was addressed to any body who has uk rental income and how they dealt with the uk and French tax authorities. It spawned a lot of comment but nobody other than @larkswood12 said …“I have rental income and I do this”…or at least if so i missed it.

The fact that such income is taxed in the UK with a French credit is fact but what seems less clear is the timimg cased by the differing tax year ends. It seems to be a matter of interpretation and my chap says use the figures from imediate last HMRC return…I merely wondered what others might have done !!

Can I echo the very positive comments about Graham’s tax guide. As somebody that once upon a time used to provide tax advice, I think the guide is extremely helpful and easy to follow, and is a great credit to those involved in its production, and ongoing maintenance. I do not remotely think it falls into the trap of providing tax advice (ie applying knowledge of law etc to an individual’s specific personal facts and circumstances to deliver a personalised opinion). Instead it provides generic, non personalised guidance that is not intended to be relied on. Anybody who, despite disclaimers etc, chooses to rely on it, or indeed any of the guidance elsewhere on this forum, surely does so at their own risk!

@strudball Although obviously totally non binding on how a French Inspector might view your question, I have direct experience of the same question (ie how to report non UK income from a regime that had a different year end) being put to HMRC. The answer/principle they came up with might be helpful here. The situation is not unknown in the UK , given that the UK’s 5 April year end is “unique”. HMRC s Inspector was comfortable with reporting on a UK return, using a foreign regime’s income arising in the latter’s fiscal year provided that a) there was no overall loss of tax to the UK and b) the treatment was applied consistently, year or year, with no selective switching to more favourable options when it suited the taxpayer.

Totally agree with that and that was the basic tenor of the information provided by Isabelle Want in respect of the French Fisc position even though they obviously would prefer the Jan-Dec arrangement and any switch from April/April if originally chosen would end at that point - ie absolutely no flip-flopping to suit the tax payers own ends.

I too give my thanks to Graham’s Guide.

Also grateful to Sandcastle for him taking the time to look at my arguments and offer his opinion - which I respect and am somewhat in agreement with at the moment as I haven’t yet been able to find any on-line references to using UK tax return figures i.e. one is a bit exposed with the approach,

I did manage to find the Impot’s bulletin on treatment of foreign income for the purposes of the effective tax and will post on this and will post accordingly after a bit more research - it is silent on timing however does reference the need for an objective method for figures as follows (google translation) -

“600

As a practical rule, and except in exceptional circumstances, the service accepts the amount of income declared abroad, less the tax paid locally. But this tolerance measure does not call into question the right of the Administration to check the accuracy of the declarations produced. Therefore, at the request of the service, any justification must be provided on the methods of calculating income from foreign sources, mentioned for the calculation of French tax at the effective rate.”

So the justification is everything - in case the administration exercises the right it doesn’t usually do.

One could take the example of calculating the euro amount of foreign income - as well known the official method is use the Paris exchange rate on the day however I read on the forum many different methods, not just maintaining a 365 row spreadsheet with income organised across the columns according to type.

Crucially, if a tax inspector ‘inspected’ the amount of an entry, would they then carry out that exercise cross referencing to a taxpayers bank statements, dates and the Paris rates?

Or would they be pragmatic and say OK the method you used may be crude but its the same one you’ve used for years and to do an exact calculation going back over the years may not be an effective use of time given the amount of tax we’re talking about…

My back isn’t totally covered here either. I use(d) an average method of start and end of the year rates with the sole exception of one specific transaction date for a specific allowance category.

I agreed with the Inspector a start and end average over my 2020 return period, however that period was for 1 month. So I have a principle, maybe of sorts.

As people point out the tax authorities are not ogres (not my phrase) and seem happy to offer advice up to a point - in a busy tax office I get the impression they are not going to spend a lot of time on small amounts (e.g. their not being bothered much about Madames lost 2020 declaration).

Finally, on the point of the forum, Grahams guide is invaluable for knowing where to put the figures. It doesn’t say how to calculate the figures - and if it did that might be ‘providing advice’. I’d say the forum is a place to share thoughts and opinions including on tax, methods and treatments and possibly help forumites reach or confirm their own consensus on what course of action or treatment to adopt.

