Unfortunately, the State Pension is technically a benefit (and thus paid at the Government’s discretion) not a payout from an insurance or savings scheme.

Something that’s generally not well understood. Any notion of paying in is just that, a notion.

Yes it’s not directly linked, any more than paying income tax relates to state healthcare.

In that case I’ll just consider my obligation to pay taxes as a notion as weĺl, and particularly NI.

And don’t ask me to go to war to defend my country if there’s another one. Because the idea of a country and defending what it stands for is just a notion too.

It is true, but still unjust, when Fran and I were on hard times in our early years I paid neither tax nor NHI and was hauled into the Nottingham office. I was told that it was obligatory to pay the back taxes but the NHI was voluntary and not paying would effect my eventual pension.

I paid the tax, but not the NHI, who needs a pension when you are young (relatively speaking), and when I got to pension age found that it was still more than adequate for our needs, and has been ever since. Only checking with others did I confirm that I was getting a bit less, but my decision was correct, if I had a full pension now I might qualify to pay French income tax. ![]()

![]()

yes, of course I am John. The two main political parties are truly acting in our best interests and really do fear being unelected at the next election - so that the other one of them can get in and continue exactly the same ‘policies’ as the first. I must have been so naïve to believe that they are both acting in synchrony for the same master. “Meet the new boss - same as the old boss”

I appreciate that you might not like it, and many don’t, but it is the reality.

If you believe that then you haven’t been paying attention.

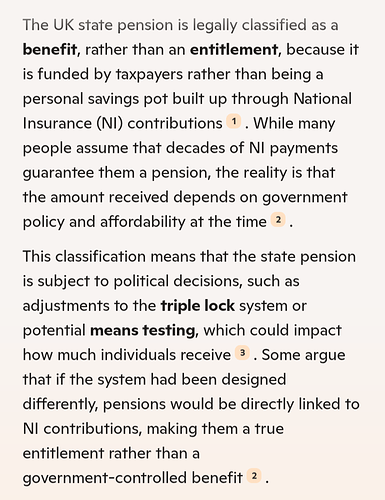

Kudos to Chris and to @JohnH for flagging up this widely misunderstood issue. For a little more on this subject, naturally I turn to that authoritative journal of record, the Daily Express, which (of all places!) for once, summarises the situation quite concisely and accurately.

At least the french side treats pensions as a paid-in deserve and is strict on how much entitlement you get from what you have contributed. Maybe thats where the difference lies!

Well not quite, I had no idea that I had paid into a retirement plan tied to the transport industry (and others) until a chance conversation, a year after retirement, with the secretary where I used to work and she asked if I was getting all I was entitled to. She then dug out a paysheet and pointed out the 50 centimes I had contributed each month. So I rang them up and yes I was entitled but no not from your retirement date, only from today. ![]()

![]()

Yes, I think there is a cut off point from when you can apply for a pension here. When I was notified of mine, I had a very short time in which to respond via their letter questionaire as to whether I wanted to take the current payment or wait another year and gain quite a bit more but it did say that if they did not hear from me, it would be the first original low payment.

Ah that is something quite different. I too was contacted in advance of my main pension and advised the same. I put it off for a year and the benefit was far in advance of what they estimated. In the case I mentioned above I didn’t even know that pension existed and when I did and notified them immediately, I found that I had forfeited anything before. It was only sheer luck that the secretary mentioned it, otherise I would have forfeited it forever.

I understand what you are saying… and yet… as I did not have a full working history of paying National Insurance I only receive a reduced pension.

I did not work for 9 years, looking after our child and some working years I paid a reduced-stamp.

all this counted against me (even with the “allowance/adjustment” by DWP of a few of the missing years ) so my "Benefit " is not the full DWPension… far from it… but I’m glad to receive something. ![]()

To me, it is clear that my Pension/“Benefit” was/is definitely linked to what "I paid in… "

Yes there is a direct link to years paid in NI, in terms of what percentage of the standard State Pension you would get - but the actual amount of the UK State Pension is whatever the current UK Government decides it should be.

So it’s very different from a private pension where as you know, you pay in X amount over your working life, it gets invested and produces a sum Y, which you then withdraw as an annuity or lump sum or whatever.

In the latter case the amount you get out is directly related to how much you paid in (and it’s investment performance), whereas with the UK State Pension even if you (theoretically!) worked for 150 years you would never get more than the standard rate (currently £931 every four weeks)…

As @ChrisMann says, yes, there is a correlation between the number of years of contributions, but not the amount of cash paid, and the percentage of the current state pension that you receive.

What people don’t appreciate is that we don’t have a state pension pot as such and, in principle, the government could end the state pension tomorrow. In theory, our NI contributions paid for the pensions of the previous generations of pensioners and the NI contributions of today’s and future generations will pay for ours. That’s why it’s claimed that there’s a pensions time bomb as the ratio of workers to pensioners continues to decrease.

…and hence why the state pension entitlement age keeps going up. ![]()

In practice it would be political suicide for any party to abolish (or severely reduce) the state pension, especially (despite my comments above) for Reform or the Tories who rely more heavily on the votes of older people.

But some modification to the Triple Lock (or as has happened recently, allowing the state pension to fall into the scope of Income Tax via not uprating personal allowances) is quite possible.

The Triple Lock was meant to redress the fall in the real value of the State Pension that had happened over previous decades, but it hasn’t fully done so, and will probably never do so given the ongoing shortfall in the Government’s funding.

Still tough $hit as people must pay in for decades and governmenf has all the data and is fully aware of demographic shifts. I don’t get to welsh on my contributions - or I get nothing - so government can’t come out witb pathetic excuses for evading paying out to pensioners based on the promises made at the time those people paid their contributions.

Fair enough for government (and companies with pension schemes for that matter) to change what will be paid out going forward, but promises that were made up to the time of any change should be honoured.

Yes, but they are not always in a position to respond to those shifts effectively, and also there is a tendency to kick difficult problems “down the road” for the next lot to deal with, especially if they are of a very long term nature.

Yeah fully aware of that and if they have to change things fine, provided done clearly to all involved, and done fairly. Fairly in the case of pensions, should include decades of advance notice and a fair implementation, with commitments made up to the time of the change protected.

Auto-enrol has been operating since 2013 and should go a very long way to decent behaviour, by taking pension funding out of the hands of government.

( Even though they’ll still try to tinker eg current calls for imposing rules that 10%-25% of all investments by UK pension funds must be put into UK investments).