The day the British voted for Brexit the pound fell from 1.30 to 1.20 to 1 euro and then continued to fall to a point close to 1 to 1. Today the pound has edged its way back to 1.20 which is obviously good for Uk funded life when living in France.

I have read various financial reports as to why the pound is gaining ground but would much prefer to understand in layman’s terms why this is so.

Given how much conservative government bashing there seems to be from some on SF who obviously derive there income from the UK why is it that under this conservative government lives for French residing UK nationals are enjoying a good exchange rate.

It seems to me that the British living in Britain are the losers with the fallout of Brexit while the British who live in the EU are the winners.

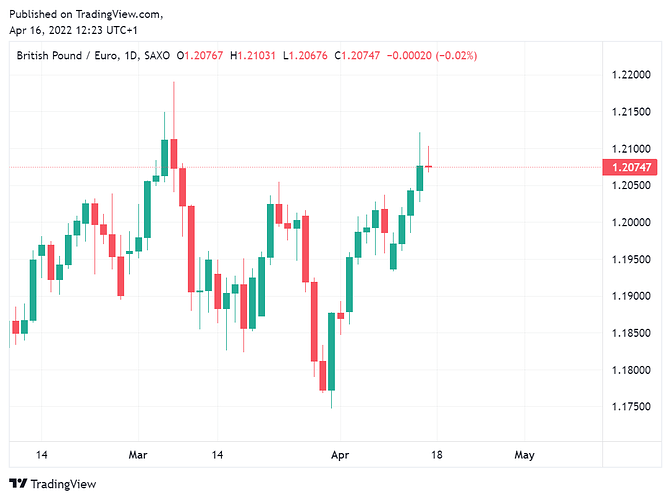

This gives a view on the GBP-Euro exchange rate.

It’s been regularly above 1.20 since January. It has been higher than it is now since then.

Not sure that the exchange rate has anything to do with most government actions. In this case, it’s probably a combination of sentiment and the Bank of England. Also, higher exchange rate is not necessarily good for the UK.

who knows John… had it not been for Brexit, the rate could have progressed on upwards to 1.40 or beyond…

I’m not sure the two issues are connected tbh.

the so called “conservative government bashing” is an expression of horror at what is happening to their country of birth and the realisation that relatives remaining on plague island face terrible challenges ahead, as well as friends and acquaintances.

The standing of British nationals worldwide has diminished beyond recognition and all this is at the hands of the crime minister and his cronies in government. You have to admit, surely, that whilst many would dearly love to hold their head high and praise the achievements of their country of birth, it is impossible to do so at the moment under this regime and their sense of frustration is understandably channelled through the medium of SF.

Thanks for the link, yet another full of long winded historical data and ifs and maybe’s about the future. So must we deduct from this and other reports that history is fact and the future is anyones guess, nothing changes.

I would be a little cautious with the Local Elections coming up next month, these could be very bad for govt which woukd reduce £.

Magic, smoke and mirrors, coincidence, the stars, one of those things, it’s a game of two halves, some you win some you lose…

Any of those do? I think it’s serendipity.

A topic close to my heart…

Have a look at this chart - GBP v EURO for approx last month

First, note how up and down it is - the lowest was 1.1750 and the high (a year high) was 1.21907. Now, I think the first reason for any movement is people gamble - they might call it ‘trading’…

I watch this chart often, coz I’m trying to use my revolut ‘free’ 1K exchange allowance each month - not least to pay rent and save up to pay taxes…

Now focus on the year high day (BTW the 1.21907 rate was just for 30 minutes at 1AM - that day was a BOE rate setting meeting - they duly raised the interest rate and up the pound started (it had dropped back to 1.2120 by 9AM). Great I thought, i’ll watch it go up and ‘pounce’. Up it duly went - in half an hour to 1.216 - and then in the next half hour dropped back and kept on dropping for the next two days - shed about 1.7% over those three days. So I never did buy my 1K euros that month - waiting for a bounce that never came.

The reason was although BOE had raised the rate, the ECB also either raised a rate or signalled rate rises, and that trumped the £ big time. There were also worries about UK inflation and that the bank might not ‘deliver’ its signalled rate rises.

There’s other reasons also - war in Ukraine, any sort of election anywhere, and very much how the currency’s trade against the USD - with the euro generally holding up here…

Basically the £ seems to be a ‘risk’ currency, so anything untoward and people will sell it evidently.

People might say it’s a bit anal to check rates a lot, but it is interesting for me - I need to buy a house sometime and that’s going to be a lot of euro’s! And I consider it a learning experience. Now I will buy when over 1.20 and maybe hold on a little - I got an ‘extra’ 2.92 euro’s the other day but ‘lost’ another 7 or 8 - but at least I got my 1200’s worth to stash for the tax bill.

