I would seriously recommend going and talking it through with them anyway. It’s reassuring and they should be able to confirm that you are putting anything else in the right place! However, you’ll still need to talk to HMRC about getting your tax situation there sorted as it’s definitely not right and will catch up with you later

Sounds as if you are heading in the right direction and this blip of confusion might actually be a good thing in the longer term as it will get your tax affairs regularised.

State Pensions are taxed here, not in UK, as others have said.

And this is the link to the HMRC guidance about which government pensions are taxed in the UK, and which aren’t

online?

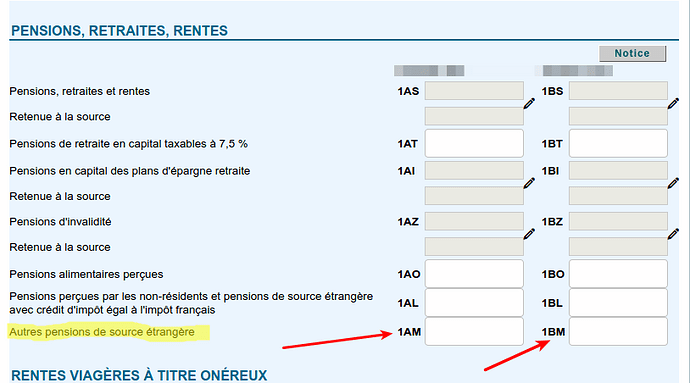

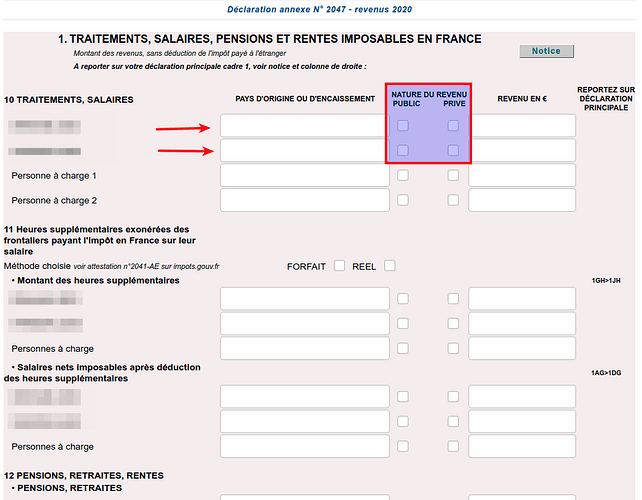

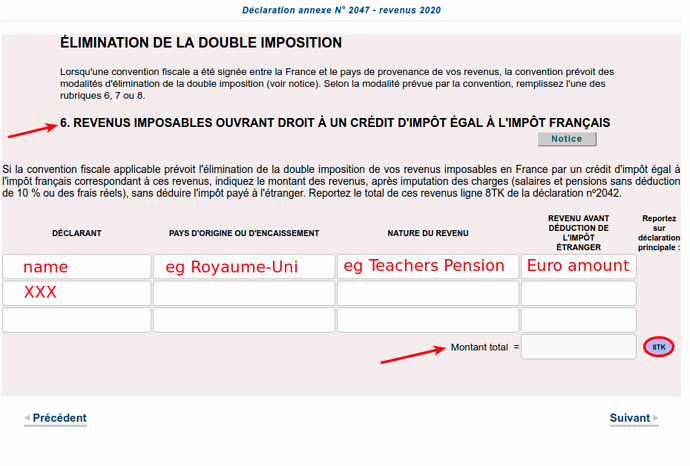

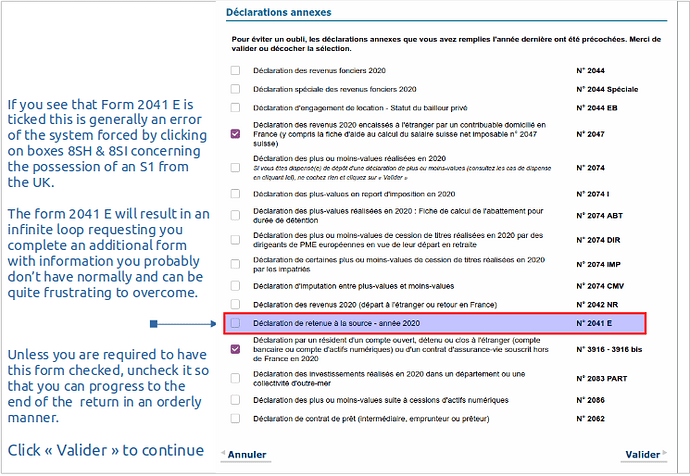

Ok I’ve now entered our pensions in the correct columns (thank you Graham). However, they are saying there are some anomalies which refer to the following, but I’ve looked 4 times for them and they’re not there. Can anyone help me find them please?

