Can anyone explain what CIPAV actually is? Just got a letter in the post from them saying they confirm my inscription (I’m an auto-entrepreneur since October this year). Also just got a letter from URSSAF stating: ’ activites relevant de la cipav accre taux % 5,70. Can anyone tell me what this means?!

CIPAV are your pension provider (but this may change soon). Their full name is Caisse Interprofessionelle des Professions Libérales.

https://www.lacipav.fr/

The line you quote is explaining your cotisation rate. Cotisations are charged at different rates according to activity and which caisse you come under. So it tells you firstly, that your business activity comes under CIPAV (presumably you are registered for a profession libérale) ; secondly it confirms that you have the reduced rate for being on accre (presumably this is because you were registered as a job seeker before you started your micro); and in view of this, the rate at which your cotisations are charged is 5.7%.

I think that’s right, although I don’t actually know how accre works.

Hope that helps.

The ACCRE status, and hence the reduced pension contribution rate of 5.7% is available for people who originally are/were registered as unemployed with Pôle Emploi and who have decided to start an self-employed activity. The reduced rate applies for the duration of the ACCRE period, which is about 12 months. After that, the contribution rate goes up to the level defined by your annual income generated by your self-employed activity. See, for example, this link:

The CIPAV or Caisse Interprofessionnelle de l’Assurance Vieillesse, is currently responsible for collecting your contributions towards your retirement pension. Whether or not it survives Macron’s putsch of the independent professions contributions system remains to be seen. Certainly, for the time being, it is being kept alive, but it may well follow the RSI (national insurance contributions administration responsible for independent and self-employed workers) into oblivion in the next few years.

My personal opinion of the CIPAV is not printable on forum like this.

I’m very excited. I was an Auto Entrepreneur for 10 years in France. That gives me 40 trimesters. The requirement for full pension is 166 trimesters. I am now back in Wales and, from 1/10/2019 will receive - wait for it - €38/month.

I’m told they are one of the worst paying pension organisations.

Still, better than a poke in the oeil with a blunt stick, I suppose

Are you saying that 10 years=40 trimestres because your dossier says you have 40 trimestres validated, or are you making an assumption? I’m just wondering, because as an auto entrepreneur you don’t automatically get a trimestre validated towards your pension every trimestre. Trimestres are validated according to turnover. There’s a table here

So for instance if you run a gite, in order to have 4 trimestres validated during one year, you need a turnover of above 20 740€.

Is that 38€ your retraite de base and your retraite complémentaire added together, or is it one or the other? I’m also with CIPAV, I’ve also been an auto/micro entrepreneur for around 10 years and my pension projections show two figures. I can’t remember now which way round they are but one is similar to your 38€. The complémentaire component has always been a great mystery to me because it seems to bear no correlation to turnover, and I’ve asked them several times how it’s calculated but they have never managed to explain it in a way I understand.

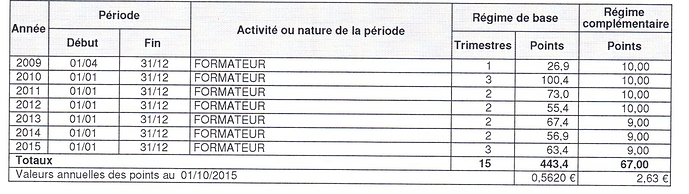

Yes, Anna, sorry, I got a bit carried away with all the excitement of my €38. I did do 40 trimesters during my time in France but only 15 of them made the cut. I received a ‘prevoyance’ (forecast) in 2017 when I ceased ‘trading’ which listed the ‘points’ that I had earned in the trimesters in which I had earned sufficient to get points. I got 443.4 points for Retraite de Base and 67 points for Retraite Complementaire. There is a note which says that the value of the points depends on the different regimes. My points (as valued in Oct

2015) are worth €0.5620 (Base) and €2.63 (Complémentaire). Multiply it all up and you get a figure in the ballpark but slightly less than the figure I’m told I’m going to get. Maybe there’s been an annual increase? I’m not sure I have the will to dig any further but I hope this helps a bit.

My figures if they’re of any help|:

Yes I’ve got a chart similar that and I don’t understand how they work out the points, though yours looks more consistent than mine. I got 4 trimestres validated for every year except the first two, but the number of points I got for those 4 trimestres varies wildly. For instance in one of the years when I only got 3 trimestres I got more points than one of the years where I have 4. Va savoir.

I have no idea how much pension 15 quarters of contributions would accrue you in the UK. Would it be significantly more than £30-odd per month? I doubt it somehow.

Rip off merchants. The sooner the government moves all independent workers pension schemes into the general système, preferably without us being even more screwed over, thé better, IMHO.