they’re obviously expecting a lot of queries…

Hi Stella,

When you say ‘UK pensions’ I assume you mean a UK Govt pension, which is taxed in UK?

Yes, I submitted a list of each investment company and bank account when I put the papers in at the local Hotel d’Impots but stupidly, I don’t seem to have taken copies beforehand, so I’ve nothing to refer to now.

Thanks for any help!

John - thanks - I’ve just found my 2019 copy of the Connexion tax guide and it doesn’t spell it out in words of one syllable, which would be rather more helpful in my case…

Hi Mary, I didn’t realise she wasn’t a member anymore. She posted on one of the topics I started and seemed liked a lovely lady. Do we know why she’s gone?

Thanks

Izzy x

Izzy I will DM you

No need for that! No conspiracy theories please Mary!

She asked to be removed after James pointed out that he didn’t appreciate her spiky comments about our finances - etc. Not the first time.

And whilst yes, she did always provide sound advice, we have found over the last nearly 15 years (!) of running SF, that no one is irreplaceable and that someone always ‘steps up’ when a long standing member decides that it is no longer for them.

Hope this clarifies things?

Tax Office has only just started… can we take some time to see how things pan out…

ridiculous (in my view) to insist on doing things immediately (as my dear friends are telling me “we must”… and I am gently saying NO…)

It wasn’t a conspiracy theory, I didn’t think it was appropriate to post on the open forum that I thought she was upset at something

Sorry I was being flippant!

And appreciate the discretion- just wanted to be transparent! X

folk ask to be removed for all sorts of reasons…

sometimes they ask to come back later on… sometimes not…

who knows… what pressures folk are under… what suddenly is the last straw…

Hi Catharine, I’m not sure what you mean by “No need for that”. Do you not want Mary to contact me? That’s a shame if so because it was very nice to be contacted by someone and we had a lovely friendly chat and I think we might become online buddies. Anna replied to me a couple of times during my short time here and it was very nice of her to take the trouble to be friendly with a newbie.

I’m enjoying your site very much and have started coming here every day.

Thank you

Izzy x

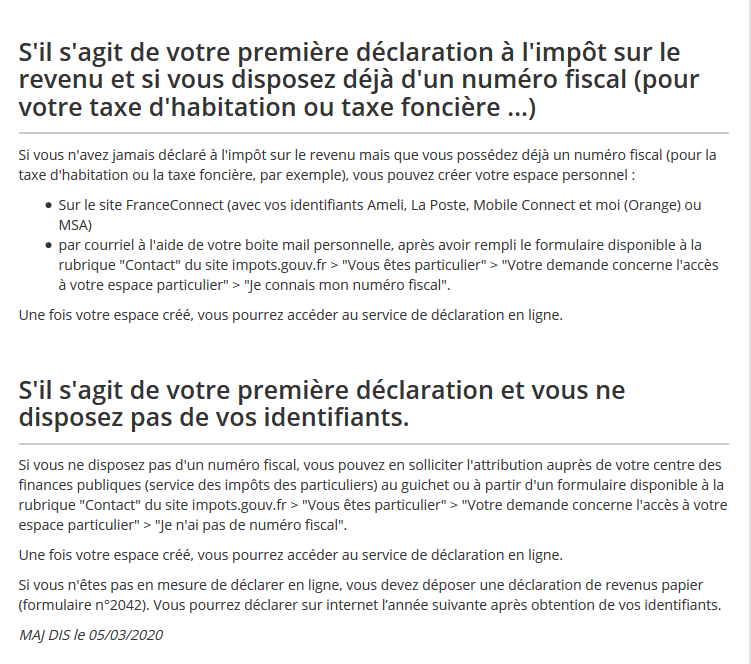

We were expecting to do our first paper declaration this year with guidance from the impots office.

Now we have to go online and feel pretty overwhelmed.

Does anyone know please if we have to do two separate declarations or one combined?

I feel I will be coming back with a lot of questions.

Combined. Taxe as a foyer en France not separate as in the UK. The form includes space for declarant #1 and declareant #2.

New Declarants during Covid-19… from the impots.gouv. fr site

It does say that if you are not able to do an online declaration… you can do a paper one: declaration 2042

why not email your Tax Office and ask their help.

If you have income from another country, eg U.K. , you will need the 2047 which is filled out first before moving the figures to the 2042 and any overseas bank accounts need to be declared on the 3916.

It might help if you could give an outline of your income sources so people can help you with the vocabulary and boxes to look out for.

Thank you so much.

When we have compiled our data I’ll be back.

Also we have double taxation forms to hand in.

As I said above, box 8TK - which is necessary to report total “government” pension mandatorily taxed in UK and thus qualifying for a credit here - and is normally found on 2042, is NOT present in 2042K but IS present on 2042C (which can be found on gouv.fr). 2042C is nine pages long! My question is, why has 8TK been left off 2042K when it is referred to in 2047K ? Is it deliberate or can we add it as a comment ?

I’m still dithering about tackling the on line forms.

CORRECTION TO MY PREVIOUS POST

Last year… our UK pension income was in 1AM and 1BM on line…

this year… the correct boxes are 1AL and 1BL (foreign pension opening a right to …)

that’s as far as I am concerned… phew… the Tax folk like to keep us on our toes…

It will be interesting to see how this pans out. I notice that on the gouv.fr site there is no 2042 or 2042K available to download, just other variations including the 2042C and 2042C (PRO).

I just looked online after logging onto my impots.fr space and the information displayed is quite different for 2019 and 2020. For 2019 I am able to see a complete copy of the 2042. For 2020 I can only see the first part of the 2042 with my home details filled in and a summary of my declaration showing that I have declared €xxx at 2TR and €xxx at 8TK on 2047) plus other income already on the 2042 because it comes from France. I cannot see a copy of the complete 2042 like before but I can see a complete copy of the 2047.

I wonder if this is an attempt to ‘encourage’ people to apply online.

Thank you for posting that. I’d made a copy of your previous post for future reference. I’ve now updated the information.