If you live in France and you have a French pension, no matter how small, France is your competent state. Even if it is not the last state in which you worked. That is how I understand it.

That’s not correct Sandy.

Well I am not goong to read up about it again because it dies not affect me but I think the op should check it. I am pretty sure ut was explained to me that where a person has worked in different countries unde the cooperation agreement then there is a series of rules that is applied in heirarchical order, last country worked/most contributions etc. But if you are in receipt of a pension from the country chère you live, it stops there.

So eg if I worked in France but then worked a few years in uk, but nowhere else, and had French and UK pensions, I would get an S1 if I went to live in Spain or Germany or anywhere except France and the UK. If I live in either of those two, that country is automatically my competent state because of the pension

I think (but I’m not an immigration lawyer so could very well be wrong on this), that it’s the visa you’ll obtain which allows you to then request the titre de sejour / resident’s permit, not the fact that you’re paying tax per se.

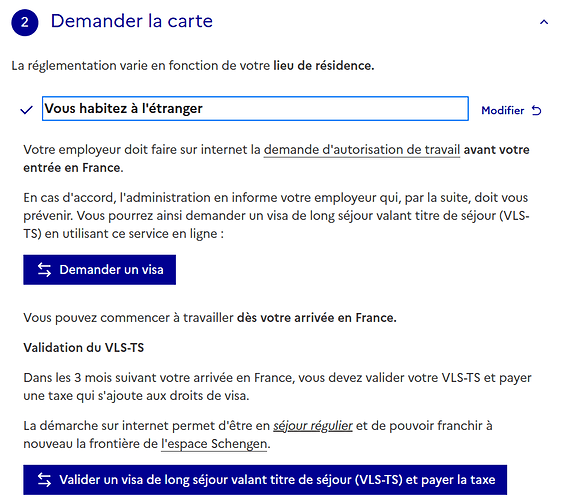

As it says here:

And:

So, basically, once you’ve got the visa and your employer has obtained the authorisation to work, then upon your arrival in France you have 3 months to submit your request for the titre de séjour.

Not my experience Sandy. I have a French, UK and Irish pension. Because Ireland has the most stamps and is the last country I worked in it is my competent state ![]()

And of course you wouldn’t be making a tax return untll some time later, particularly if you arrive in France after 31 Dec 2024, as it’d then be in May 2026 -but that’s probably best left for another thread!

Thanks this is very useful to know in advance. Hopefully this is something my French HR colleagues will help with if my relocation is successful.

Wow I can’t believe how long this exercise has taken to reach the final stage.

I now have the job offer and a summary of the package being offered etc. It’s less than my UK remuneration but I did expect that, anyway that’s by the by to be honest.

I really only had a couple of questions, one being let me see the company car list ![]() and second one being much more important, what if I’m made reductant or I wish to retire after being a French tax payer for say 12 months or 2 years, do I have to sell up and return to the UK. This has played on my mind a bit as we intend to sell up in the UK.

and second one being much more important, what if I’m made reductant or I wish to retire after being a French tax payer for say 12 months or 2 years, do I have to sell up and return to the UK. This has played on my mind a bit as we intend to sell up in the UK.

My plan would be to start the new role in France in May, my wife finishes her UK job in May and starts the titivation of our UK house in order to put it on the market with a view to her coming to France once it sells or once she’s sorted everything out.

Any way see below for the response to the above question from my companies immigration consultant:-

Hi Charles

As agreed, I have checked your immigration status with Fragomen in case of a Permanent Transfer to France.

It looks like you will most probably qualify for the Talent – EU Bleu Card in France (no master degree is needed, bachelor degree is sufficient or 5 year experience in similar position).

The Talent EU Bleu Card is issued for 4 years and renewable.

Under the Talent EU Blue Card category, the employee is not tied to his employer and may change job under the condition the new employment still meets the eligibility criteria of the residence permit he currently holds. If not, a change of status to the applicable immigration category will be necessary.

The Talent EU Blue card opens rights to permanent residence after 5 years of continuous residence in France. Please note that there are other requirements such as a certain level of French language skills.

Let me know if further questions.

I’m still not convinced I fully understand what would happen if i leave the job after a couple of years ( maybe someone here can explain simply) , but never the less I’m going for it. There’s no relocation package or anything just a straight swap of location for my role. I can travel with work back to UK periodically so that helps with the house sale, my wife’s relocation etc.

I appreciate any feedback from you guys.

Sounds like a plan ![]()

![]()

Do you have protection in case of involuntary termination? Outside chance eg if company taken over etc… are you guaranteed a minimum time employed no matter what? (time being nominally still employed being even more key than any payout as lump or compo).

