I think the ability to buy years started in 2006. Before that you could top up any years where you had missing weeks to make them a full year, but couldn’t buy whole years. And I think any sort of top up didn’t start until the late 70’s

Yes, but only up to 12 trimestres (i.e. 3 years) & only for certain reasons, such as years ‘lost’ in higher education etc.

Thanks for that @hairbear. Much appreciated. So it’s 12 quarters max mostly to cover when you were in HE or were working but not earning enough. A crude calculation shows it would cost me at least 4,000 € per quarter to ‘top up’ based on my current age/income. If I bought the whole three years I think I’d be dead before I got that back! ![]()

I’m going to be very reliant on my UK state pension especially as my French one will pay out almost nothing… I had paid about 6 or 7 years in the UK before I moved to France some time ago now, and have been paying since, but what I don’t know is whether they will simply transition class 2 to class 3, or whether they will turn around and say, you didn’t pay 10 years into the UK while living there, therefore you can’t contribute anything more… In which case I will be at least 12 years short on my contributions, and life is going to be pretty tough if I make it to that age.

I haven’t seen anything to suggest that there’s going to some retroactive move whereby people who have already built up more than 10 years’ contributions would be stripped of their entitlement, Gareth. Am pretty sure the only change for you will be that you’ll have to pay more in future, if you want to continue contributing.

I hope so Helenochka, I’m not a fan of retro-active “punishments”, but the wording of it is very ambiguous. I believe I heard that letters aren’t being sent out until June or July 2026. I’m hoping we have a better idea before then.

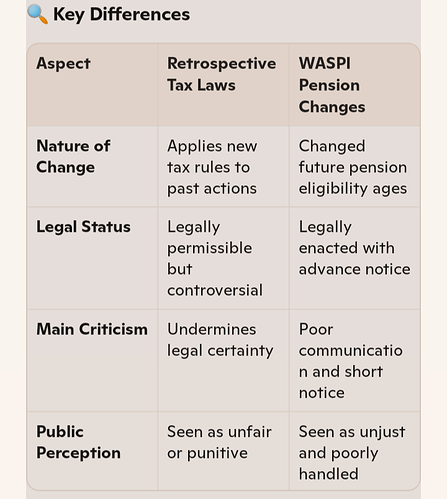

Retrospective legislation is utterly despised in the UK tax world, and is exceptionally rare, if indeed it happens at all. UK Governments and courts have issued statements over the years confirming that taxpayers need to have certainty of treatment at the time they carry out a transaction, and cannot be expected to anticipate changes that are not either law or in the pipeline at that time.I would be extremely confident that there will be no retrospection, regardless of the colour of a future government.

I recall the issue of the ‘WASPI’ women’, wasn’t that a bit retrospective - they were brought into the increased retirement age regime at short notice, so UK maybe not ‘retrospective’, though seems to match the criterion of “anticipate changes that are not either law or in the pipeline at that time” - they didn’t really have much time to plan? Or were fully informed and alerted.

No, there was quite substantial notice, decades if I recall.

I must not be recollecting correctly then! Was the court case they raised not justified - I thought they were on the right side of opinion…

The issue from what I understood was something of a technicality in as much as some people didn’t get letters addressed to them to enable them to be told individually, and what went to court was around this issue of whether every person involved specifically needed to be told of these changes individually or whether a years long government information campaign and significant coverage in the press would have been enough to consider the job done. That’s what I understood the crux to be, people saying “I wasn’t given this information by the government at the start of the campaign so I had to find out by myself and that meant I didn’t have enough time to prepare for it.”

None of which is a judgement about my feelings on the merits of the argument, just how I understood the issue.

It has a very similar sound to discussions we had on here. Some people received letters from the government stating that as uk citizens resident in France we needed to apply for a withdrawal agreement CDS, others of us got nothing. If we didn’t apply for one, could we then say we didn’t know we had to as the Government didn’t tell us, or is it enough for them to spend money on an information campaign, have significant coverage in the press etc, and so say “Well, you must have been hiding under a rock as everyone else knew, it’s no excuse.”

You are too kind to the UK Steph. They screw pensioners (triple lock or no).

They didn’t think it Steph, the UK Government thunk it ![]() People just availed of the law as it was.

People just availed of the law as it was.

Well yes, because they have been contributing at the Government defined rate ![]()

No, because it’s a Government Ponzi scheme and always has been.

There’s no bleeding way the stingy UK pension would ever fund a decent retirement, here or in the UK.

State OAPs.

- 1. Iceland: €35,959

- 2. Luxembourg: €31,835

- 3. Norway: €30,879

- 4. Denmark: €30,211

- 5. Switzerland: €27,010

- 6. Austria: €24,349

- 7. Netherlands: €24,092

- 8. Belgium: €22,577

- 9. Sweden: €22,436

- 10. Ireland: €21,766

And in last place… the UK with less than €14,000. Mean bastards.

