One could turn GPS off? Or is there still the triangulation thing so beloved by cop shows?

The phone can still report which network it is attached to.

For a modern Android phone you can turn the relevant permissions off, of course, but most people won’t bother.

Morning Sue

Hope you do not mind but I posted a copy of your letter on the FOS Facebook site and received the following reply.

Hi Andy,

thank you for taking the time to share your concerns. As you may know, our service was set up by Parliament to resolve individual disputes between businesses and their customers. As part of our work we regularly share our insight with financial services and if we see the same issues arising systematically, or something that we think would help them to understand issues we’ve seen from consumers, then we do of course let them know. If you have a complaint, you can send a private message to us, and one of the team will be able to advise you further.

Not the most positive of responses.

As Nationwide have no plans , at the moment, to cancel my accounts I have no further avenue of complaint.

Sounds like it is too complicated an issue, and they want to brush it under the carpet.

Have a good day

Andy

@andyw I don’t mind at all Andy. The more the FOS is approached the better. Unfortunately we still are facing an attitude in the UK which is “when something has already gone wrong then we’ll help you” and “give them time to find alternatives”, which is hardly the point when there are no alternatives.

Perhaps you should write to Sir James Dyson - he’s an expert in sweeping things under the carpet ![]()

It might be a cop show thing but it works

thanks for the link!

But if you only turn it on, when contacting the bank and afterwards turn it off, the provider thinks you are on vacation and then it works!

IMPORTANT CO-OP BANK CUSTOMERS

I have been pestering my bank - CO-OP Bank for the last few months to get an answer about closing accounts. Couldn’t get a straight answer. They kept referring me back to their Brexit statement ( dated January 2020 !!! ) Or said

’ when we know we’ll let you know ". Eventually a week or so ago I found the email address for the Chief Operations Officer ( COO) Chris Davis and emails him. This is the reply from his office. Paragraph 3 is the important one.

" Thank you for your email to Chris Davis, he has asked me to respond on his behalf.

I’m sorry that you’ve not had as much information on whether we will retain services for customers residing in the European Union as you would have wanted at this stage, and we understand the importance of communicating to our customers clearly and with sufficient time for you to make alternative banking arrangements, should this be required.

We value your loyalty with the Co-operative Bank and would like to thank you for your many years of support. As an ethical bank we seek to comply with local laws and regulations, and we are continuing to monitor developments with regards to changes in local legislation, including those in France. The regulations post transition period are complicated, and specific to each European Economic Area (EEA). We will make decisions about services within the EEA and France based on local regulatory changes, and this may mean that we will no longer be able to provide services to our loyal customers who now reside within the EEA as we are not intending to apply for permissions in France or any other EEA nation, continuing our focus as a UK ethical bank. We regret this position, but it is one which is a consequence of the UK exiting the EU on December 31st 2020.

I’m sorry that you found our onsite information was not as current as it should be. We are in the process of updating FAQs and our information for colleagues, and appreciate you bringing this to our attention.

We are aiming to have more information to share with customers as soon as possible and we will contact customers in due course.

Monuwar Ali

Executive Customer Response

The Co-operative Bank

2nd Floor, Balloon Street

Manchester M60 4EP "

I read this as Co-op is closing EU customers accounts. What that will mean for affiliated banks ( Smile is one and I think Nationwide is under the Co op umbrella I don’t know) I wasn’t sure whether to post this but it does come straight from the horse’s mouth. When they intend to let customers know I don’t know but I think it’s important that customers know.

Dear Mrs Young

UPDATE AND CLARIFICATION FROM CO OP BANK

We currently have no plans to withdraw banking services to our customers based in France. We are continuing to review the situation and monitor for any regulatory changes announced by the French authorities to understand what that would mean for our customers should any be announced.

My previous email stated: ‘ We will make decisions about services within the EEA and France based on local regulatory changes , and this may mean that we will no longer be able to provide services to our loyal customers who now reside within the EEA as we are not intending to apply for permissions in France or any other EEA nation, continuing our focus as a UK ethical bank .’ If there was a regulatory change announced by France which required us to ‘apply for permissions’ we do not intend to do this, currently changes to our services would be in relation to regulatory changes announced by an EEA. As yet we have not been made aware of any regulatory changes by French authorities but we continue to monitor for those.

A regulatory change has been announced by The Netherlands and we are reviewing that currently.

We understand the importance of communicating to our customers clearly and with sufficient time for you to make alternative banking arrangements, should this be required, and we continue to monitor the situation across all the EEA. When we have a final decision we will contact our customers.

Show quoted text

@Sue_Young Thanks Sue for update.

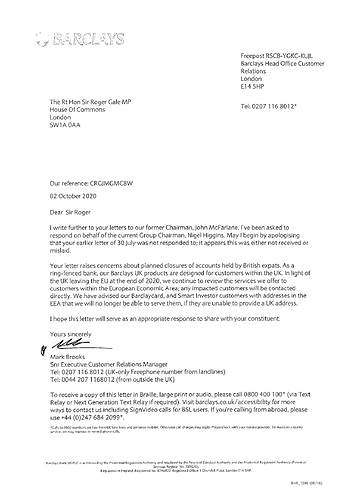

Here is a heart warming (not) letter from Barclays. (Sorry, it’s not a very good copy)

Interesting “sit on fence letter.” My interpretation of it is that "we haven’t made a final decision yet but its likely we will be closing accounts for customers outside the UK. " It is unlikely Barclays will think it worthwhile to set up systems and seek local banking authorisation in EU countries for a few thousand accounts.

I’m not sure I see much fence sitting John. I’ll be astonished if they continued to provide retail banking services to anyone living in France.

What I meant was on the fence until they are ready to make formal announcement,.

They will be waiting until it can be done causing minimum fuss.

Basically its not worth the effort for any uk bank to set up local subsidiaries (of the Uk domestic bank) just to service a few thousand expat accounts. Its just conceivable that one might think it worth it for the Spanish Market,

This continues to have the potential to cause significant problems. In addition to losing flexibility of when to transfer income from a UK account there is the issue of not being able to make regular payments . I have a number of subscriptions that require sterling payment and some organisations insist patent is made from an account in the customers name, for example my ISP and O2 require this and its not possible to pay via a nominee. I have Orange internet and French mobile and use Amazon.fr but also find it useful to continue with some uk services. For example continuing with a UK mobile allows friends to call without incurring foreign call charged.

So any body got updates on what the latest bank missives are, any mobile network that will allow the account to be debited to a different account.

@strudball I haven’t the same issues as you but from what I can see of Revolut, you can set up regular payments as required from your Revolut GBP account or the EUR wallet as required so both of your conditions could be met in that way. Further, IIRC, if there are insufficient EUR funds in your wallet to meet a monthly payment (but sufficient GBP) they will automatically fund it at the current exchange rate so the payment is not bounced…

So the Treasury is not prepared to consider the issue of pensioners living abroad whose pension cannot be paid into any non-UK account.

That’s just a private matter, up to the pensioners and their pension provider. Jesus wept.

AFAIK the Treasury will continue to pay State Pensions in Euro directly to a EU bank account at close to the inter-bank rate. It is for other providers to decide what they will do in the event of a no-deal Brexit but some providers (typically Local Govt pensions) will no doubt continue to use 3rd party providers and charge a small fee for the privilege.

Certainly when I first retired, 13 years ago, a couple of my small pension providers said they couldn’t pay my pension into a French bank account. In fact at the time it suited me to keep them in the UK. I haven’t bothered to contact them yet in the context of Brexit. I’ve fingers crossed that HSBC will be one of the few banks that continue to provide a sterling account to their French customers.