Yes explicitly, They also mention a form called the "Foreign Tax Credit " Have you heard of this?

Only by americans…but I guess a similar system in that were to have been charged tax on this pension by France you could reclaim it. But since you haven’t been charged any tax you can’t!

Edit….I think that might be the confusion. When you look at your avis d’imposition does it have a “credit d’impôt sur revenu étrangers” amount that effectively cancels out the potential tax? This is on top of the 10% abatement.

You have said you are being charged tax on your government pension, so where does that figure in your avis?

I get an abatement of 10%. So this is where I am confused, they allow an abatement on my received pension so there is an amount that is not abated which is being taxed on and my argument is that HMRC insist that the total pension should not be taxed. I do understand the way that the French system works but common sense tells me that I am being double taxed on a part of this pension if not in it’s entirety and this clearly contravenes the DTA.

So there is no line that says credit impôt sur revenu étrangers further down the avis in a separate section? As this is the credit for the hypothetical tax, which means you pay no tax on it.

The abatement makes sure it’s fair, but that is entirely different from the tax (that is calculated but you don’t pay). And the last time I calculated it I was actually in profit because the actual tax I paid in the UK was less than the reduction I got here. But it can go either way.

Yes there is a credit impôt sur revenu étrangers however it is less than the pension I actually receive . Again the difference between the two figures is what I’m being taxed on and that figure has already been taxed at source. So, am I must be paying tax twice on the difference. here’s the thing, I was a senior civil servant for over 32 years and the amount of tax I’m actually paying in this country is negligible but there is a principal here that makes me want to argue this point to it’s logical conclusion. It’s not about fighting city hall it’s about the French accepting that when an agreement has been reached between states in this case the UK/France Double Taxation Convention signed on 19 June 2008 which then entered into force on 18 December 2009 and took over 5 years of damn hard work to secure which then is completely ignored because someone in a provincial tax office thinks ‘French Law’ supersedes international agreements then I get quite irate. No offence to you but I’ll continue to fight the good fight.

Fight away……Really not sure what relevance it has, but I too was a senior civil servant and I’m not joining you! On my avis d’imposition it is clear that there is the “montant déclaré” which is the total (we have other UK income that is included in this) then “montant retenu”and the “montant réduction”.

The difference between the two figures you mention (ie pension less abattement) is what is used to calculate your overall RFR. The montant déclare is used to hypothecate the tax. As I recall the actual tax is the montant retenu, which you immediately get back as montant réduction.

Yes once could say that you are hypothetically paying tax on it, but that’s only on paper.

Can you describe where on your avis you actually pay tax on your pension?

(Edit - and do let us know how you get on with your fight! It will help others)

I’m not sure where on my avis where it says how much I have to pay but they send me a tax demand every year. So while you might say that I’m hypothetically paying tax in fact I am in actuality paying a tax bill every year and just to clarify I’ve just had a demand from 2019/20 to pay 3500 euros.

Lucky you, I’m looking forward to being rich enough to pay income tax ![]()

You have filled in the France Form Individual haven’t you? Doesn’t apply to your civil service pension of course but seems to help get things right.

I didn’t realise we were discussing a tax retunr from 4 years ago!

Does this help you see why we are all saying you are wrong. It is an extract from the French Government Tax Manual. Full link below

Octroi d’un crédit d’impôt

S’agissant des conventions fiscales conclues par la France, pour les résidents, deux méthodes d’élimination de la double imposition sont envisagées :

- méthode 1 : l’octroi d’un crédit d’impôt égal au montant de l’impôt payé dans l’autre État à raison des revenus de source étrangère dont le résident de France est le bénéficiaire. Dans ce cas, l’impôt étranger doit avoir été établi conformément aux principes de la convention applicable et le crédit d’impôt sera limité au montant de l’impôt français calculé à raison des mêmes revenus ;

- méthode 2 : l’octroi d’un crédit d’impôt égal au montant de l’impôt français correspondant aux revenus de source étrangère dont le résident de France est le bénéficiaire, sous réserve que le revenu ait été effectivement imposé dans l’autre État, quel que soit toutefois le montant de l’impôt effectivement perçu dans l’État étranger concerné. Dans ce cas, la méthode de l’imputation conduit à l’exemption des revenus de source étrangère.

Pour la méthode 2 évoquée au II-B § 43, le crédit d’impôt est égal au produit de l’impôt sur les revenus de source française et étrangère par un ratio comportant au numérateur le revenu de source étrangère considéré, et au dénominateur le revenu net imposable.

Il est précisé que le revenu net imposable se calcule par imputation sur le revenu brut global des charges déductibles liées à la situation personnelle et familiale et des abattements spéciaux pour personnes âgées, invalides ou enfants à charge ayant fondé un foyer distinct.

Le calcul est donc le suivant : crédit d’impôt = impôt sur les revenus mondiaux x (revenu net catégoriel de source étrangère / revenu net imposable).

One option you might consider (may have already considered?), if you have been specifically advised in writing of the above by HMRC, is to request a referral to the Competent Authority responsible for the UK/France DTA. As you may know, this is a senior HMRC officer who is responsible for discussing - and seeking to resolve - issues arising under the DTA with their French opposite Competent Authority number.

