Hi Stella,

Thanks for your response, it is very of help.

Hi Stella,

Thanks for your response, it is very of help.

Hi again Stella,

I’ve found a piece of paper which the tax officer put down her name and contact number back to 2010, do you suggest that I call her for an advice for my situation (if she still works at the same office)? or I simply just put a note for explaining my overlooking mistake in previous years.

I’ve been panicking since I discovered it could result in a massive fine whilst I did my tax return online.

Thanks in advance.

Alisha… I’ve sent you a private message…

can you find it ??

Hi everyone, I’m actually in the same boat as Alisha, I’ve been here a few years and have always overlooked the form 3916 (it wasn’t really obvious until this year when it is now automatically ticked!). I am worried about all of a sudden declaring about 8 foreign accounts (I’ve lived a few different places, had dormant student accounts etc). Do you think it’s best to just declare them without any extra notes/explanation?

These accounts have nothing in them, there are 2 ISAs with about £2 in them and I’ve started closing the dorment ones.

Just wondering how important are the opening and closing dates too?

Any advice would be appreciated

Marie

Hello Marie and welcome to the forum.

Please could you amend your Registration to show your First and Last Name (Full Name) s per our terms and conditions…

if you aren’t sure how to do this… simply put your full name here, on this thread and i will amend things for you.

cheers

Of course! Sorry about that.

Marie Watson

And many thanks for accepting me.

All the best.

Marie

Hi Marie…

First of all… no point in worrying about what the Tax Folk might or might not think. You are not the first and most certainly will not be the last to be in this situation…

Put together your info… as best you can.

If they want explanations, or to discuss things… they will get in touch… but they will not be banging on your door…

Hi Marie

Better in my view to declare them now rather than not declare them and as for the dates, I would suggest not to worry unduly about that aspect.

We have two principal UK accounts and I’m buggered if I can remember the dates they were opened - possibly some 40 plus years ago.

Declaring them now will be the correct thing to do and if the fisc really want to know dates, they can do one or both of two things, they can request the information from UK or ask you to elucidate. Somehow, I doubt they will and if you are closing some this year, then don’t forget to include the date of closing on next year’s return. You’ll find that the software doesn’t demand a date in either field.

Thanks Stella, this has been keeping me awake for the last few nights. I have had other problems with my declaration last year (unrelated to 3916 of course) which took ages to solve, I so dread to see a letter in the postbox these days.

I’ll get this right eventually!

Marie

Thanks Graham,

I agree, now that I’m aware I’ll declare them all, I am worried about the fines though. I’ve been chasing banks in New Zealand and Australia the last couple of days to ensure they are all closed, no-one seems to be getting back on opening and closing dates either. I’ll fill in what I can and hope for the best.

I’m glad I stumbled across this thread

Marie

You only have one option and that is to declare the accounts. Presumably you have not been hiding considerable amounts in multiple accounts so all you will be doing is normalising your position. I can’t see that any tax office would see that as unusual.

The fines are there to discourage would be tax evaders and people illegally hiding assets.

Some time ago there were anecdotal reports of lots of people getting substantial fines for not declaring accounts which I think served its purpose in ensuring compliance and people are now more aware of what they have to do.

Personally, I wouldn’t worry unduly about it. You will now be setting the record straight so breathe and relax… ![]()

Thanks David,

No! Absolutely no huge sums of money. Some are student accounts from 20 years ago. I have a UK savings A/C (I lived there for 9 years, it’s not an ISA though) and a UK current A/C that I use for a regular direct debit, so I transfer from my French A/C to this one a few times a year but just the minimum to keep open. I declared my non-residence to HMRC when I left

The empty ISAs bother me, I feel I need to declare these somewhere other than 3916 but if there’s nothing to declare.

I’m just worried (like Alisha above) they will find it unusual that I’m declaring these now and not in the past few years. I’ve read other blogs and it seems that they are justified in fining for multiple undeclared accounts for multiple years. I know there is a buffer for small fiscal errors but I’m not quite sure what is considered a small error or not

Marie

Thanks Graham…I’ll have a long time to wait and see if anything happens

We had 12 accounts to declare with different banks/purposes - mostly with very little in them unfortunately. I also closed a couple of redundant accounts.

Next year should be simpler as they will not need declaring again hopefully.

IIRC it is only necessary to mention accounts opened, used or closed in the year you are declaring. So if you are declaring closures in 2020, the accounts you ave previously declared will still be listed in your 2021 (for revenues 2020) declaration (if on-line, they will be re-listed automatically) and if you add a closing date, they should disappear from your next following return.

The term “used” is an interesting one though… I believe this to mean “in use” i.e. existing as opposed to actually making transaction to/from it (and that is probably the safest option).

Just wondering, is there a special place to disclose tax-free UK savings on the form 3916? I know I have to register my ISAs here but surely I have to disclose more detailed information on these somewhere?

The income from UK tax free savings should declared as they in all probability are not tax free in France in the same way that winnings from UK Premium Bonds are regarded as taxable here.

I would guess that if they are bank associated, the bank should be declared on 3916.

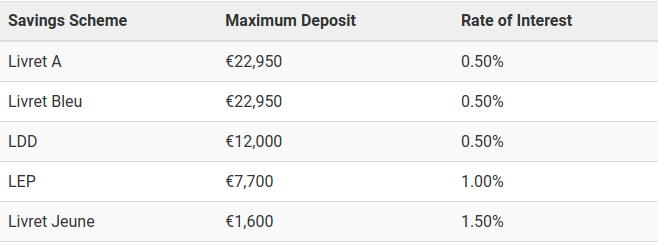

Maybe time to consider moving the investment in those tax free UK vehicles to French based ones - Livret-A , LDD, LEP, LEP etc.

Rates table here:

That way you won’t have to declare them on your French tax return and the interests are probably not much different anyway (are they?) and remember that you can have one of each account per person…

If you qualify to set up Livret Jeune the rate is more lucrative. IIRC the LEP tax free interest is dependent on your tax status - if you don’t pay tax, you qualify tax free but you have to prove to your provider each year with a copy of your tax advice (which they copy and stamp to prevent multi-use with another provider).

Thanks Graham. I have kept them in UK for now as I will probably move back in a few years although don’t know when.

The problem is form 3916 doesn’t ask for any amounts associated with tax free savings so I think I should be entering this information somewhere else. I think form 2047 - do you have any experience in this?

Sorry no. All our assets are here in France now but I recall after selling our UK home (which was done before we moved), we invested a substantial sum of the proceeds in Premium Bonds knowing that we’d call it in when we bought something here. The rest in a UK bank (France declared) for liquidity as we were inactifs. Any interest gained was declared as required on French tax returns.

The bond holding wasn’t declared (I was advised we didn’t need to as the holding was placed before we moved to France) but the winnings were on which we paid tax and cotisations (before we got S1’s on retirement) as I recall.