Good to know, thanks. That’s what I would be doing too. What area of business are you in, if you don’t mind me asking?

The last thing I would want to do is make an incorrect declaration. I would not be fronting any cases or advising clients directly - it would be more of a support role and I would look into how best to register that activity.

Urban development….

I have no idea if it was the “right” way to do things, but when I spoke to local tax office they weren’t bothered as long as I declared income. It was my wind down to retirement so only did for a short while anyway.

That sounds more manageable, the way you did it. The more we all discuss this, the more I’m thinking I should just forget the whole thing and retire completely. But it’s a shame that so much red tape seems to stand in the way of carrying out a bit of occasional, post-retirement work on a legitimate basis.

France is not an ideal place for small entrepreneurs! If it looks like becoming a reality go and chat tomyour tax office.

Yes, I was just about to say I might do that. They’ve just closed down our 2 local tax offices, so may take a while to get an appointment, but think it would be good to lay the groundwork.

Hi, I’ve been reading your thread occasionally and @KarenLot ‘s mention has woken me up (well actually welcomely interrupted a rather full on hectic stint of frontaliering’!).

Firstly I wish you well, especially as you mentioned medical conditions.

You also mentioned you’re a lawyer - you’ll be well ahead of an amateur such as me! For what it’s worth my opinion would be claim for an S1 (I think you said you will?) on the UK pension entitlement basis, following your quitting your french activity. You are not receiving a French pension, therefore France will (no longer) be responsible for your healthcare. Yes you would be eligible for cover through PUMA but I think you have a choice as to whether continue with PUMA or request UK cover on basis of your UK pension. As you are covered under the WA you have the additional benefit of being entitled to (free) UK treatment as well (only a six year wait for that - hopefully you were in the queue when you went to France  ). Of course in France you might get complimentary top up cover?

). Of course in France you might get complimentary top up cover?

For UK work I’d say go ahead whenever and without trepidation, you are part time self employed (or better occasional one off income), declare income in UK under self assessment and as foreign (worldwide) earnings in France - it might increase the overall tax band for your France taxable income. Remember the ‘work where you sit’ rules of course though as previously mentioned will the fisc be ‘pragmatic’ ? NB one would be unlikely to obtain a S1 through this route as it is not regular cross border working - that of course is an aside to your query. (And good luck anyone defining regular cross border in this current covid restricted travel environment!).

However as I say you’d qualify for an S1 from your state pension, as long as you aren’t employed in France or receiving a french pension when living in France. UK state pension is taxable only in France.

PS - for general interest, if you did have a french and UK pension and then went to live in e.g. spain where you did not have a pension from that state, then you’d be entitled to a S1 from the state you had contributed the most years to your pension. I think survive france community are now agreed social co-ordination rights continue under the post brexit trade agreement?

All the best and good luck - let us all now how it goes!

Hi, firstly, let me thank you for your good wishes and for setting all that out at an unearthly hour of the morning - depending I suppose on which frontier you last crossed!

Secondly, the fact that I know how to sue someone in the UK in no way puts me in a more knowledgeable position than anyone else when it comes to the intricacies of the French Administration - never was this group’s name more apt! So I greatly appreciate your input.

I was so thrilled to come out of the UK tax system and at least just have the one country to declare in… but your suggestion of declaring any UK income in the UK (and of course France) may well be worth further exploration. But two tax declarations??

I’ve been so busy having surgeries that I think I missed the memo on the six year wait you mention - not sure what you mean by being in the queue? Or re complimentary top-up cover in France. Is this a thing when you retire? I’ve seen a couple of Facebook ads, but they’re always accompanied by lots of angry faces so I assumed they weren’t what they claimed to be and haven’t delved any further yet. Thanks again!

We do two. It’s not that onerous once you are in the system and into a routine.

I think I actually did two for a brief period. You’re right, it shouldn’t be too bad… and I seem to have got the hang of the French one now, so there’s that!

