Saying us plebs as Graham did is, whilst not exactly a term of endearment, entirely harmless!

We’re all plebs after all.

He lives in the center of Brexit land…Redcar, near Middlesborough.

Did I see the words paper tax return and Luddite in the same post…I thought you now had to it using an online account.

I did my first French return of years ago and needed some information to send to HRMC for a double taxation claim and the only way to get it from FR tax office was by opening an online account. Which seemed OK as I hadn’t done a uk return on paper since 2012.

Yes John, Its an odd thing isn’t it. I understood that continuing to use paper returns was for people who were tech unsavvy, don’t have a computer or are in some other way, shall we say, “challenged” and there are plenty of ways of obtaining assistance in completing the return online as outlined in this thread or by using a public access computer either at the local library or Mairie. I may be wrong, but I also thought you declared sur l’honneur that you were unable in some prescribed way to use the technology.

I would have thought personally. that someone used to using social media, does use social media and clearly with the means to do so would not fall in to that category requiring the submission to be made electronically like everyone else.

From Wikki:

The Luddites were a secret oath-based organisation of English textile workers in the 19th century, a radical faction which destroyed textile machinery as a form of protest. The group are believed to have taken their name from Ned Ludd, a weaver from Anstey, near Leicester.

Don’t be embarrassed @graham if you are struggling with these Tech issues - just ask for help, a Tech Guru will be along shortly to help!

My mother managed to remain independent and living alone right up to the last 2 weeks of her life aged 95. And part of that was her determination to keep up with technology as she lived in a small village. She conquered using the internet for shopping, playing bridge and so on. Without that she would have had to move.

Being a luddite is all well and good as a philosophy - and something I support in many areas - but not a good strategy in practical terms.

There’s an awful lot of tech savvy intelligent people on other forums who seem to be receiving paper tax forms Obviously I don’t know the ins and outs but they are discussing them

Maybe they haven’t yet had a tax form or done the on line tax set-up. I have just got paper tax forms for various daughters who were still on my tax declaration last year. Mine is online.

Hi Eddie - We receive our paper declarations each year from the fisc and each year the accompanying Form 2041NK

REMPLIR LA DÉCLARATION DE REVENUS 2019

Si votre résidence principale est équipée d’un accès à internet et quel que soit le montant de vos revenus, votre déclaration de revenus doit être réalisée par

internet. Toutefois, si vous estimez ne pas être en mesure de le faire, vous pouvez continuer à utiliser une declaration papier.

Translates to “However, if YOU feel that YOU are unable to do so you can continue to use the paper declaration” It does not mention anybody else. It is a Subjective decision made by each individual.

Personally, I don’t think it’s clever to fight back against the gouvernement or the fisc in their drive to move the electronic submission of tax returns forward without good reason particularly when the gouvernement have applied so much in the way of resources to make the process as simple as it can be as it helps keep taxes down and contributes to reducing the carbon footprint.

If anything, I wonder if those deemed not to have good reason may well be those whom the fisc specifically target for a closer inspection.

So, why stick your head above the parapet as a target when it is so unnecessary?

Firstly, from a professional and personal point of view I think the Impots website is excellent and a pleasure to use (one certainly can’t say the same about ANTS  ) Secondly, I agree fully about keeping one’s head below the parapet on tax matters. I’m fully compliant and always have been, but I’ve had two friends in an other jurisdiction, who were equally compliant but subjected to personal audits because of sloppy/late filings. Neither suffered any sanction but they had to dig up all sorts of paperwork, I think going back five years. I’ve everything filed away but I can certainly do without the stress and hassle of an audit.

) Secondly, I agree fully about keeping one’s head below the parapet on tax matters. I’m fully compliant and always have been, but I’ve had two friends in an other jurisdiction, who were equally compliant but subjected to personal audits because of sloppy/late filings. Neither suffered any sanction but they had to dig up all sorts of paperwork, I think going back five years. I’ve everything filed away but I can certainly do without the stress and hassle of an audit.

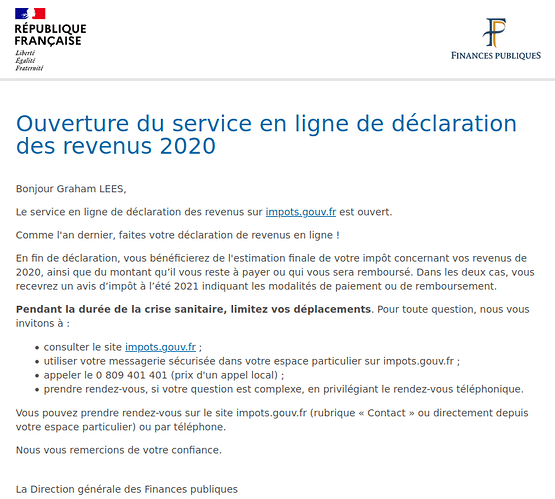

Update: Right on cue this just popped into my inbox… “Ouverture du service en ligne de déclaration des revenus 2020”

My point exactly John. I too am fully compliant but I know, also from a professional perspective, just how much work, expense and trauma goes in to responding to a côntrole by which ever regime - even if you come out the other side “clean”, as it were.

Who knows what criteria the fisc use to select their target taxpayers for a closer inspection but one thing is certain, increasing the reasons for doing so is madness.

And just to add…

The fisc have today sent an email advising that the site is open for déclarations des revenues est ouvert:

with solid advice about using the on line site in view of the ongoing pandemic and limiting your travel for consultations et al.

Who wouldn’t want to follow such sage advice and limit exposure to harm?

This Press conference turned into a disaster.

He just doesn’t care any more Jane but perhaps his messianic attitude will bite him in the end… Johnny Mercer was a good honest Defence minister…

I can imagine him running in a Rotten Borough in days of yore.

Now he doesn’t actually buy votes as much as lie for votes.