Hi, Last year we had, like everbody else, double our normal monthly tax payment, because they were taking the tax for 2018/2019 at the same time. Understood, but in Seprember 2019, it suddenly doubled again for the rest of the year, and is only slightly lower for all of this year, during which our financial situation has not radically changed. For arguments sake, lets say its normally 200 euros per month. For the first part of 2019, it was therefore 400, but in September, it jumped to 800, and this year, when it should have gone back down to 200, its 600, ie 3 times our normal rate. Has their been some new tax on gites that I have not heard about? Has anybody else had a similar experience?

Hopefully, someone will come back with useful information.

Meanwhile… have you tried contacting your tax folk… by email perhaps… ??

fingers crossed this is all just one big mistake… on their part.

Are you talking about your prélèvements? It should all be set out in your espace particulier on the impôts website, and you should be able to see how they have decided what monthly amount you should be paying. And if need be change it!

I’m not aware of any new taxes on gîtes. We don’t yet know what level the CFE tax will be set at, but that isn’t included in your monthly prélèvement anyway. So no clues I’m afraid. Ours hasn’t changed by that amount.

Hi, Jane,

Thanks for that. I am talking about the prelevements, and I have been to our Espace Particulier. As far as I can see, they just tell you how much “impots” you pay and how much CSG, but crucially, not what figures they are based on. I have changed the “impots” figure ( it seems that you cannot alter the CSG) in May, but so far, that has made no difference.

Yup, I’ve sent emails to the local tax office, and via our “Espace Particulier”. Could, of course, phone, but we have found that unsatisfactory in the past. Just have to make an appointment to see them, I suppose, but I bet they are up to their eyeballs because of the virus…

I’ve had a lucky chance with a phone call… but not in the last 2 weeks.

Emails are still working well here though… just takes a day or two…

did you get the acknowledgement that your email had been received ??? that is very important, 'cos at least they can’t say they didn’t get it… and it should be in the “reply” tray… and get dealt with asap.

THanks for that, Stella, but we had no acknowledgement of either email.

Ah… did you ask for one… I know with email… you probably have to set your preference,when sending, to “ask for confirmation of receipt” of how ever they put it.

I forgot to ask once…and was waiting for a reply from an incorrect address… so my important question was lost in the ether and I never knew it.

any govt dept should send an automated receipt… if you ask… and sometimes even if you don’t

Any taxes paid are based on what amount you have declared. Important to establish that you have established your business in the most cost effective way. Also essential to put your earnings in the correct section and box on your declaration des Impots, in order to get the correct abatement. My advise would be to have a one off visit with an expert contable.

If you look at your last avis d’imposition you can see how they made the calculation. And then if you pencil in the figures you submitted this year in the appropriate places you should be able to see if there is a big difference.

Local tax office will be slow to reply tight now as in the middle of their busiest period. But they usually get round to it eventually!

Thanks again, Jane for that. Our last avis was for 2018, and that looked completely normal. But I think that came before that first hike in Sept 2019. The only thing that makes any sense is that we sold a house in England that year. It has been declared in the latest tax return, but is it possible they assessed it before, with information from the English tax authorities? And without letting us know? I suppose we shall just have to wait for the 2019 avis d’imposition, or try and get to see them.

I didn’t realise there was a double tax take for businesses. How did they justify that? A windfall for the Impots and a cashflow issue for the business. Individuals got a years tax written off.

HI, John,

I dont know that it is that. We are a micro-enterprise non- professionelle - it could be that they have just mixed up us with someone else.

I think they might be offering a face-to-face appointment (albeit with all precautions)… have you tried emailing them and asking… ???

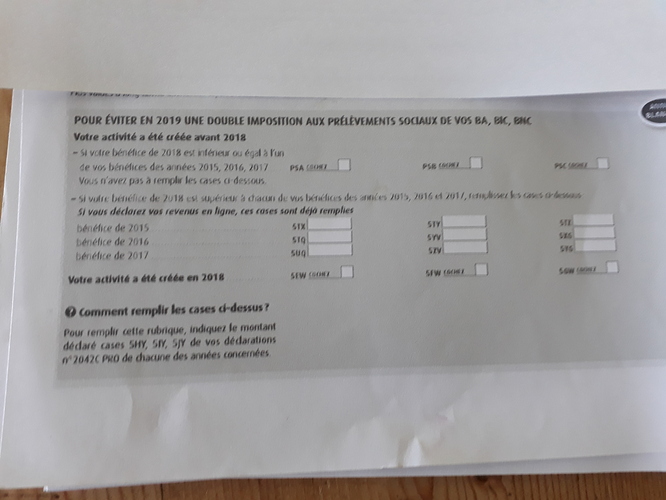

Declaration de revenue 2018 pour l’anneé Blanche for micro enterprise there was an added section and a notice of explanation.

. It was easy to mis understand , something could have gone wrong if you didn’t read the special notice that came with it.We had a big mistake on a tax return…erroneously an extra 10,000 got added on to income! And stupidly didn’t notice until we got the surprisingly high tax demand - which we had to pay. But all sorted in the end, so have faith that if there is a mistake it will be rectified eventually.

When the move to prélèvement was announced Peter, I remember postulating on to this forum, to much scepticism, that we’d get a year “free”. Which we duly did

That means when I die (and/or leave France) my tax will be uptodate rather than a year in arrears  I love it, whatever I have in the bank is now mine, mine, mine… lunatic laugh…

I love it, whatever I have in the bank is now mine, mine, mine… lunatic laugh…

I’m not sure how they could hit you with a double whammy just because of an administrative change in tax collection. But one never knows, worth a look.

Hi, Anne, Thanks for that - I had’nt seen it, but thats maybe because we filled in the tax return on line, and it says that it would be pre-filled in that case, though I dont even remember that. Good thing about the paper form is that at least you would have an independent copy.

Peter

Peter I fill in on line but I still have a copy I can click into my account any time and look at everything that I filled in.

Also from your account you can email them your concerns and they will reply very quickly.

Good luck

Thanks again for that - you are obviously an expert at this. I did email them from the account, and from the national site, but have had no reply from either. That was several weeks ago.

I think the section of the tax form that you showed us was for professional louers (?). We are non-pro, and it has been very good in the past. Could it be something to do with the fact that the renting platforms are now submitting their own information to the tax people, and there has been some sort of mix-up. Who knows? Time will tell.

Thanks again, Peter