yup, thats the one - appeared as a tax credit afterwards. Haven’t got my doc on this machine I’m using - will post the details from the other machine tomorrow.

Here’s the details, had to post as an edit as you can’t post three in a row evidently:

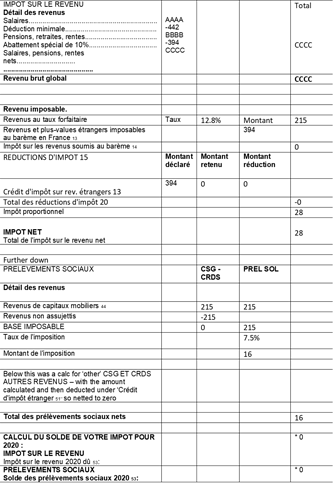

In the hope that others have a similar return, I’ve made a table of my pdf return (pasted as a picture). I declared UK salary, France taxable pension and interest - lets say 215 interest for example. Salary and pension total well within the 0% band. Interest calculations exactly correct (with the S1) but at the end - no tax to pay - so I’m asking for a check - did the 394 pension deduction make the tax credit?

Also included are the fields from the declaration document - one wierd thing, box 8TK Foreign income with tax credit = French tax equalled both pension + salary - I would have thought only the UK salary would have a tax credit? But the other boxes look right…?

Obviously the paper form would have been input manually by someone into the system.

Thoughts gratefully received - thanks.

fields from the declaration document -

Salaries, wages

1AF French CI=I salaries and salaries of non-residents - Declarant 1: YYYY

Pensions, retirements, annuities

1AM Other pensions from foreign sources - Declarant 1: XXXX

Income from movable capital (2042 and 2042C)

2TR Fixed income investment products without deduction: 215

Various

8TK Foreign income with tax credit = French tax: this equalled pension + salary

8SH Affiliation social security scheme EEA or Switzerland - Declarant 1 (tick): 1

8TV Retirement and disability pensions subject to CSG at the rate of 8.3%: this equalled pension + the 215 interest

Selon nos informations, vous déclarez pour la première fois. Pour cette raison, vous ne pouvez pas déclarer en ligne cette année. Vous devez déposer une déclaration de revenus au format papier auprès de votre Centre des Finances Publiques.

Selon nos informations, vous déclarez pour la première fois. Pour cette raison, vous ne pouvez pas déclarer en ligne cette année. Vous devez déposer une déclaration de revenus au format papier auprès de votre Centre des Finances Publiques.

I can/will certainly point them to the impots people but I just wondered if anyone here could give me an answer given I imagine they get more busy when the site opens for declarations.

I can/will certainly point them to the impots people but I just wondered if anyone here could give me an answer given I imagine they get more busy when the site opens for declarations.