Wearing my Warren Buffet hat I venture to guess that with a low GBP, exports do better and vice versa. Amongst other things …

This whole problem, the same in many countries, stems from the way the working population pays for the retired rather than their own retirement . It is a flawed concept as periods of high and low birth rate cause surpluses and deficits in the money available to pay pensions. If those starting work contributed to their own state pension fund throughout their lives, rather than the pensions of people already in retirement, then the problems of funding the state pension wouldn’t exist

Nobody was put on this Earth to grind and slave. We have the misfortune of existing in a world based on money and transaction. I’m with the French. Money can always be magically found to pull banks and corporations out of the doodoos. It’s a consensual illusion. Its use is governed by a set of changing rules to benefit those who can clamber the greasy pole.

![]()

I hate to break it to you, but I paid for my state pension and various private pensions. Nobody paid those for me. I coughed up.

And lo! [pun intended] GBP down amongst the €1.12’s and my Scot Wids has put on 5% in a month! Mmmmwwaah! ![]()

I got screwed with Equitable Life as well. “It’s the safest place you can put your money” we were told by the two goons from EL. I wonder if I’d just put it in the bank as a sibling did, would it be worth more.

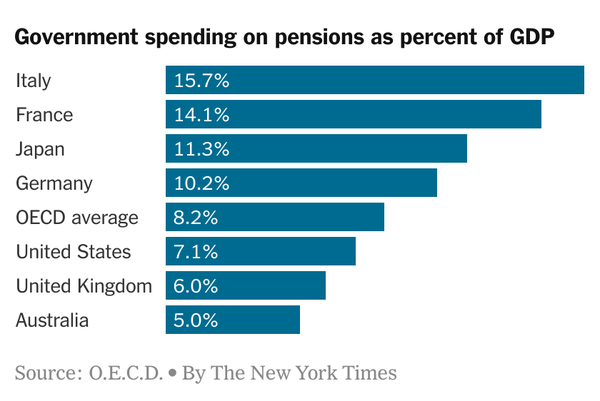

I fully support the French balance attitude towards work-leisure. However, the retirement issue is becoming a global problem. This article puts in some clear perspective

France spends just over 14 percent of its GDP on pensions, one of the highest rates among the group of rich countries that comprise the Organization for Economic Cooperation and Development. “We need to work more,” Macron said in a New Year’s address, to “pass on to our children a fair and durable social model, because it will be credible and financed in the long term.”

Governments have made steady changes to national retirement policy in recent years. The O.E.C.D. average for the minimum retirement age is 62.5, but will tick up to 64 in the coming years as a number of countries, including Denmark, the Netherlands and Sweden, push up the minimum pension age to correspond with increases in life expectancy.

Hervé Boulhol, a senior economist at the O.E.C.D. specializing in pensions, bristles at the idea of an aging time bomb threatening the world’s biggest economies. But he does see a risk if policymakers and business leaders fail to address the matter. “Yes, the clock is ticking,” he said.

O.E.C.D.

Depends on the index - the '100 has a lot of international companies with share prices in $ so when the £ is down it tends to go up.

The '250 is a better indicator of how the UK is doing.

You paid for your private pension but your NI payments that build towards your qualifying years for a state pension are not kept in a special account for you personally in retirement, they were spent on the then current pensioners. Hence the increase in the number of pensioners now , as a result in the baby boom in the late 1950’s/ early 60’s, leads to a problem because there are less people working now, to pay for the pensions of baby boomer pensioners. Hence the system doesn’t work and they put the pension age up so that less people survive to claim their pension/ get it for a shorter period.