We are due to complete the sale of our holiday cottage at the end of May. We live near Chalus 87230 where the tax office used to be. Not speaking much French just wondered where to go from here.

Your notaire should advise you (and the tax office) on this when you complete the sale

It is nice ( and useful) to keep one’s Mairie in the loop re the Sale… ![]()

Many thanks for your info

Yes, after the sale, the Notaire will deal with the Impôts who in turn, will send you any bills or refunds. You don’t do anything at this stage.

Since you sold the property in May you will still be liable for the 2024 taxes. The bills for 2024 will be sent to you as normal towards the end of this year so it is probably a good idea to keep your French bank account open until you have dealt with them, and also to make sure that the tax office knows where to send the bills if you do not deal with these things online. It is customary for the buyer to pay a contribution towards the taxe foncière, the notaire should arrange this.

Agree, the notaire will pro-rata your taxe foncière. For the capital gains on the house, if this is a holiday cottage you will be liable for them and the notaire will detail it in the “act de vente”.

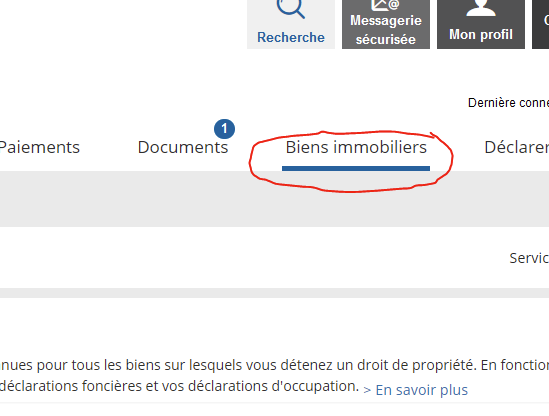

On the impots.gouv.fr website (if you have a login) you will also need to fill in the property details and change the names and addresses to the new owners:

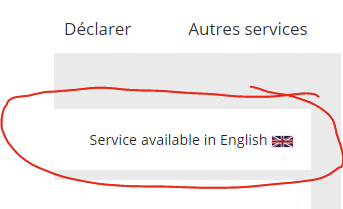

This is accessible from the front page and is also available in english!