Im currently filling out french tax returns and form 3916.

In regards to foreign bank accounts. Do you declare business accounts? As in limited companies where you are a director of that company, so have access to the accounts. But it’s not an account under your name, its under the name of the limited company which you’re a director.

Would you declare those as well?

Hi @mhadley1984 welcome to SF

To be on the safe side, yes - absolutely. There are places on the 3916 (online version or paper) to facilitate advising the structure of the account, society etc.

My guide here explains the completion process of this form.

where abouts on the form?

I suppose my worry is, i’ve been in france 3 years and never declared these as didnt think they counted.

So i worry they could go back and fine me for the years i never declared them

Don’t worry about that. Better to declare than not. The fines are often levied when they find out you have not regularised matters.

Look through the guide… it may help.

1 Like

agreed. i think i would click that im power of attorney on the account i think.

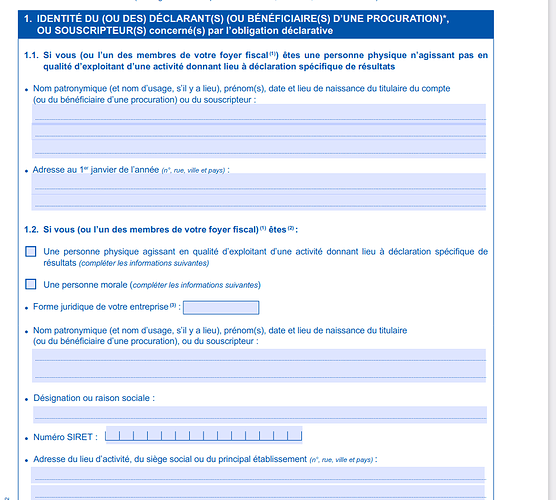

section 1.2 perhaps

You fill out one form for each account.

I would say “un person phtsique agissant en qualitie d’exploitation d’une activitie” translated to mean “a natural person acting as the operator of an activity”

Are you filing on paper or online?

I’ve never declared these I must admit since the business is the business, nothing to do with me as an individual whether I’m a director / shareholder or not.

im filling it in online

online your asked:

Modalités de détention du compte bancaire ouvert, détenu, utilisé ou clos à l’étranger :

(cochez la case utile)

Un des membres de votre foyer fiscal est :

Titulaire en propre du compte bancaire à l’étranger

Bénéficiaire d’une procuration sur le compte bancaire à l’étranger

Followed by:

Dans le cas d’une procuration : renseignements concernant le titulaire du compte bancaire

(cochez la case utile)

le titulaire est une personne physique

le titulaire est une personne morale

that has always been my understanding, so i never have either.

1 Like

Yes, basic company law, here, the U.K. and wherever else would suggest so. I can’t, as a company director, just go strip all the cash from the accounts if I fancy as it would be against my fiduciary duty as a director, it’s not my money it’s the company’s, and I get no benefit from it outside of dividends that I would of course declare, so it never made sense to declare them. But this is pure uneducated opinion so don’t think I have anymore information than you

@graham is the impots whizz so definitely consider his thoughts more valuable than mine, I’m just a fool stumbling blindly behind a keyboard!

exactly. thats why i never bothered declaring them. however i thought i would ask what other people did.

i’ve nothing against declaring them personally. i just want to make sure i do it right so dont get a big fine.

I found nothing online answering this question despite a range of varying google searches.

ah but @kirsteastevenson if you have access to the account and this is a anti-money laundering exercise essentially, and the account is based in the UK, I would take the more cautious approach and declare it. If the Fisc aren’t interested, then so be it but at least you have attempted to comply which is the safer route, yes?

1 Like

Very good point. I guess the best thing is for someone to ask and see what’s said!

go with that one… “Beneficiary of a power of attorney on the bank account abroad”

If the Fisc have a question about it, they will ask for clarification.

Thank you then which of these would you then go for. the 2nd one seems to bring up the options of entering a company

well, either really… physique is a “natural person” and morale is a"legal person". The least worst case perhaps is the first in that case as it goes on to refer to “aggisant en qualitie d’ecploitant d’un activitie donnant lieu a declaration” translated to “acting as an operator of an activity giving rise to a declaration” which seems more appropriate in my view.

I don’t include my ltd account - it is a third party legally - and it doesn’t give rise to a declaration in france. But we all make choices.

My reading on that is the ltd being a third party is enforced via the UK - there’s anti money laundering controls everywhere. What a UK company does is none of imports concern being blunt.

But that’s how I chose to interpret it - they have all my personal accounts so if I’m on the fiddle they can check - if my companies on the fiddle HMRC would be the authority.

But it doesn’t fit a neat French box so we make our choices

I’m following this with interest and wishing this question had arisen a week ago.

As I understand it… French Tax Folk want to know what money we have/can touch… in accounts abroad.

Thus, if one can write a cheque or arrange a transfer of funds to and from XYZ Account… I’m presuming that XYZ Account needs to be declared.

I could have asked the Tax Lady last Monday… but haven’t any plans to make the journey again in the near future… such a shame.

1 Like