If HMRC genuinely believe they have (somehow!) persuaded the French authorities to exclude your particular type of pension from any and all tax calculations in France, directly or indirectly, then the authority for reviewing and resolving the implementation of that lies with the Competent Authorities. Obviously I haven’t seen the full wording of the email to know what HMRC believe the scope and extent of any exemption to be. I also don’t know from which part of HMRC the email came from. I assume it’s from an International-type Division officer with authority to state this (rather than somebody ‘freelancing’ from elsewhere in HMRC!?)

It is not totally unknown for tax authorities to have special bilateral arrangements for dealing with very specific, niche situations, particularly ones that are probably relatively rarely encountered day to day in DTAs.

Please do let us know how you get on, regardless of whichever route you do go down.

Thank you, I have already started the process of appeal and clarification not only from HMRC but also the mediator from the French tax office

But this isn’t rare! Of the, say, 75,000 retired British people in France a goodly chunk will be retired civil servants (senior and otherwise! ) ,military, local authority, police etc. Probably similar proportion to the number of people on here with UK Government pensions.

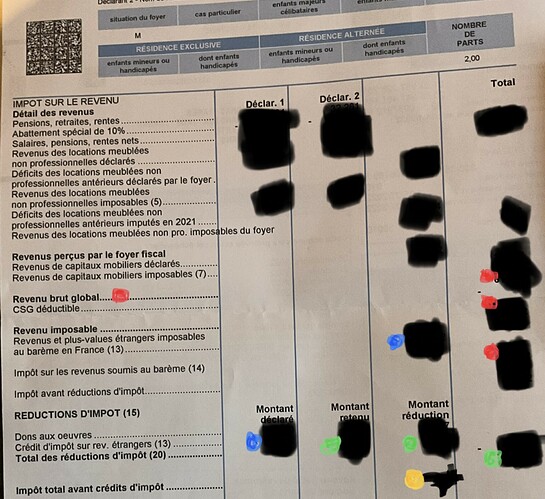

As a final gasp to show Richard what I mean here is an extract of our avis and the way I understand how it is calculated. Hopefully adequately masked, and similar to other with similar pensions.

The pink shows overall income (revenu brut global) and then the amount of that which is subject to French tax (revenu imposable). Below that is the line that shows what that tax would be (impôt sur les revenus soumis au barème 14).

Then the first blue figure is the amount already tax paid in UK that is subject to French rules (revenus et plus-values étrangers imposable au barème en France). This figure is repeated a few lines down against crédit impôt sur rev étrangers. Then the green figures are the proportion of this that is affected by the credit impôt, and the montant réduction should then be the amount that is DEDUCTED from the impôt figure marked in pink a few lines up.

Leaving you with the smaller figure in yellow which is the tax due before other deductions, Which if you work it through shows that you have not paid tax on your government pension!

I was not referring to the number of retired UK civil servants in France!

I was actually referring to the type of pension Richard highlighted above, (s641 ITEPA 2003) and the one specifically mentioned in the DTA, ie people receiving ‘war wounds/disability’ type pensions (probably not the right term, apologies) eg from service in the armed forces. I think and suspect it’s not inaccurate to describe the numbers of people likely to be specifically affected by this under the UK France DTA to hopefully be relatively rare. Happy to stand corrected.! I was trying to suggest that for DTAs there are often special arrangements for the less common situations (which are often unpublished).

I hadn’t picked that up, sorry!

So if this is the pension Richard has then I will have to eat my dwindling supply of hats! I had understood a standard civil service pension.

If things are not straight forward… there might be areas of confusion on both sides.

It could well be that a Declaration has been incorrectly completed… who knows…it’s not unheard of…

Maybe the Tax Folk are not understanding the actual situation…

Whatever… it will be interesting to hear how the investigations turn out…

Yes that is a possibility. I know a lot of people need time to get their heads round how to declare correctly, and put things in the wrong boxes. Which of course results in having to pay the tax here and reclaim it back from HMRC. Slow and frustrating!

It’s good isn’t it. People spend time trying to provide sensible advice/explanation/help and then not so much as a holding reply while wait to get rdv with tax office, let alone any sort of acknowledgement,

My current presumption is that Richard has realised that he filled in return incorrectly in 2019, so no option but to pay and reclaim from HMRC. And in subsequent years his correct return has been treated correctly, even if not to his liking.

Thank you, I have already started the process of appeal and clarification not only from HMRC but also the mediator from the French tax office

I doubt there’s much more to say… until the appeal/clarification has been finished… and bearing in mind that the poor chap is dealing with Govt Depts on both sides of the channel… things could take quite some time… ![]() (certainly longer than 3 days)

(certainly longer than 3 days)

I understand that, and would’t expect any sort of update for a long time. But I find it slightly off-hand not to post a single word….like “thanks”. This is not Facebook.

not so much as a holding reply while wait to get rdv with tax office, let alone any sort of acknowledgement,

When I needed an rdv, I did it through the online portal and got an acknowledgment straight away, followed by an email the next day with an rdv. All the info was visible on the portal. It was quick and straight forward. The fact that they cancelled the appointment the day before it was due, after waiting 6 weeks, with no explanation was not so good.