…and quieter. That was one small reason I left. The constant noise from them and the bigass trucks going by my place.

I assume you meant to reply to @JohnH. ![]()

I ride a Honda NC750S. I will not be buying a Hardly-Driveable anytime soon. ![]()

![]() Although I will concede that an Indian FTR is a cool looking bike.

Although I will concede that an Indian FTR is a cool looking bike.

And I currently have a BMW, but there are American motorcycles that aren’t Hardly Ableson.

Anyway, I tried a Triumph Street Triple today and it was very nice.

How about a Ferris Buell? ![]()

I’ve heard the Street Triple is nice but I can’t get over the look of the wasp-eyeball headlights.

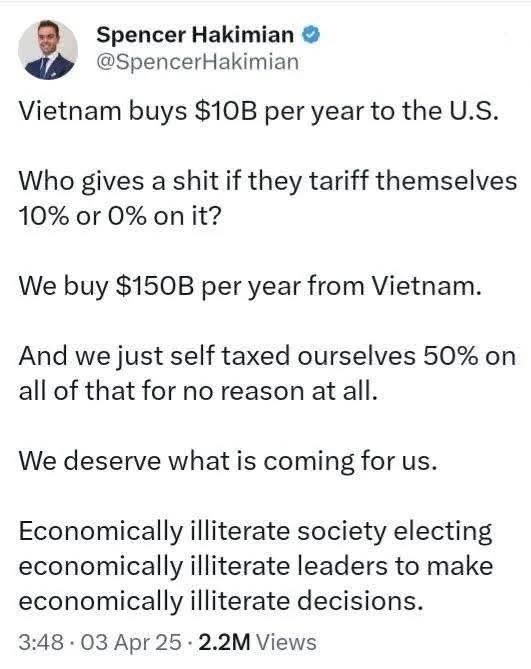

Trump’s views of trade seem simplistic - he seems to think that running a trade deficit with another country (i.e importing more from them than you export to them) is somehow “subsidising” that country rather than paying fairly for goods and services obtained.

He does kind-of have a point that years of importing goods has impacted the USA’s ability to manufacture in house - all those car plants in the mid west unable to compete with Asian and European manufacturers who produced either cheaper or better quality vehicles respectively, for example.

But he won’t rekindle US manufacturing by crippling the economy.

It’s in the oligarchy’s interests for stocks to crash, that way DT and his carpetbagger friends can carpetbag away to their hearts content while pocketing government subsidies to build their businesses up again.

Depends on whether it’s torus or against us?

But also, unlike the 1950s car production etc is much more roboticized, no need for human welders etc.

And very deliberate that was. American companies figured out long ago that they could make more money outsourcing manufacturing to foreign companies instead of making them in America. Trump seems to think that was the fault of the foreign companies and countries that accepted and fulfilled the orders rather than the American companies that shuttered their American operations to earn an extra dime on the dollar.

Very true, one only has to look at where archetypal major US brands like Levis, Nike or Timberland are actually manufactured.

A few days ago I bought a pair of ‘US’ Sebago boat shoes - they were stitched by hand in Portugal and that for me was a plus - Portuguese leatherwork is usually of high quality and the shoes were made in the EU .

I once bought two pairs of Levis from an American PX store. I tried one pair, found the right size and took another identical pair from the pile. It was a couple of weeks later that I discovered that the second pair didn’t fit, they were much too small. I checked the labels and both were 34 waist, 34 leg. I looked closer. One pair was made in Pakistan, the other in India. So much for for the number on the label!

I worked on a ‘Levis For Feet’ campaign. We had a large cardboard box with a selection of sizes of groovy cowboy-style boots.

At San Fran airport Customs wanted to know what the box contained

“Cowboy boots! Levis! Good ol’ US of A!”

He opened the box, peered down a boot and offered us a look at what was printed down the bottom

“Made in Mexico”

How we laughed!

Or, looking at the chart for the past week, +2.07%. … €10350 extra PLUS the extra €828 on that for the [8%] sales tax.

The thing is that the drive to offshore manufacturing was at the behest of the previous financial superpowers. We’re getting the fall out of one set of mistakes being battled in order to make another set.

Next year we’ll all be millionaires. ![]()

Well, those of us who live here and bought a while ago.

And want to sell.

Oh, I knew there must be a catch. ![]()

More specifically, large Western corporations (a lot of whom supported and funded Trump), moved their manufacturing to other countries because that way they lowered their costs and made more profit.

It wasn’t national governments that organised this, but businesses themselves. Developed nations make their money from high-tech design and services, not churning out trainers, T-shirts and household goods.

In setting his “reciprocal” tariffs Trump of course failed to take into consideration the USA’s $270bn surplus in services, which make up 70% of the US economy.

So as Trumpy-boy would have it, it’s “totally unfair” that dirt-poor Vietnamese “take advantage” of the USA by selling it things the USA wants and can’t make itself at a viable price, but totally fine for the US to make a mint selling software to the rest of the world.

He’s just as thick as Johnson, who thought “trade with the EU” was only in physical products, not services, and proceeded to make no allowance for those in his wonderful Brexit deal.

Hence why I am now no longer allowed to take photographs professionally anywhere in the EU, post Brexit.

Sorry not to be clearer - that was what I meant, but in many ways those are no longer superpowers, largely replaced by the digital versions instead. Now that the manufacturing industry is weak, it’s been replaced by the digital industry, which badly wants US government protection to ensure it’s not taxed at point of sale. So we see the old suppliers of real goods thrown under the bus in favour of the virtual businesses.

How interesting.

So do European and other governments have nothing to fear by finally, finally, finally actually taking reslistic enforceable steps to tax the tech giants (mostly Americsn, unfortunately) via taxes on turnover - since they structure themselves so that their actual profits are out of taxable reach?

Tbh if your product is vaporware and has a margnal cost of close to zero, each bite a government takes out of your turnover is close enough to a tax on profit anyway. And the joy will be that they might not be able to simply re-bill all that point of sale tax to customers.

I’ve been wondering why European governments hadn’t been making headway on this. But perhaps now is a good time. Trouble is that when foreign companies get cut back they seem willing to cut productive jobs in non-home countries sooner than cut unproductive jobs at home.

I am by no means an economist, but I happened to photograph a seminar for SMEs at a big London law firm last week on how to expand internationally, both for UK businesses wanting to grow overseas and foreign companies wanting to set up in the UK.

A lot of it went over my head, but they did explain how different corporate structures (subsidiaries vs branch office, for example) affected where tax was due, and the ramifications of those.

What companies like Starbucks and Amazon do is charge their subsidiaries licensing fees for things like use of the company logo and marketing materials etc. so as to move profits into a more favourable tax jurisdiction. The local subsidiary also benefits as such overheads are tax deductible locally.

So I think often it’s hard for governments to distinguish between normal and legitimate business practices and actual tax dodging.

Expensive lawyers are involved!

ETA: and of course if the EU and UK crack down on American firms operating in their jurisdictions it opens the door to shouts of “unfair!” from Orange Donnie, and retaliatory action against EU firms in the USA.