On my recently received tax papers ie Tax form 2042 K, there is a typed note ’ veuillez renseigner la declaration 2047 ainsi que le Formulaire specifique 3916’ I have tried without success to find the solution to this question and I am hoping that some reader of this forum can assist me

Do you mean you what to know what form 3916 is ? It’s the form to declare foreign bank accounts. If they haven’t sent you one - just list any non French bank accounts on a sheet of paper and send it back with your tax forms. They need sort code, bank name, branch address, account number and whose name is on account. They don’t need to know how much money you have in the account.

If you have foreign income you declare that on the 2047 and transfer the figures to the 2042. You will have to download and print a copy.

Here’s the 3916

And here’s the 2047

https://www.impots.gouv.fr/portail/formulaire/2047/declaration-des-revenus-encaisses-letranger

Thank you all for your response, Particularly Sue, You provided exactly what I required and I have followed your suggestion

Hi All,

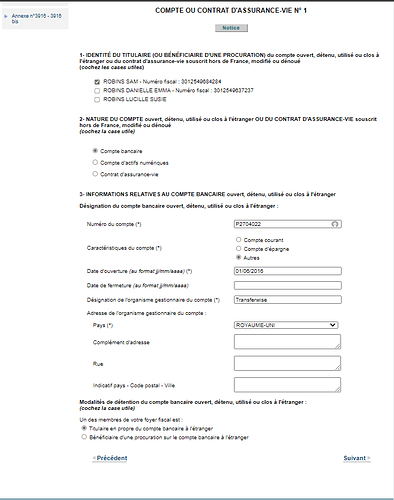

I am also having issues with the 3916 because all the latest literature I have read (French tax notices, government information and 3rd party websites) say that we now have to declare foreign currency exchange accounts such as Transferwise (now “Wise”) and Paypal accounts - I have both.

For example, service-public.fr says the following:

Vous devez déclarer les comptes ouverts à l’étranger auprès d’un établissement bancaire ou de tout autre organisme ou personne (notaire, agent de change, etc.). Vous devez aussi déclarer les contrats d’assurance vie.

However the 3916 form does not seem to be adapted to these types of account. For Transferwise as an example, the money is transferred via THEIR account to my account and they say that I do not have a declarable account with them.

The form also asks you to tick a box saying you are either the open bank account owner or have power of attorney - neither is applicable… so I don’t know how to fill out this section this year (and its doing my head in!).

Transferwise have suggested consulting a local tax lawyer but I wanted to check with SFN, font of all knowledge first!

Any advice / info / clarification greatly welcomed. Thanks in advance,

Danielle