Perhaps the OP, having received one source of advice, albeit expert, was simply reaching out to check and broaden their knowledge. Surely that is one purpose of a ‘forum’, forum citizens!

The simulator for 2023 (2022 income) is now available

As usual, there are two versions - the simplified one and the complete one for you to use. I seem to recall in the past that neither version is able to cope with UK Govt Service pensions income but since no data is actually uploaded to the Fisc, you can “fiddle” the system to give you an idea of what you lability could be given your figures.

Another useful reference:

Services Publics

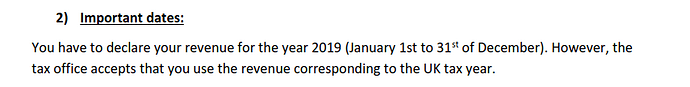

I found the source of the reference after further research…

May 2020 Newsletter.pdf (1.0 MB)

Page 2 contains this reference:

@graham …that’s a jewel in your crown, and very much corresponds with what my tax man has said.

I’m talking to him tomorrow and will just rain check the fact that in the first French return I do, which does include months in which i have UK rental income, i won’t actually declare it on the return as the year in which accrues is still the current uk tax year. But for next French one i will declare income for the uk year ending 4th April 2023.

…now off to lie in a dark room

@strudball ah John… but be wary of mixing and matching figures from differing time scales to just suit your purposes… I’m not sure that you can use some figures from the UK fiscal year mixed with figures from the French fiscal year in the same return but if the Fisc agree it’s OK, get it in writing and guard it for future reference in case you are later challenged ![]()

In other words, for your first return I guess you could perhaps use the April/April pension income figures alongside the April/April rental income results then agree with him to formalise the Jan/Dec fiscal year next return - he’d probably run with that. See what he says. Good luck with your meeting.

I have just collated my papers for my French tax return, and I have included estimates of all the UK incomeas I have yet to get the 2022-2023 confirmation from the UK. So, for example I have yet to get my P60 confirming tax paid April. -Dec 2022 on my pension. As others have said you need to look at it though French eyes.

For our UK rental we have one spreadsheet which sets out the April to April costs and charges based on UK requirements. We have another spreadsheet which does similar for Jan to Jan, but based on what the French system allows you to offset. The two figures are fairly close, but not identical.

To add to this, for years I declared a small gov’t pension on April to April as I couldn’t get the figures for anything else. So in the same tax return there was April to April, and Jan to Jan UK stuff. But i did this consistently every year.

@graham

Not sure how your last post is consistent with the earlier comment

I think it probably about using a consisent set of time periods

And i also think as long as a submission looks “normal” ie has no suspicious and none credible enties then the tax man or woman is very unlikely to trawl through more than a random say one in hundred online submissions to check the minutiae in detail…like the uk they are snowed under chasing high profile evasion and money laundering and not checking that every last centime is extracted from joe public !

correct.

never, ever assume… they stopped using Cratchit style quill pens, ink wells and high stools a long time ago - these days its highly technical and cross referenced in an instant electronically ![]()

I’m now preparing the 2023 tax help files and will publish them in a separate #stayontopic post in due course.

(subject to approval from @cat) - since approved, Thanks Cat.

In the meantime - the calendar for 2023 (2022 income) submissions:

The website says

La déclaration en ligne est possible à partir du mercredi 13 avril 2023.

Except the 13th is a Thursday. Whoops.

If for some good reason, making the declaration on-line is not possible/suitable… paper declarations are still possible…

I always do it on paper and have requested this. My PC is getting on and I don’t trust online important stuff from bad experience.

I read that if you have a Cartezero MasterCard Gold you must declare it as a foreign bank account as the issuing bank is in Luxembourg. I hadn’t thought of this before!

Just trying to get things in order ahead of the tax filing season, and in anticipation of @graham 's very helpful guide, does anybody happen to know where I can find the official average exchange rate for 2022 for £:€? I’m obviously not using the right search term, having drawn a blank online…