Hi, welcome, I haven’t actually taken any lump sums yet with the S1, so can’t confirm, however no solidarity charge came up when running them through the tax simulator. Also, the tax bulletin on the flat rate has ‘pensions’ written all over it.

Many thanks for your prompt response and I also notice Gouv.fr appear to treat a lump sum payment as ‘Pension’ (understandably and predictably) and that the prélèvement solidarité is not applicable to ‘normal’ annuity/periodic sum pension payments but just exercising caution due to the possibility of varying constructions by different tax offices etc to the ‘exceptionnel’ payment under prélèvement forfaiture. Also very interested in the ‘tax calculator’ you used - do you have a link to it please?

Readily discoverable googling, here -

I agree with this treatment for both S1 holders and those who have private medical cover. I do not believe the tax authorities distinguish (or would have any basis for distinguishing) between regularly paid pensions and lump sum pensions, for this purpose.

Thanks George,

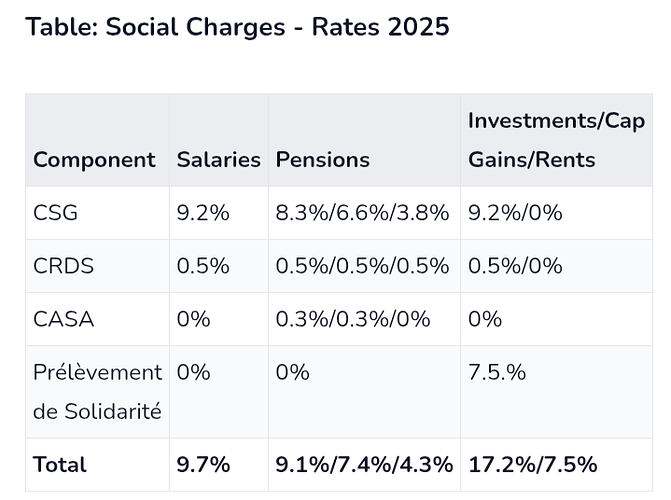

That’s very reassuring. May I ask where you got that table from please?

Kind regards

I don’t know if you’ve accessed these guides. I find them authoritative, up to date, relevant and very much written from the perspective of foreigners moving to France. The social charges table came from here.

Thank you George for all your very kind help!