Nul n’est censé ignorer la loi… Especially where tax is concerned!

You seem to be well informed Karen,

Do you fully understand this: French government statement,

https://www.impots.gouv.fr/international-particulier/questions/taxation-income-received-abroad

Because even when it is written in English, I am struggling.

Is your understanding that French tax residents when declaring interest from English accounts should ignore:

240 INTÉRÊTS OUVRANT DROIT À UN CRÉDIT D’IMPÔT ÉGAL À L’IMPÔT FRANÇAIS

And only fill in:

250 INTÉRÊTS N’OUVRANT PAS DROIT À CRÉDIT D’IMPÔT

Thank-you for sharing your knowledge.

Not sure why it’s unclear.

They want you to declare interest-type earnings. Depending on whether there’s a tax treaty in place between France and the country in which the interest was earned, and then depending on what it says, France either has agreed with that country that any tax you paid that country on your interest earned in that country will be taken off whatever tax you pay in France, or France has not.

You enter the amount of interest you earned in either the ouvrant droit.(if France allows a tax credir)…, or the n’ouvrant pas droit (if no treaty or no tax credit in it)…(…à un crédit d’impôt), accordingly.

Btw I am not an expert but the language in French is not at all ambiguous. Any English translation provided may well actually be less clear than the French is.

PS I’d also be wary of interest-type earnings not being necessarily just bank-type interest. I’d also expect that part of the form to be a home for roughly, very roughly what the UK tax people would call “unearned income”. Fortunately my stuff doesn’t get that complicated so I’ve not had to look into it.

Categorically - yes.

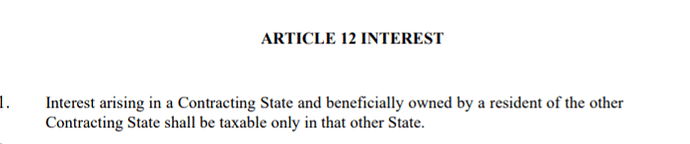

Since the treaty article on interest is very clear that France has sole and exclusive rights to tax the UK interest income of a French resident…

…the accompanying treaty article (24, setting out the mechanisms for actual tax relief) tellingly doesn’t even bother to reference the interest article. The treaty negotiators clearly understood that since only France can tax this UK interest, there is no double tax relief (ie credit) required. So filling in box 250 is indeed the logical approach (or if you prefer box 260 - intérêts et autres produits de placement etc, which gives you the same tax treatment).

BTW I salute, and agree with the comprehensive explanations above of fellow SF members…

Thanks again, George, for your proposed note, which I included this year in the white space in my UK return.

Although I had to go back and remove the circumflex from the “o” in “impôts” because my software 123 efiling didn’t like it.

Incidentally, a friend mentioned recently that although she’s been living in France for decades, she’s always filed directly on the HMRC site. Didn’t think that was even possible.

Wouldn’t it be easier (fewer mistakes) if plain English or French was used: i.e. interest gained from UK accounts in box 250 (it is already state on the form which country is concerned), and for box 250 to be blanked out. ![]()

I too made that “mistake” for several years: if you claim to be a UK resident (no financial advantage) then the on-line form works perfectly, but you cannot then submit form SA109.

It would be so easy to up-date the on-line form by including this, but HMRC, seems to want tax payers to subsidise third party software; I now use the paper version; not very ecological, or efficient, but free.

I have been making this point to HMRC over the years, but I am not sure that anyone is listening.

I’m aware of a workaround that a number of non UK residents use to file online UK returns, ie addressing the problem of the non availability of the Non Residence pages… They simply complete those in hard copy, scan and upload them to the section of the online return where you can include additional documents. For reasons best known to HMRC, they warn against doing this in their notes, but I find it hard to see what they’re objecting to. The return is in substance complete and accurate etc…The alternative is, as Rouretan and Helenochka note, you are otherwise obliged to either use 3rd party paid for software or file paper returns (with all the pitfalls of the somewhat unreliable HMRC handling and processing of inbound post).