No probs, good luck. There may also be something in the bulletin which assists - it does have examples where two withdrawals can be made - for foreign pensions.

A couple of further resources, don’t know how useful for you.

No probs, good luck. There may also be something in the bulletin which assists - it does have examples where two withdrawals can be made - for foreign pensions.

A couple of further resources, don’t know how useful for you.

Hmmmm. I may be wrong about this, but you may find that cashing in the whole thing may put you in a tricky situation with HMRC even if you aren’t a UK resident. There are specific rules about this and they may override the normal double tax treaty rules. As I say, I may be wrong but I would get expert advice on this just to be sure.

@hairbear Thanks for your concern (genuinely). I actually have no fears on that score. The 2015 pension “freedoms” changes (copyright George Osbourne) now actively permit the withdrawal of the entire amount of a typical pension plan (see screenshot) fyi.

To test it, I just went into my (Standard Life) pension site and started the process of withdrawal, and told it I wanted to withdraw 100%. The only question it asked me was ‘where to’ (ie which bank account) and would I mind terribly if the payment took 3 working days to clear…My scheme is a Group Personal Pension but I don’t think that makes much difference nowadays. It possibly helps to have worked for an employer that has literally thousands of pension and tax specialists - they would mutiny if the firm’s own schemes were too restrictive!

Do you recall the then pensions minister, Steve Webb explaining in 2014 that he was relaxed if a pensioner could, in principle, withdraw the lot and spend it on a Lamborghini?!

This may sound like a daft question but I am a newbie at this pension lark so forgive the question. My payment will be coming via the UK International Pensions Dept but…will I have to pay for their use of getting it transferred into euros direct into my account here? I cannot find anything online about any charges or even how/who they use to transfer monies to us outside the UK. Thanks for any info.

simple answer - no, not in the case of the UK State Pension.

Other Govt Service Pension providers (Teachers, LA et al) often will use a 3rd party to make the payments and you can usually expect to get less in the exchange rate but the UK State pension is often as close to the headline rate as you can get - although with volatility in the market place the rate can seem skewed and difficult to track.

@Shiba and just for clarification - there is no time penalty involved in selecting your UK State pension to be in Euro to your French bank account.

The pension is paid every 28 days (the day is fixed according to certain criteria) and you will therefore get 13 payments per annum.

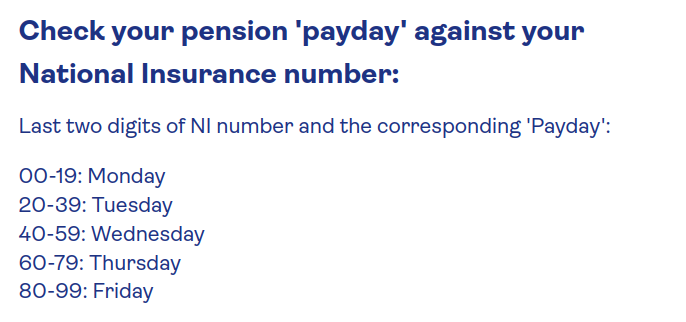

The day on which you are paid:

and for most people payment of the state pension normally begins not on the day you reach your pension age but on the next ‘payday’, which can be over a full week later.

thanks very much for the info. Their pages online give absolutely no info at all. I have a feeling their UK office is being dealt with by NI as my original certs came back from Belfast and everyone I spoken with has a NI accent.

I believe you are right about NI. ISTR a post about that a short time ago.

Edit - sorry Hairbear, it looks like I’ve replied to you when copying the quote. Post is meant for George1.

I’ve had a thought @George1 - could you transfer the remaining pension to a new plan or provider? Then withdraw that whole amount?

That would give you the non-fractionne requirement. When I asked the tax inspector about my two SL pots (one a group stakeholder pension) he agreed they were separate plans and taking one and leaving the other would be fine.

The other requirement, that the funds attracted tax relief, might be more difficult to show, as you wouldn’t have that displayed in the new pot. I suppose you could point to the old pension to show that.

In any case it is only if you are asked to demonstrate it that you have to - and the impression I got from my tax inspector was just add a note with the plan number - he didn’t;t say to supply any documents with the declaration.

Hope that might be of help.

