thanks, once again - all very helpful. It would certainly be possible to spend a little more time in the UK in the near future while I negotiate with my company to find the best route - either get them to agree to set up to comply with French employment laws are to change my status to that of a freelance - and then re-apply for an entrepreneur/independent professional visa to replace my VLS-TS. Any ideas whether there’s a danger of such a visa being withheld (assuming I can provide the right evidence)? Also, I don’t know whether it’s allowed to recommend firms/professionals on this forum, but I’d be grateful if anyone knows of a company or an agent who’d be able to walk us through all this

@fabien will be able to help and comes 100 % recommended.

You can use the visa tab at the top of every page to contact him directly.

Being practical it is not reallyabout being whiter than white because who is, it is more about looking at where the obstacles and pitfalls are and can you avoid them. France’s systems are pretty rigid and it is crucial to tick the right boxes otherwise it is Non. How do you declare an income on your tax form when there is no box for it, how do you tick the proof of sufficient income when you apply for or renew your carte de séjour if you cannot tell them what the source is, how do you tick the healthcare cover box if PUMA will not accept you unless you continue paying for private healthcare, So I agree that it is might be best to start again with a fresh slate.

This looks up to date and useful. If you go for the frontier worker route I do not think it is sufficient to simply start spending more working time in the UK. you have to get official approval and an S1 from HMRC in order for France to recognise it.

RIFT is a reliable site. Helped loads of people during Brexit chaos.

“

”Fair comment @JaneJones .

I did ask if the OP was well known at his Mairie… as I am aware of 2 instances (a few years back) where foreigners found themselves in an innocent-pickle … were advised/helped by their Mairie (not mine)…

Seems they were highly valued members of their local community and (perhaps) some strings were pulled on their behalf.

Obviously, if one does not have a good relationship with ones Mairie one doesn’t poke the bear… ![]()

They would have to start by obtaining a work permit.

Presumably your employer is aware that you have moved to France? Really they should not have allowed this situation to happen, they should have known that they could not simply keep a person on the UK payroll as if nothing had changed, when that person lives and works in another country.

They do know, but it’s a small company/charity and to be fair to them, it was up to me to do the homework. Ours is essentially a village mairie, so I suspect wouldn’t have the expertise/clout to do other than kick it up to the regional authorities.

These are not the kind of issues that maries are involved in. Mairies deal with local issues. Visas, work permits etc are handled initially national level and then by the préfecture.

Fair enough…

Many of you might be surprised to learn just how well-connected/well-known some Maires actually are…

For sound advice on a personal level … I have no hesitation in asking at my own Mairie. They are used to my obscure question (on behalf of others)

but I also visit Mairies in various Departments.

One very large Mairie was an eye-opener. I’d an appointment with a lady in Planning and was sitting quietly waiting in the Reception area.

A gentleman approached… we had the usual Bonjours and then he asked if I was OK. I explained briefly who I was, where from and why waiting… and he came back quick as a wink… Ah, I know your Maire Monsieur blah blah blah…

Turns out this pleasant gentleman was the Maire of this large town/city… and he had known my own Maire for years…

If I ask a question to which the answer is not clear… my own Mairie will endeavour to find out for me… if they can.

(but I can appreciate folk especially Brits being wary of admitting anything…)

HMRC will question you closely as to where you perform your work ie where are you physically sitting when you work even if remote.

I am a frontier worker and luckily the 2 main questions - where do you work and how often do you return home, my situation was absolutely unambiguous. I work 100% in the UK, I might look at an odd email on the train coming home or in an airport lounge but that’s all. And most of the time I come home for weekends then back out again Monday morning or Sunday.

Covid obviously stretched this as travel was impossible as no transport or not allowed, and there are gaps between my contracts where there was tolerance. But you are asking HMRC to accept your health costs in France (and there are other benefits) when you ask for an S1 and so you need to be clear that your work pattern broadly conforms to the above if you apply for one.

I agree that maires are wonderful people, and most of them network regularly and have many valuable contacts.

But inevitably as more and more processes go online, personal contacts are left outside of the loop.

Visa applications, application for work authorisation, CdS renewals and most other immigration matters are now almost entirely dematerialised and no matter how well connected you are you cannot bypass ANTS and the other platforms. In a way I think this is a shame because everything seems to be becoming so impersonal but I can also see that it is more efficient and perhaps fairer.

Yes this is how I understood it to be. Even before Brexit I knew of people who applied for an S1 as a cross border worker and were refused and told to join the French social security system, and it would be surprising if HMRC has become more lenient on this post Brexit. Especially as I believe an S1 also covers the healthcare of family dependents? so as you say HMRC is going to be quite cost conscious.

are you able to return to the UK while this is all sorted-out???

Your only two options ignoring the visa are your employer registering with ursaff or you using a portage salarie company

You may want to start with the financial reality. The portage companies have calculators on their site - you can see what your take home would be. That figure is accurate for portage or if your employer registers with ursaff.

I’d begin with the money and work out what’s actually viable.

And I think you might be surprised at how many Mairies are not as helpful, well-connected, knowledgeable and effective as yours. You appear to have an exceptionally good Marie, but this is not universal.

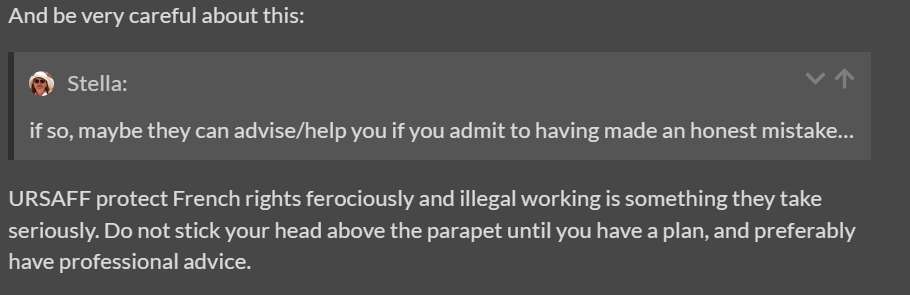

It’s not just a question of being wary about admitting anything, but not doing so until one has a feel as to whether it is worth it. One of our conseilleurs is a nit-picking police man and the mayor has a habit of kicking things to him.

Once Paul has a plan, that is legal, then the marie might well be able to help getting it realised. But they can’t support anything that isn’t.

Or being an AE if it is not an employer - employee relationship this can be doable.

He doesn’t have to return to the UK, just be there often enough to justify that he is working in UK, not France. As a stop - gap this is low risk .

He’s a full time employee - AE doesn’t work. Multiple clients needed - that and the reality of a visa/business plan.

Anything possible but it does mean quit your job - set up a new business from a second country…

There’s always a danger of a visa being withheld, but if you were accepted for a visitor visa then that suggests that you had the necessary standing to be considered ok. And an application that is essentially saying we came over here as visitors (travelling back to UK to work) but like it so much that we know want to contribute to and integrate into French life so want visa X sounds a plausible thing to me (but I am not an immigration official of course!)