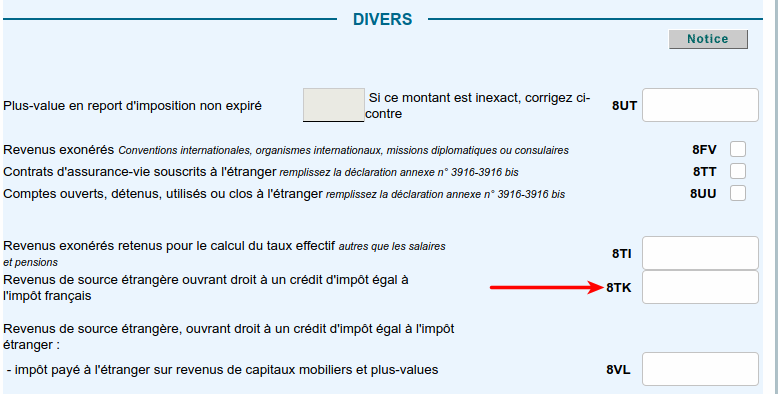

810-02, 1DL, 1EL, 1FL, SANS SAISIE(!) and 8TK which Graham told me to complete, but it’s not there! Mind you they’ve also mentioned the 2 columns I have entered our figures, 1AL & 1BL, so maybe it’s not thinking straight and I’ll have to go there after all!

