Hello Survive France!

I know this group leans towards the UK, but am wondering if anyone has experience with the below.

Husband and I want to sell our Australian property this year, we’ll be paying CGT in Aus.

Speaking with a French accountant this morning, she stated that the Social Contribution of 17.2% will still need to be paid in France, on the total taxable value of the gain.

This will mean we pay about €40k tax to the Aus govt plus an extra €56k to France! Seems a bit wild… Is it correct that the social contribution is not included in double tax agreements?

I was also advised that we can avoid this fee by not signing up for social security - and proving that we are covered by healthcare in other countries…quite happy to go private health insurance etc… we have British and Latvian citizenship… not sure how this would work…

This is going to hurt… and just as I was celebrating my Carte de Sejour applicaiton being approved!

However on a quick flick through the forum it appears those selling UK properties don’t generally need to pay this?

Grateful for any advice, we are hoping to buy a small apartment or maison in our town in the Pyrénées and this will put quite the dent in the budget.

Happy to pay consulting fees if anyone can point me in the direction of a professional in this area as I’m keen on a second opinion.

Thanks SurviveFrance. Grateful for this forum.

Eve

Hi Eve

To escape all social charges except the prélèvement de solidarité, it’s not enough to not be a burden on the Sécu because you have private health insurance.

You have to be affiliated to the health system of another country. In other words, you have to hold an S1.

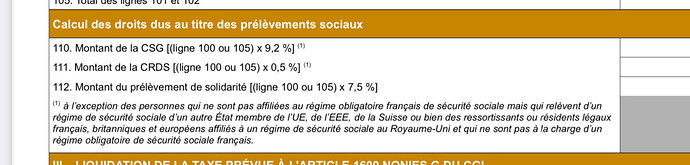

Here’s the relevant section from form 2048-IMM for declaring a capital gain on selling your house. Hope you can read it.

How long have you owned the property? Liability to social charges tapers off over the years. And disappears completely after 30 years of ownership.

1 Like

Hi Eve, you don’t say if this property in Australia was your main residence before moving to France. If it was your main residence, and is sold within a year of moving out, is not let out or made available for occupation by family, in practice it’s generally considered to be exempt from French tax and social charges. Might be worth revisiting this point with the French accountant if relevant.

The other point is make is the calculation of the gain. If the property isn’t your former main residence, in arriving at the gain to be subject to social charges, did the French accountant convert the purchase price and estimated sale prices at the prevailing exchange rates of Aus $ to € at each separate date? I’ve seen estimates in the past where the adviser or taxpayer only used the exchange rate at sale to convert both the purchase price and sale price. This is completely wrong and in the case of changing exchange rates over many years can give a significantly different answer.

I haven’t addressed the issue of whether there are any French CGT charges on the sale, in addition to Australian CGT as I haven’t looked at the Australian/France tax treaty, but assume you or the accountant has specifically reviewed this point.

1 Like

Thank you!

This is helpful - my French is not good enough to read this yet but I have discovered you can drop documents and snips into ChatGPT and it will read and translate, so have done so.

You hve raised a couple of points that weren’t expressed in my - quite expensive! - consultation yesterday.

As the accountant suggested we could reduce the social contribution to nil not 7.5% and also there was no mention of the time we’ve owned the property - 10 years.

Will be looking into the S1 and the discounted rates for longer property ownership, thanks!

Hi George,

Ahh yes - so we haven’t lived in the property for 10 years as we have been living in the UK! So definitely no longer our main residence.

This is a good point on the calculation of the tax rate - actually we were just given a ballpark 17.2% to apply ourselves to the taxable rate, not very confidence inducing!

Cheers,

Eve