My accountant held a presentation recently about the imminent introduction of electronic invoicing to French business life.

Why is this important ? VAT collection, or rather, the perceived lack of adequate VAT declarations by a vast majority of French businesses (whether deliberately or through genuine mistake).

When is it coming ? From September 1st, 2026, all French businesses must be capable of receiving electronic invoices per the established norms and format.

From 1st September 2027, all businesses that collect VAT on their invoices must be able to emit invoices according to the new electronic formatting norms.

One thing to note is that even those businesses not normally subject to VAT collection, e.g. “microentrepreneur”, and “personnes morales bénéficiant du régime de la franchise de base” will also have to sign up, or implement an electronic invoicing system capable of receiving and emitting electronic invoices, and generating an E-report, even if they don’t normally have to include any VAT in their invoicing. The stated aim for the fiscal administration is fraud prevention and being more quickly able to determine whether the turnover ceilings have been exceeded.

The determination as to the type of business entity (small, medium or large) is made from the standpoint at January 1st, 2025, on the basis of the previous year’s annual return, or from when the subsequent annual return is made after that date.

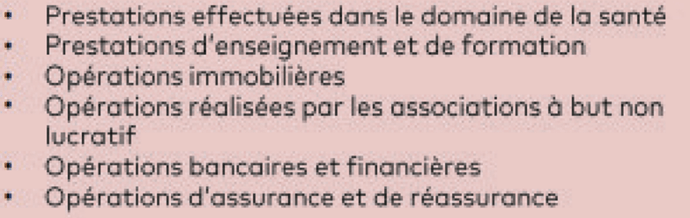

Activities that would normally fall under the application of VAT, but which are excluded under Art 261 CGI:

See also here.

Excel, Word, PDF, images, or handwritten invoices will no longer be acceptable, nor will they be able to be sent via email.

The accepted normalised formats are UBL, CII or Factur-X.

The fines for non-compliance are:

- 15 Euros per invoice up to a maximum of 15K€ in any one year.

- 256 Euros per invoice incorrectly transmitted up to a maximum of 15K€ in any one year.

The platform you use for transmission of the electronic invoice needs to be certified by the French fiscal administration.

E-reporting will be obligatory for invoices made out to businesses established outside of France, irrespective of where they are located. What this means is that even if the entirety of your activity is with non-French based entities, you will still be under an obligation to transmit the data in the normalized format via an accredited platform, for reporting purposes vis-à-vis the French tax administration.

With regard to the receipt of payments, E-reporting will also be obligatory for services billed and paid. A very small number of exceptions to this general rule will continue to exist, e.g. reverse charge operations in inter-EU member state commerce.

At a minimum, the majority of people running a business registered in France will be subject to the E-reporting obligations.

Deadlines for transmission of the invoicing/billing transactions.

- for businesses with a 1 monthly VAT return:

- operations between 1st and 10th of the month, by 30th of that same month;

- operations between 11th and 20th of the month, transmission by 30th of that same month;

- operations between 21st and 31st of the month, transmission by 10th of the following month.

- for businesses with a 3 monthly return:

- for any given month, transmission by 10th of following month.

- for business using simplified return scheme:

- for any given month, transmission between 25th and 30th of following month.

- for businesses with a basic rate of VAT subject to annual turnover:

- for a given 2 month period, transmission between 25th and 30th of following month.

Some of these transmission requirements may be subject to change by the administration in the future, e.g. the 10 day system.

Deadlines for reporting payment transactions:

- businesses already subject to 1 monthly or 3 monthly reporting, transmission by 10th of the following month;

- businesses already subject to monthly simplified VAT regime reporting, transmission between 25th and 30th of following month;

- businesses already subject to VAT base rate based on annual turnover with bimonthly reporting, transmission between 25th and 30th of following month.