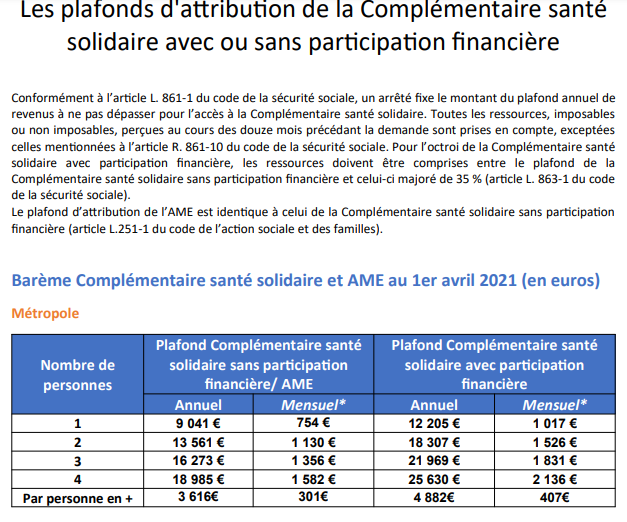

If you have a low income there is a free/very cheap (depending on how low the income is) government scheme for a mutuelle - complémentaire santé solidaire.

We do two tax returns, not difficult.

OK, thanks Jane. I’ll look at the income limits…

Top-Up/Mutuelle Health Insurance is well worth considering if you’ve not got something in place already.

It can come as a nasty shock (financially) to discover just what is NOT covered by the French State should you have anything serious happen here in France.

This is the same situation, regardless of which country covers your health costs: UK(S1) or France.

Thanks Stella, I was just looking into it using an online simulator. Based on last year’s income I’d qualify, but as soon as I start drawing down pensions etc I wouldn’t, so I’m not going to go down that route.

I have a mutuelle now, thank goodness, as I’ve had 5 major operations in the past 4 years.

Good news about the Mutuelle… which will have served you well by the sound of it.

It’s provided excellent cover in every respect bar one : I got 13 cents towards a very expensive pair of progressifs specs

Ah, but I reckon your glasses will have cost you nuffink compared to what you might have had to pay as “your share” of the other medical bills…

I have very complicated specs and am now thinking of re-using some frames which are still good… and just getting the new lenses paid by the State+Mutuelle. I’ll just have to see how it all works out with the various Devis.

Just my bad joke - I watched something in the news the NHS treatment delay now is 6 years (coz of cancelled treatments due to covid prioritisation) - a good reason to be with France healthcare! A benefit of the withdrawal agreement S1 is it gives you access to both healthcare systems, though with the mutuelle, or complimetaire which others have now briefed you on, there’s not a great advantage of ‘free’ NHS entitlement - especially if there’s a massive wait. Maybe free prescriptions (for over 60)? You did however mention one advantage of NHS access - free eyesight tests! (again over 60). I think a lot of UK France resident retirees do pop in to the opticians when visiting the UK…

I think all the UK abroad could feel virtuous at taking a load off the UK health system?

Tax - you might not even have to do a UK tax return if your work is of a ‘one off nature’ - ring up and declare , and argue as a retiree this is not a m self employed situation - and there wouldn’t be any tax to pay if earnings below your 12.8K tax free allowance? And as others say, if HMRC did think you were in self employed category it’s not too onerous to do a SA return - you could probably do it online in the time you’ll be hanging on the phone for someone to pick up.

I’m presuming you want the S1 to remove the France CDG charges on UK pension income.

Regards

I’ve come into this conversation a bit late, sorry! Like you #Linz I can at long last take my UK state pension this year. I am also an ME (since 2011). My French pension forecast was that I would receive around 56€ if I take it now, but it will more than double if I wait till I’m 67! So I will be taking my UK pension, direct from the UK, but will delay taking my French one. As I intend to carry on working anyway (but minimally, just the odd little bit of French admin or copywriting here and there), I will remain in the French health system through my ME contributions, and will end up paying social charges on my UK pension.

Sorry for delay, been running around a lot (for someone not working ![]() ).

).

I rarely visit the UK. I’ve had phenomenal health care here in France and wouldn’t even think of seeking UK treatment unless in an emergency situation on a visit. Happy to take the hit on the specs charges, given all the other treatment I’ve received.

That’s an interesting thought, thanks. Especially given it may not even happen that I get work from the UK - and I would surely remain below the tax-free allowance.

Really, this is the crux of my original post - I’m trying to understand the level of charges on UK pension and investment income and whether they would be any lower if I were to move to the S1 system.