Obviously the free revolut trade is helpful, but if the rate goes up a euro, that’ll far outpace any ‘Wise’ fee - the perennial problem is knowing when to ‘pounce’…

Where next? At the moment the pound sterling live site has an article suggesting the £ might go up 9% - it’s also had articles expecting the £ at 1.17 later this year. But the articles are interesting, if not always correct - and do talk about news and movements - i.e. try to give reasons, though there’s a lot of talk about ‘fibonacci retracements’ too!

At the moment I can be content I’m paying my tax bill computed at 1.16 with euros purchased at 1.20. Undoubtedly the reverse might be true next year, so maybe I’d better get next years bill sorted now as well!

Cue a certain song - ![]()

been there, done that with my Revolut account too ![]()

The problem is though, that you don’t carry over/accumulate the unused 1K€ so if you miss it, it’s lost. The other faux pas I have made (did it this month with one of my pensions paid in Sterling) is to not notice/observe the reset date for the 1k€ free exchange/month. If you jump too early before the reset date, you are hit with a fee… that better exchange rate just melted away in my case ![]()

My father in law liked a bet and spent hours studying ‘his system’ and when asked if he had won anything his answer was ‘broke even’.

Seems that whether its the gee gees or currency trading its as @vero said:

was it “broke even” or “broke, even”

courtesy of Eats Shoots and Leaves

Yup, use it or lose it - though for me the 1K does act as a throttle, though if the pound is going to go up high I’ll have to jump in with Wise.

Although… I went to check how you see how much free allowance is used - click icon top left and go to plan - and there I see they’re flogging unlimited Forex for £7 / month for 12 months. That would beat a large Wise exchange - tipping point is approx 25K.

May be catches though.

Also, you know you can set it to do the exchange at a particular exchange rate? Of course the pound may not reach that price ever, or for a month of sundays!

But it can be quite soothing - think what the pound might reach over a day / week, set it and relax …

Yes, I do and in the past, I did use that facility.

However, since they reduced the monthly amount exchange free, I’ve not used it since it might trigger an unexpected fee if the rate is hit at an “inconvenient” moment.

I think you have hit the nail on the head!

Much of this is due to factors adversely affecting the Euro zone, rather than residual strength of the UK economy. This is easily demonstrable by comparing £:$ exchange rates (£ has fallen against $ while rising against €) . Furthermore, UK inflation and US inflation rates are nearly double those of France.

However, I’d certainly agree that UK residents are being hammered at the moment and it’s obviously going to get worse, whereas British retirees in France with index linked pensions should be less affected. Nevertheless, UK state and gov index linked pensions are only increasing by 3.1% whereas French cost of living is currently rising by (I think) 4%.

Precisely Mark - over the last year the £ has fallen from over $1.40 to below $1,30.

The Euro has fallen more quickly over the last few weeks I would say primarily because of Ukraine - lots of factors but the obvious ones that don’t affect the UK are the proximity of parts of the Eurozone, and the possible impact on energy supplies eg. to Germany - which constitutes a huge part of the Eurozone economy.

The difference is that the Eurozone is victim of circumstances largely beyond its control - the UK government is trashing its own economy.

Exchange rates are by and large determined by relative interest rates. Sterling is rising right now because of higher interest rates real and anticipated in the UK vs the Euro, as the BoE seems more hawkish than the ECB.

And not sure about the 1.30 you quote as being the reference rate pre-Brexit. Not many months before the referendum it was around 1.40 but the market started getting jittery as the referendum neared.

From an economic viewpoint, Brexit has been bad for Britain and bad for the EU, but relatively worse for Britain (and that is despite the government repeatedly delaying implementation of many of the changes due to their incompetence in planning for them). From a social and political viewpoint I would argue that the impact is similar - bad for everyone but especially the UK.

A monumental exercise in self-harm for the benefit of a tiny minority of tax-dodgers and thieves.

That’s how it was explained to me years ago - but it can’t solely be due to that.

Other economic KPI’s will certainly have an effect - eg inflation, pretty much must play a role in the longer term trends - over time if country A has a 10% inflation rate and country B has a 5% inflation rate then after one year country A’s currency will have slightly under 5% less purchasing power and, all other things being equal (they never are) would drop ~ 5% against country B’s currency.

That would feed into today’s exchange rates, not just those in a year because there would be less demand for currency A, who would want a currency that will be worth less in a year (yes, I know modern transactions can take a view which lasts less than a second, indeed less than a millisecond for arbitrage).

But, as I said, things are never equal - interest rates are a tool to combat inflation, maybe country A increases rates to provide downward pressure on prices - making currency A more attractive.

So, it’s kind of a bit of everything at the end of the day, what’s happening with the KPI’s now, what might be happening tomorrow, next week, next month or next year, what the market thinks the governments might do all seasoned with a large amount of gut instinct and herd mentality.

I agree that the rate hovered around 1.40 pre brexit however my reference to 1.30 was where it stood tge day before the referendum and the day after it fell immediately to 1.20 and kept on falling.

I was planning on exchanging a large amount of sterling to buy a car and figured that the vote would be to stay in and the rate go sky high so imagine my disappointment the day after the vote. Brexit, the gift that keeps on giving.

I still bought the car though!