IANAL but I think it would need to be in a “survival” clause ie that right is stated to survive even if the contract is terminated otherwise it vaporises with the contract.

Honestly speaking it’s more a case of me wanting retirement after 2 years than the threat of redundancy, hence the question what would happen?

My length of contract with the company 11 years (time of typing) is still honoured by the way in case of redundancy.

If I was in your shoes, I would ask my employer for written responses to your entirely reasonable questions. I can’t immediately see why you couldn’t retire in 2 years. I recall from earlier in this thread you mentioned you’d be able to remain in your UK pension plan. Ask them to confirm this, if not already clear, and also what the impact of you retiring in 2 years would be on your pension. They’re normal questions to ask. Obviously you’ll know how much trust/confidence to place on their responses as you know them better than any of us. But binding contractual, written commitments are always best.

I’m quite surprised there is no relocation package. This would be common even for people moving at their own request, and/or people moving to a local market gross salary in another country. I’m thinking of removals costs, tax return assistance, actual travel expenses for you and your wife to move to France etc. I assume you’ve asked whether the salary is similar to what somebody doing your job would be paid in France by the company - if not, I’d ask, to ensure you’re being paid the market rate.

Might be an idea to speak to an IFA about pension options before burning all your bridges. Putting funds into drawdown usually means keeping hold of a uk address (relative/friend) and bank account.

I know absolutely nothing of this but I’ve seen peeps mentioning something called an S1 which can give some benefits for a Brit when retiring to France. If I’ve followed correctly, if you work in France during the last years of your working life you would lose this and possibly lose out financially.

Maybe something to look into. I’m sure knowledgeable peeps on her will come up with answers or more questions for you to think about.

Mentioned earlier in the thread, around post 77

Checking that you will be able to keep your U.K. bank account when you become a French resident and if not changing it for one that will allow it while still a U.K. resident would be at the top of my list of things to do.

Or two to be on the safe side.

Since your manager suggested the move and you being here will benefit the Company I!d push for a few bob towards relocation. Even if only travel expenses ![]()

Ask them (if you haven’t already done so) whether this is because it’s what the French company would pay somebody for that role (known as a “local market gross” salary). Alternatively is the difference because the French cost of living allowance (“COLA”) for that local area is less than the UK cost of living for your home area, based on commercially accessible comparison COLA data. Any reputable employer sending people cross borders within a group would, and should consider such COLA data, when determining salary packages cross border, and may be prepared to share the basis with you, to help explain the reduced salary in France.

You and wife may have quite a complicated tax residence situation between the UK and France ie spanning the period from your UK departure to hers. This may impact on how any £/€ gain (hopefully!) from the sale of your house is impacted and treated in both countries. PLEASE do request UK tax departure advice and French arrival tax support from your employer, as you may be walking into a complex scenario due to the relocation at your employees request. It would be most unfortunate not to be informed about the various tax, benefits and pensions issues that might arise in advance, and what steps might be taken to mitigate any issues. Tax planning after the event can be expensive!! Wozza and Jane have both rightly flagged up the S1 health benefits issue. That’s exactly the sort of issue that should be carefully looked at by your employer and explained to you, to help you make informed choices, particularly those with potentially long term (adverse) impacts.on you.

Do you or your wife need language lessons? If so, your employer should be asked for help.

PS once upon a time, this used to be my bread and butter work professionally…

The French remuneration package is neither here nor there to be honest, I think it’s merely my remuneration being brought in line with the French payroll of my employer, honestly no deal breaker.

Relocation allowance, I get what you guys say but we’ve had property in Normandy for 11 years and therefore most of our UK stuff will be skipped or given away, one trip with a panel van would suffice for the furniture and gear we want to keep. I’m working in France this week and took the opportunity to bring yet another car full of gear over, it’s not like I’m office based or it’s costing me for LeShutte , tolls, fuel etc. to travel.

Employer paying for French lessons makes sense though at least, I’m sure that’s not a problem.

Thanks guys, I’ll be honest the last few posts have really put the fear of god in me, I was pretty much just cruising along thinking I / we just have to pack our suitcases but health S1 issues ![]() can I retain UK bank acc

can I retain UK bank acc ![]() tax planning (house sale)

tax planning (house sale) ![]() pension

pension ![]() all of this really causes anxiety and puts me off the whole move to be honest, my fault I know for seeking advice

all of this really causes anxiety and puts me off the whole move to be honest, my fault I know for seeking advice ![]()

I’m thinking bugger it, let’s just go for it and see where the journey takes us. If at some future point we have to return to the UK, they’ll be enough left in the kitty for a new caravan (Park Home) I’m sure.