The UK’s attitude to pensioners abroad is best exhibited IMHO by the odious IDS bundling in the DOM/TOMS into the average French temperatures to avoide paying winter fuel allowance to pensioners in France.

BTW, balancing ROI and life expectancy, I bought four years at the bargain rate in April The HRMC and DWP still can’t manage to get it sorted. The UK Public Sector is a shambles, though they are very pleasant on the phone ![]()

Not correct JohnH most people (me included) knew that ages would be equalised, but there was absolutely not enough notice and notice where given was not executed as it should have been. It’s been officially judged to be that way by bodies that reviewed it. Can’t remember which bodies but I think one had a title of Parliamentary Review Committee or sonething.

I’d remember the names if I hadn’t spent my life in the UK working so ridiculously hard and long hours that I barely had time to keep up on things. And whichever body reviewed it say individual notice should have been given in a proper way and that it wasn’t.

I get very cross when people think everyone had such a nice easy life and of course I had no issue with the principle but it was a bastard move against a cohort of women. Ah, but women don’t count do they.

It was made even worse by the original transition arrangements which I think Mr. Bottomley had set up, so that people falling earlier into the years being adjusted didn’t have to suffer the full 6 year delay, and those later would suffer all of it, with a sliding scale in between…. A fair implementation which probably had helped get a plan of such enormous impact accepted as reasonable.

But as I understand it this fair tapering was tossed out by later Tories, I would guess by Iain Duncan Smith and David Cameron, and everyone in the cohort got the full brunt, even if born just the wrong side if the divide. Of course there was a nice tapering on a separate occaaion when the overall pension age went up very slightly but then men were affected too so that was done more properly.

Also it was originally 5 years delay and also without proper notice a further year was added on for quite a few which was brought in earlier than it had been said it would be.

But women don’t matter, do they ?

Exactly. It wasn’t retrospective.

Also, at the risk of being unsisterly, I’m 61 so a bit younger than the ladies concerned but the level of ignorance among my female friends when it comes to personal finance is pretty shocking. Maybe it’s just because my husband is a dunderhead in that department but I’ve always felt I had a certain responsibility to educate myself about such things.

Anyway. What Gareth seems to be talking about - people who have already paid contributions suddenly being told those contributions don’t count because they weren’t living in the UK when they made them - is a different matter altogether. And surely a highly unlikely scenario.

Am off to get my flak jacket.

You’ve lifted this from a piece by LV who also say -

“However, UK pensioners make up for the shortfall by receiving more of their retirement income from workplace pensions and personal pensions than in other developed countries where the State Pension is more prevalent.”

There was no talk of the UK applying anything retrospectively and it would be too difficult. So you emigrated but rather than pay into the system of your chosen country you chose to continue paying into the UK to get a state pension there? My confusion aside (as I don’t know your situation) it may be worth you looking more closely at French pensions as they also have a minimum income - look up ASPA. So if you have been resident for some time you may well get over 1,000 € a month even if you haven’t paid enough for the contributory state pension.

Ah … that’s an entirely different discussion. I totally agree the UK pension is shocking and the ability to organise the proverbial pee up is way out of the skill set. And there shouldn’t be a winter fuel allowance - the pension should be enough to allow pensioners to heat their house without any extra benefits! But how bad the pension is, is a mute point.

That wasn’t the original discussion . It’s not so much people availing themselves of a scheme that exists, it’s the attitude of some Brits (obviously not all) that when this generous system is watered down that ‘they’re only doing it out of spite’ and grumbling about how poor they’re going to be when the country they no longer live and haven’t contributed to in years is stopping them buying a pension on the cheap. They emigrate but still expect to be able to get the full benefit of something from that country as though they had fully contributed. If people want full anything, don’t emigrate!!

I see this decision as just an easy way of grabbing a few million to help fill the ever changing “black hole” that is so important to Reeves and the government.

That’s a key point. Accurate figures are a little difficult to come by, but DWP or HMRC research I saw recently suggested that the average combined State plus workplace pension in the UK is around £19,900, which converts into €22885. This would put the UK’s total pension behind The Netherlands but ahead of Belgium, Sweden and Ireland in John Scully’s European pensions table.

- Iceland: €35,959

- 2. Luxembourg: €31,835

- 3. Norway: €30,879

- 4. Denmark: €30,211

- 5. Switzerland: €27,010

- 6. Austria: €24,349

- 7. Netherlands: €24,092

- 8. Belgium: €22,577

- 9. Sweden: €22,436

- 10. Ireland: €21,766