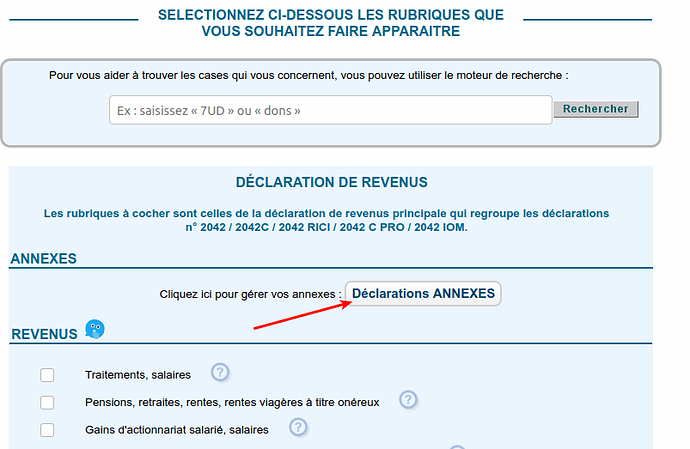

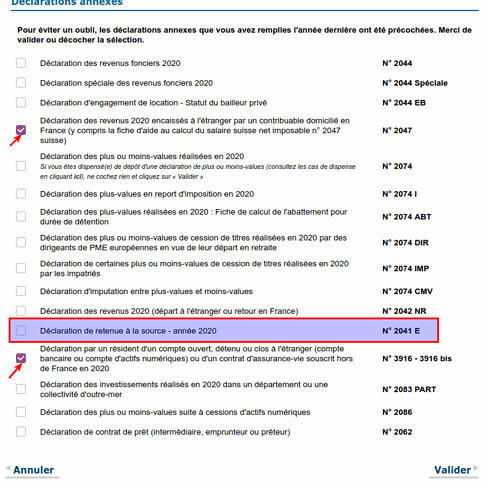

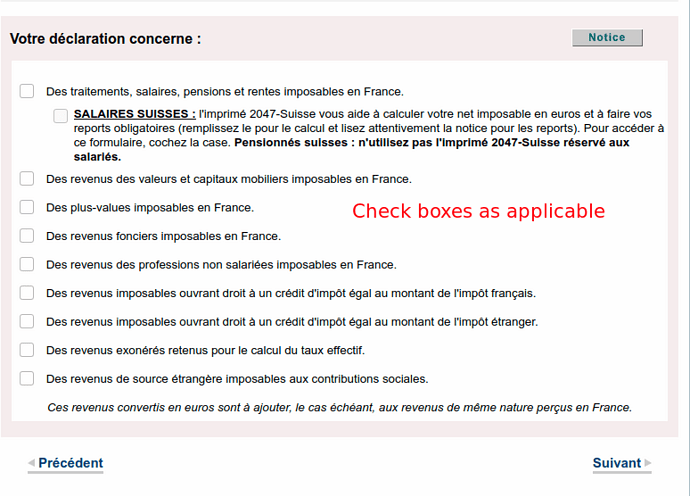

These are the screens you should be looking for (in no specific order) from my preparations for next year:

Image 7 may only apply if you have completed the Form France-Individual.

But in the interests of preventing cardiac arrests Stella, credit will generally be given for tax paid abroad ![]()

@John_Scully No need for heart failure…

I have said it so many times… and yet, I will say it again…

France will look at the Worldwide Income and decide if Income Tax is due…

If ITax is due… they will look at how much ITax was paid in UK…

If France wants more ITax than was paid in UK… France will demand the difference (from you).

(Sadly)… If France wants less Tax than was paid in UK… France will not give you a refund…

and… it cannot be over-stated… the French Tax Folk are not ogres and will discuss things carefully.

@Tanya … and anyone else…

Important tip I learnt the hard way…

Make sure you’ve got your Impots Gouv password with you.

You might be able to amend your Declaration under the guidance/watchful eye of the Tax Clerk… (or maybe not… can’t hurt to be prepared)

I didn’t have mine and the clerk made quick notes for me to follow when I got back home and onto my own computer…

@Stella should you not change the tag in your last post from @AngelaR to the OP @Tanya as it is she who is the one going to the tax office?

I’m losing track of who’s going where…

easy… I’m off to bed!

great screenshots!

captured about 50 of them to sort through and adjust as required with appropriate explanatory text and pointers. Still, got until next tax round to get it right - then they’ll change the formats again

If you have declared any income from your property rented out in UK (if you do rent out) then this is now taxed in France, a change since UK left EU

@Haydn_E_Ebbs do you have a reference for that please?

The Double Taxation Treaty (DTT) was nothing to do with the UK being in the EU and was a separate matter altogether thus unaffected by Brexit. The income from UK rental property has always been declarable in France by French residents - as is all their worldwide income from whatever source but the DTT acknowledges that when the tax paid in UK is declared on the French Tax return and account is taken of it.

I’ll try and find it when I am on my desktop. Double taxation exemptions do still apply of course but the rental income from UK I recall reading as being treated as investment income by France

Haydn E Ebbs

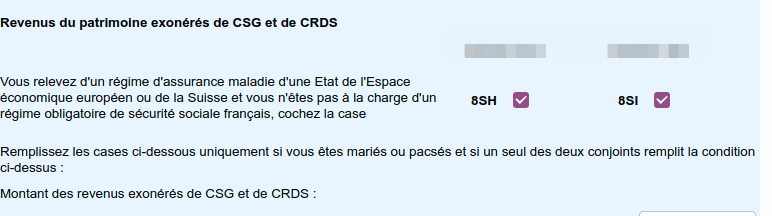

are you referring to this in respect of social charges - in particular where it says

“Non-EEA residents remain liable for the full panoply of social charges at the rate of 17.2%, which of course, since January 2021, includes UK residents.”

Perhaps what is less clear is how this change is impacted by the holding of an S1 recalling the earlier controversies.

Ah yes that could be right

Haydn E Ebbs

I’ve given this a lot of thought, and am inclined to think / argue that because the relevant social security co-ordination regulation is included / cited in the WA, there will be no change for those with a WA CdS at the least.

I know there is something in the possibly shortly-to-be dumped-by-the-UK trade agreement which has kept the S1 going for future non-WA pensioners, not looked into this much.

At the end of the day, the country surely knows it’s a good tax regime for UK retirees and they want to keep the taxes they already get - not kill off the golden goose? (I accept I may be a bit optimistic here…)