Being in an EU country over six months is not only about tax it also triggers other things like car registration. Healthcare is another thing that needs addressing. George might be correct in thinking that a U.K. citizen will be able to remain a U.K. tax payer if they stay in France on a six month visa then use up their 90/180 days but I’m sure if they tried it every year they would find it impossible to claim that they were not French resident. France Visas make it clear that visitors visas are exactly that, for visitors.

You will be waiting a long time for a form from the tax office. The onus for establishing residency is on the individual.

Which is why for now/next year it wont be a problem. Just a step into future plans possibly which we will address when and if the time is right.

I would agree. Determination of which country a dual tax resident has the closer fiscal ties to, is entirely facts and circumstances based. If the weight of a regularly visiting individual’s life decisively tips towards France, they will have to deal with the consequences.

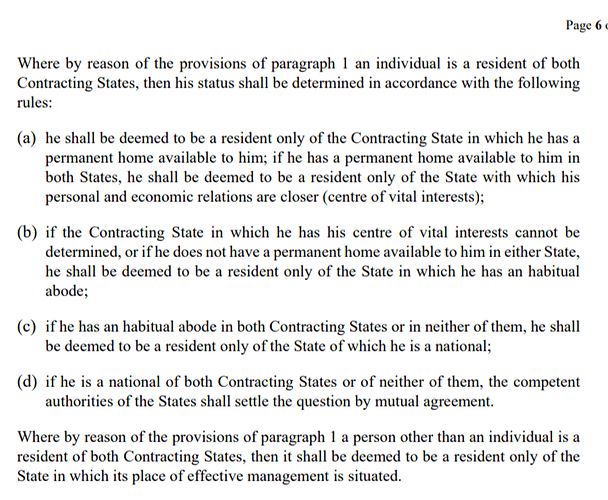

My own experience of dual residents with second homes is that what often keeps them in their home country tax system is nationality. In other words, a Brit tax resident with a second home in France that is visited very regularly (such that they are also French resident) will (in theory) work their way through the so-called ‘tie-breaker’ tests below in the treaty..They may well have to rely on their UK nationality (c below) to enable the UK to continue to have primary taxing rights over them.