PS when withdrawing, doesn’t one get asked for the remaining lifetime allowance amount? (Graham’s video jogged my memory)

Thanks for posting the video 5 reasons not to take tax free cash.

It’s a useful reminder of all the things to consider. I don’t have to take a lump sum from the two pensions when they mature, so I will have to do the maths - of course the figures are all different for France, the pensions will be taxed each year at probably 30%, the lump sums would be a one-off 6.75%. As the video shows, need to factor in lifespan and inflation - as well as lifestyle - get a better house in France and / or travel the world?

On the down side, I didn’t fully realise while I might have a 1 in 4 chance of reaching 92, I also have a 1 in 2 chance of NOT reaching 84!

The bit about the lifetime allowance jogged my memory - I wonder if people abroad from the UK have to pay that if triggered? Maybe if it’s a charge - and not a tax? A quick google seems to indicate that it applies if abroad - QROPS seems to be the method to ameliorate it if one is lucky enough (?) to be affected.

Perhaps the lifetime allowance was what @hairbear may have had in mind?

Yes, I am aware that a whole pot can be taken, as you say it’s been like that for a long time. It’s the penalties that ensue, i.e it being taxed at your marginal tax rate, whatever that was for you when you were last a UK tax payer (I think it’s actually what your highest rate was in your last 3 tax years). I’m not entirely sure that HMRC would not be entitled to take that large chunk off you, even though you are not currently a UK taxpayer. It would be a very expensive mistake to make.

Edit: Come to think of it now, I’m pretty sure that even as a non UK tax payer, the only way to export more than the tax free 25% from a private pension from the UK, out of the UK jurisdiction is via a QROPS. If this were not so, then HMRC would not have a list of valid QROPS schemes, indeed QROPS schemes would not exist at all.

Any other, means other than a QROPS should incur a penalty equal to it being taxed at you’re marginal rate in the UK. Unless this has changed since 2019, I’m now sure this is the case. Please get expert advice before doing this.

When I looked at this in 2019, with the intention of transferring my private pension out of the UK and into the EU, I’m sure that in general, the only legal way to transfer more than the 25% out of UK jurisdiction was via QROPS, and it had nothing to do with the lifetime allowance. That is what was nagging at the back of my mind about @George1 idea of just cashing in and transferring. I’m as sure as I can be without doing further research that doing so would incur a charge from HMRC at the last marginal tax rate.

Thank you for your constructive , and very creative suggestions. I’m probably still more comfortable with taking the lump sums from my 2 existing SL plans, because (for example) I can clearly evidence and demonstrate they were paid in by my employer without being taxed on me (as you know, one of the key conditions for French lump sum tax approval). The plans also correspond to the ones listed in the annexe of the Officiel Bulletin that you kindly sent through.

![]() larkswood12:

larkswood12:

In any case it is only if you are asked to demonstrate it that you have to - and the impression I got from my tax inspector was just add a note with the plan number - he didn’t;t say to supply any documents with the declaration.

Very useful to know.

Good point. That was dealt with properly at the time of the original lump sum - that “fixes” the amount within the lifetime allowance, irrespective of when you might take the balance. SL have a copy of my 2016 Income Protection election for substantially raising the lifetime allowance, which amply covers the amount of the lump sums in question.

I’m glad we’re in agreement on that point…

There will be no UK tax ultimately to pay, as a French tax resident in receipt of a private sector pension from a UK scheme, per Article 18 of the treaty. None. Zero. The previous marginal rate of tax in the UK is not relevant here. There will also be no lifetime allowance issue. When the original lump sum was taken, that, plus the balance were below the lifetime allowance figure, once and for all. As mentioned above to larkwood, I have a high lifetime allowance due to the income protection election made in 2016. QROPS don’t come into this situation, as the approved fund/plan remains entirely in the UK.

I believe I am qualified (to advise myself!) in this area, by virtue of my previous professional experiences in this area. Thank you (and I mean this sincerely) for your concerns and suggestions.

how many doctors do I know of who have misdiagnosed, self medicated and died as a result…

It’s been 3 hours now and I’m getting so near the edge of my seat that I’ll fall off if you don’t answer this soon, how many do you know of? ![]()