It would need to include recommendations of things to do well before as well like making sure that bank accounts and cars are accessible by the surviving partner as well.

Well, there were a lot of wells in that sentence!

A good topic !

I arrived in 2005 at 60 years old.

Now approaching 80 and twice moved ,(a tangled story ) I really will not ever move back to the UK . I have gleaned a lot of information from the replies and made notes for my next Family visit in July ! So I choose to end my life in France and am happy living here with some lovely friends and sunshine in the South .

I think that is the difference. We have no one to turn to for this. We have dear friends who are our age or older with their own health and family issues. We wouldn’t dream of burdening them with sorting out our deaths.

Our inheritors are young people in the UK who (a) would face paying 60% inheritance tax (b) don’t speak French (c) don’t drive (not great if they have to come out to rural France where we live) and quite frankly would have to revoke any inheritance - money which in fact would make a huge difference to their lives.

We bought our house en tontine, have only a joint (M. Ou Mme) bank account. In the event of one death our children would only be entitled to a share of the “biens” and the notaire says it is simple for them to refuse that. When husband was first ill, I put together a folder of documents for them, in the event of both our deaths. It includes copies of living wills, ordinary wills, funeral requests, all suppliers and contracts like EDF and should also be useful as a source of who we have to inform if / when we leave France.

We have started a list of things we would want to take back, close and extended family have been invited to take anything they want and the rest can go to charity.

Is there anything else people can think of to do in preparation? It might be useful to others.

[quote=“David_M_Matthews, post:103, topic:52113, full: true”]

How old, Wozza?

I have a well as well.It gets well used as well.

![]()

![]()

![]()

![]()

![]() .

.

well done.

TBH that’s not just the city, Helenochka. There seems to be a focus on self and not the "think of the other’s position and help out especially if it doesn’t cost you much’ orientation. I think it’s in the culture, so far but I’m still learning.

Kind of "I’ll pilot my own canoe and it’s up to you to pilot yours and there’s nothing external (eg a moral duty to others) that makes me take account of you.

I have a pair of wellies, does that count? ![]()

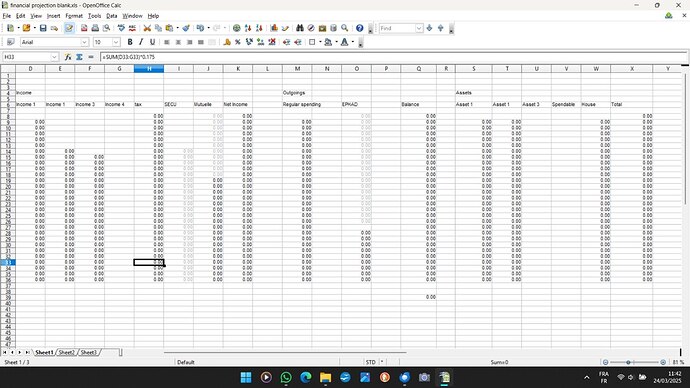

Of course! Unfortunately, removing the personal details seems to have played havoc with the formulae so, to keep things simple, here is a screenshot of the single page spreadsheet.

Missing on the far left is the column of age by year. The intent is to show each year what the total estimated income is, less tax, any mutuelle and prélèvements sociaux, then to compare with anticipated outgoings (eg factoring in EHPAD/carers expenses in at some point).

Finally, on the basis that outgoings might well exceed income in the future, we listed our financial assets, hopefully increasing each year (!), to be liquidated as and when we spend capital (if needed) year by year.

Get copy of your medical records if you haven’t got full set, plus any referrals that might be useful

Customs declaration, and change tax residence

Forward mail

Car and driving licence

Talk to bank, and things like assurance vie

[quote=“ChrisMann, post:112, topic:52113, full:true”]

Thank you, that is really helpful. Will add it to my list.

Consider getting advance tax advice eg consequences of selling French home when French or UK resident, impact/tax treatment of holding ‘French’ savings/investments (eg AV etc) if you become UK resident

Thank you. I have seen that we have to sell the house (our only residence) by the end of the year following our departure to avoid any taxes. It is in easy commuting distance from Caen and houses in the village tend to sell quickly.

We have lived solely in France for 20 years. We only have a current account with no savings accounts.

Thank you so much! My husband loves deciding by spreadsheet. Should have had his secretary create a plan before he retired. ![]()

Just don’t give any originals to the NHS because in my experience they completely disappear ![]()

The reason I suggested considering getting advice is that you may also need to think about the UK capital gains tax aspects IF you sell your former home when you’ve moved to the UK. Obviously you hope to sell asap, and thereby benefit from all the available CGT reliefs in the UK as well as France (eg last 9 months of ownership of a former main residence are considered as being occupied as such in the UK, which can help).