Not completely pointless if one can still open uk accounts, e.g. frontalier, because some are currently the highest paying UK savings accounts. E.g. T212’s ISA 5.07% with bonus.

Mmmm! I need to phone M&S’s unit trust department tomorrow. I’ve been paying in £25 a month, every month since we moved to France. They know I’m in France as they send all their paperwork here.

Now what?

Maybe the simplest thing to do is to stop any further contributions. The past is the past, and you obviously can’t rewrite history, but you can ‘cure’ the problem going forward.

M&G will (possibly) claim you haven’t formally told them of your move to France and that you should have known you can’t contribute to an ISA when non resident.

I would let sleeping dogs lie, personally, rather than taking this up with M&G, unless for example you plan to sell/close the ISA

Thanks George - interestingly not M&G but M&S. ![]() I invested in the early days when they first started to get into the financial sector and it’s one of those things I forget about, £25 per month standing order is nothing. Then suddenly a nice little lump sum has accumulated which is useful for the occasional emergency.

I invested in the early days when they first started to get into the financial sector and it’s one of those things I forget about, £25 per month standing order is nothing. Then suddenly a nice little lump sum has accumulated which is useful for the occasional emergency.

Just had an interesting call to HMRC today. Am about to do my self assessment for my uk rental income and of course am asked if I am in receipt of a uk state pension on my declaration. I asked if I have to declare it and also if I have to declare interest on my uk savings account. I was told categorically not to declare either as I will be liable to french taxation on both. So now feel happy to go ahead with my uk self assessment. By the way took literally 3 mins to get through at exactly 9am French time!

There’s a couple of interesting points in your post, thanks. Can I ask a couple of queries please, hope you don’t mind!

I wonder are you doing SA online - some in France have reported having Government Gateway access cut off or being unable to file online without the employment section. Or am I getting confused and maybe one can file online with just the rental income section?

Good they are alert to where the state pension is taxed - I wonder have you submitted the double tax form yet for this, I fear eventually they might try to recover incorrectly tax on the state pension from your rental income? But I can presume you can resist this because they can’t attach a tax code to your rental income!

That reminds me though, are you declared non-resident landlord with the tax at source exemption? I also have Uk rental income and do self assessment - as a frontalier I am also UK tax resident and they’ve mentioned for me to do NRL but I have never got around to it…

PS with my self assessment, I don’t tick the ‘Interest’ section and the boxes don’t appear. But with my non-state pension I have to tick the pension box otherwise it doesn’t let me progress - I have to amend the figure to zero, and I add a note saying the DTT form is lodged with HMRC.

Regards.

Hi

Yes I am ding my self assessment online as we have done for the past 9 years. Last year I did not declare State Pension but did declare bank interest. This morning it was pointed out to not declare that either. So all done now. V straightforward as was last years.

Ps. Yes I am declared non resident for tax in uk

But I do not do NRL either

@chrisell That is incorrect.

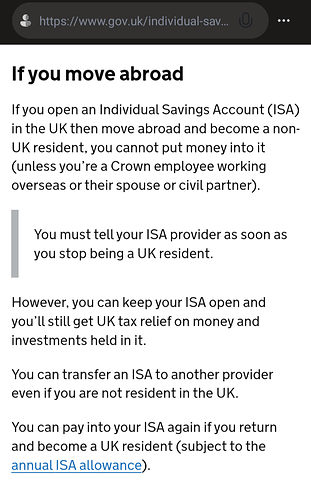

One can keep existing ISAs but not open new ones.

If I were to move back to the UK, my ISA would still be active.

Just saw post from George1, which explains it.