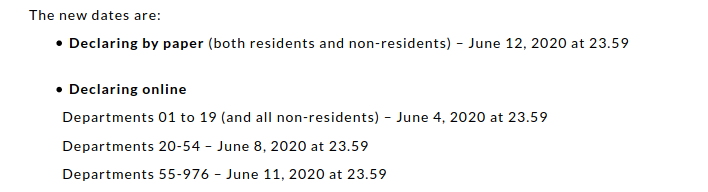

It was the 4th for on-line declarations in the Charente Fay.

Timothy,Do you mean 4th July is the date for my figures to be in or there is a queue and mine is the 10th July? I pay a bilingual lady to enter mine but she does not live in the Charante. Regards

I don’t mean this in an unpleasant way Fay but your comments are a tad worrying, the declaration dates have been out for several months so whoever you get to submit your return ought to have known this.

Whatever Timothy Cole, I have a reply from my local Tax office to say they have received it. So please do not try to panic me again.

Sincerely

Don’t be so harsh on @tim17 he was only trying to help.

You said the 10th June which was wrong and that is what alerted him (and me) to reflect that the last date for submission in the Charente was indeed June 4th at 23.59

If your bilingual lady knew that and submitted before the closing date and the submission has been acknowledged then that’s fine but don’t shoot the messenger!

I think it is easy for folk to get confused… but I cannot see anyone trying to panic anyone …

Phew… it’s nearly over for another year… let peace and goodwill descend on us all… please.

Dear Graham Lees, Thanks for taking the time to respond. I do panic easily but my Tax people are great as they know I am not bilingual and do try to use my Google Translate but that is not accurate. They are not Commercial like Timothy Cole. Everyone is on edge with the DownLock stuff.

Sincerely

No idea what this means but assume it wasn’t a compliment? ![]()

Unless your declaration includes items such as foreign rental income. I thought I had fone something wrong as I didn’t get any indication of what I would pay - but anything out of the ordinary means you won’t get one. You can’t use the simulator either if you have foreign rental income. It just tells you it’s not possible.

Which is not subject to tax anyway. ![]()

Foreign Rental Income will (presumably) have to be declared to be included in the overall picture… which is Total Worldwide Income Declaration…

and I am wondering if it is liable to French Social Charges too…

not something which affects me… but I’m wondering for others…

I know - but you still don’t get a preview of tax to be paid.

No social charges either.

If you follow what Tim did and poke the details (without the foreign rental income) in to the simulator you will get an idea of your liability.