Checked with a Notaire? I have the paperwork both by my Notaire and the TGI to proove my point so yes, fully correct

My response about SdB is from my own personal experience when I was widowed

We are similar, but slightly more complex as a thrice blended family. We were told the will of the first person is enacted, so in our case everything goes to other spouse except the specific legacies that are in that will. Since our will is under UK law then everything should be free and clear.

However if under French law then there would be the réserve héréditaire so one would only get the part of the legacy that is freely available and the rest is reserved , ie house could be in usufruit, for the eventual inheritors.

The traditional approach is to set up an assurance vie with the children as beneficiaries so they have the funds to pay the tax.

But the estate is in France? So why need a représentant?

As a general rule, all non-French-residents living outside the EEA have to go through a représentant fiscal when selling a property in France.

The UK is now outside the EEA. My niece and nephew would be in the UK, trying to sell the flat they’d inherited from us.

Yes if they come to sell, but I thought you were referring to settling the estate which the French notaire will do without need for a representative. After all, maybe they will keep the house?

Certainly none of our beneficiaries will be able to afford 50%/60% inheritance tax and will have to sell our house ASAP. All of this is beginning to look pretty ugly. There is so much good my god daughter could do with her inheritance. I hate the thought that I may have to give our/my money to a French charity that I don’t know or care about when someone in the UK whom I love is so deserving.

They couldn’t afford to keep the flat, Jane. And they wouldn’t want it. They don’t speak French.

Anyway, this is all academic in our case because there is just no way they could come up with the £500 000+ that would be payable in inheritance tax on French assets within 6 months of the death.

Even taking out life insurance policies for each them in the maximum amount wouldn’t cover the bill.

It’s best if we just cut them out of the French will and leave them something in the UK.

Can I ask there are no brothers / sisters - the parents of your niece / nephew? Brothers / sisters would have a lower tax rate?

This is often a factor in older people’s decision to move back to the UK eventually, especially when they have children back there.

The finances just get too complicated.

I don’t mind the thought of leaving money to charity. And I really don’t want to create a huge headache for my brother’s kids.

Quite apart from the tax issue, would they also have to deal with all the practical arrangments like closing bank accounts, utility accounts, etc? Can’t see them doing that, to be honest, With zero French.

In fact, I can’t even see them working out how to park their vehicle in the centre of Strasbourg for long enough to clear out the apartment! And phoning up EMMAUS and

begging them to take our furniture, etc.

Sure, I have a brother but he’ll likely be dead before I am!

Husband’s brother is in Russia and, er, out of the picture.

In any case, none of them would be well equipped to cope with sorting out administrative hassle in France and in French.

Sue, perhaps you could make some arrangment for your god daughter involving life insurance. There’s definitely a cut-off age, though. You have to do it before you’re 70, I think.

Thanks for the info. Inheritance planning is something I’ll have to think about - and before buying a house / apartment.

If you are French resident at the time then all your assets can be part of the French estate. You will need to discuss with a lawyer specialist in cross-border planning.

Assurance vie has no maximum - it is not life insurance - but of course your pockets might have. It is not a total solutions as the tax free limits for inheritors other than spouse have limits (after 70 it is less favorable).

“Primes versées avant les 70 ans du défunt exonération à hauteur de 152 500 € puis prélèvement de 20% jusqu’à 700 000 € et 31,25 % sur le reste.

Primes versées après les 70 ans du défunt: exonération à hauteur de 30 500 € puis primes intégrées à l’actif successoral”

It has occupied us for a while, and one reason we are still toying with downsizing to something where the tax would be affordable with the money we have put in assurance vie, once the tax free amounts are set off. Our English will allows us to give stuff to who we want, but they still have to pay french tax.

We are not rushing, and maybe will leave it too late anyway as never know what’s round the corner. However I know most of those involved would prefer us to live happily than stress about leaving them anything.

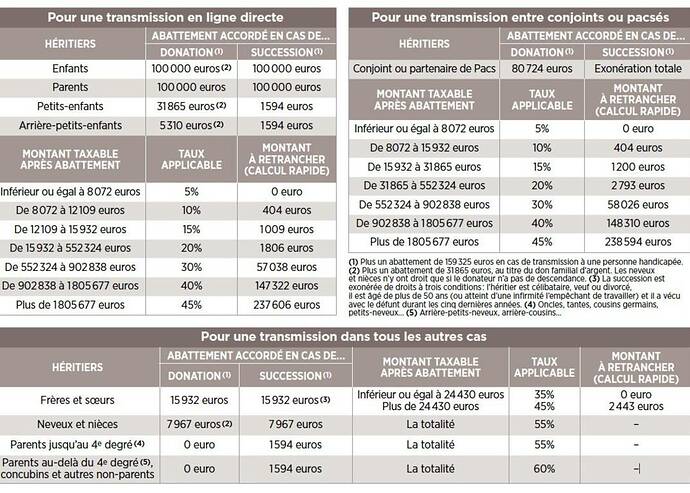

Just for information this is a chart of tax free amounts and tax rates.

Thanks very much.

It was a French Advocat specialising in inheritance planing and a Notaire who gave me this advice. Obviously the tax implications are dependent on the value of the property being transferred and the value of the estate. Of course one should take advice from a Notaire as everyone’s circumstances are different, but it is better to have an idea on what the options are when you see the Notaire

Too late for that, unfortunately.

Seeing the table that Jane has kindly posted, I remember being quite shocked to discover that gifts above 80724€ between (living) spouses are liable to tax in France, quite unlike the lifetime position in the UK. I suspect there must be numerous people who have been unaware of this potentially major tax trap, to their cost. The actual tax rates on gifts are quite significant.

EDIT - I’m not sure what the policy rationale is for taxing lifetime gifts between spouses, yet exempting them on death.

So pleased we are old school, married 48 years, 4 children, 6 grandchildren and counting. Property on both sides of the channel and wills to be administered under UK rules for UK assets.

Looking at @JaneJones chart heirs should be tax free.

Unless someone knows different.