My wife and I are British and are residents in France. My wife gets the ordinary state pension and I get the state pension and a pension from working in the Civil Service for most of my adult life. I have been told by HMRC that as this pension falls within Article 19 of the Double Taxation Agreement and taxed at source (and cannot be reimbursed by HMRC) and therefore should not enter into the calculations for tax purposes by the French tax office , however I am been taxed on all three pensions added together with a percentage of the total set aside. My question is this: is there anyone on this forum that gets a Government pension which is taxed at source and falls within the remit of of Article 19 within the International Double Taxation Agreement. Secondly has anyone challenged this with their tax office and if so what was the outcome? Thank you in anticipation.

I don’t have my pensions yet, but I’ll be similar to you. My understanding is that you declare the income in France and the tax paid in the UK, which offsets any French tac liability.

If you do Facebook, then join the group Strictly Fiscal France where there are a number of very good documents and people who know his inside out.

Yes, precisely that. The civil service pension is taxed in the UK and then entered onto my French tax return as required by French legislation to declare your worldwide income.

As a French resident the Double Tax Treaty comes into play, but the French legislation is also paramount. So your UK Government pension is subject to French tax with a credit equal to the French taxes that would otherwise be payable. This is entirely in accordance with the DTA.

Of course the pension amounts can take one into a different band of taxation here.

If you look at your avid d’imposition there should be an abatement, and then a tax credit.

Thanks for this Jane however my point was that although I do get a tax credit which is removed from the tax calculation the balance is still taxed by the French and this is the portion of my pension that I have already paid the tax on. Ergo - I am being taxed twice on an amount of my earnings which is in contravension of the DTA.

I suggest you go to your local Impots office and speak directly with them.

Some years ago, a French Tax Official carefully explained that Worldwide Income is looked at to decide if Tax is applicable… and at what levels etc etc…

Any UK Tax already paid, is looked at… to see how it fits with what France reckons is due…

If UK Tax comes to more than France would charge… tough luck… France does not refund UK paid tax…

If France wants to charge more than UK have … you pay France the difference…

Hello Richard,

By any chance were you working in Paris in the early/ mid 2000’s. If so we may know each other.

Hi Stella, Was there yesterday and met with two french tax officers who refused to accept the DTA and just kept repeating “it’s French law”.

If they’ve taken “UK Tax Paid”… into account when calculating your Tax balance due to France … then I can understand their comment. ![]()

Is that the 10% abattement? And the the rest will be taxed according to the French income tax rules, and then this tax credited back to you further down your avis. Which may not be identical to the tax you paid in the UK, but this is how the DTA works.

Just looked at our last avis. 10% is taken off total sum of pensions as abattement.

Then further down we have the actual amount of impôt, the % of which depends on your total income, before reductions

Then in next section the credit d’impôt sur revenu étrangers amount will reduce your tax due.

The double tax treaty doesn’t exonerate you from French tax obligations.

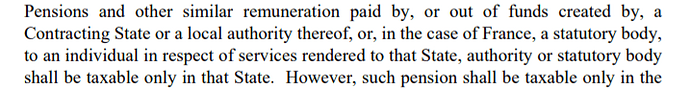

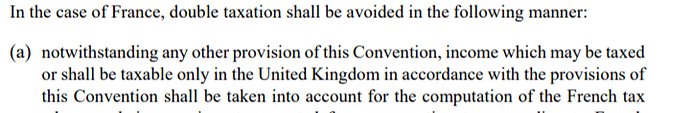

It seems to me that the French authorities are following what the DTA prescribes. Here is an extract from Article 19 dealing with government pensions, plus an extract from the avoidance of double taxation Article 24 and finally the French tax authorities own DTA

guide.

Personally I’ve always thought the DTA term ‘taxable only in country X’ to be something of a misnomer and misleading, for the reasons you’ve found and Jane has outlined. Yes, the actual UK pension income is not directly taxed in France, but it clearly can have a knock- on impact on your other taxable income here in France.

The technical term is exemption with progression (EWP) or ‘taux effectif’ in French. DTAs between Anglo Saxon countries typically completely exempt such pension income from having ANY impact in the country of residence, and broadly speaking, Continental European countries favour EWP…

Or another way of putting it

“The effect of the DTA is always a credit for the french tax which would have been paid, not the UK tax which has been paid “

While not a ex-UK public sector employee, when in the past I’d other questions on this I read the UK DTA (and the Ireland/France one too). They’re quite short documents, especially if one focusses on the specific areas of concern.

As I understand it (in simple terms which might not apply to all situations), tax is calculated on total worldwide income and then you receive a credit equivalent to the French tax that would have been due on your UK imposable income.

For example:

Taxable Income as follows:

UK rental taxable in UK 10,000

Other income taxable in UK 5,000

UK State pension taxable in France 9,000

Total income 24,000

Tax due in France on 24,000 = (24,000 - tax free allowance, say 10,700) = 13,300 * tax rate, say 11% = 1463

less: Deduction re UK income = ((10,000 + 5,000)/24,000) * 13,300) = 8312.50 @ 11% = 914

(ie ‘UK taxable’ divided by ‘total’ multiplied by ‘taxable in France after personal allowance’

Tax due in France = 1463 - 914 = 549

Please note this is my understanding of how it works, the example is for one person and doesn’t include various French abatements etc. I’ve just given the example to show that you can end up paying tax in France even if your only taxable income in France is a UK state pension which is less than the French tax free allowance.

Tres compliqué ![]()

Perfect.

No sorry Wozza, I’ve been in the Aveyron for 18 years. I bought a Hotel/restaurant here and ran it until 3 years ago when I retired

Thanks John, although I have a copy of the official DTA the document you’ve recommended is by far more comprehensive so thanks very much for this

Thank you Jane, but yes it does. Article 19 of the DTA is quite explicit. Quote “(b) the pensions referred to in section 641(1)(a) to (g) of the Income

Tax (Earnings and Pensions) Act 2003 and benefits paid by reason

of illness or injury following the termination of service in the

armed forces or reserve forces referred to in section 641(1)(h) of

the Income Tax (Earnings and Pensions) Act 2003 and injury and

disablement pensions payable under any scheme made under the

Personal Injuries (Emergency Provisions) Act 1939 shall be exempt

from French tax, regardless of the nationality of the pensioner” Unquote

They are exempt from French Tax, as you get a credit for it! But they are not exempt from being considered within the French tax system along with all your worldwide income as you are legally required to disclose as a French resident.

Two French tax officers have told you this, George, Amanda and I have told you this, so I’m not going to argue with you if you don’t believe us.

The main issue that I guess that’s really grieving me is that the HMRC are absolutely adamant that a pension that falls within article 19 of the DTA (which is mine) should not enter into any calculation for tax purposes in any country that is a signatory of the DTA. I have an eMail from HRMC that confirms this.

“Should not enter into any calculation”. Does it say that explicitly?

I think you might find other French legislation that allows it to be considered in order to assess the barème. And as a French resident and tax payer you are subject to French law.