I’m just starting to advertise a part of my home as a Gite on booking dot com and would be grateful for any advice from others more experienced than myself. I know we have to register at the Mairie with regard to the tax de Sejour, but I was also thinking of trying to gain some ‘etoiles’. Other than being a validation of what you are offering I believe that being categorised will lower the taxe de sejour and also the level of income that we are taxed on - is this correct? If so, can anyone recommend where to go to get this classification. I would also like to offer breakfast as an add-on - can anyone advise what we have to do to be allowed to do this? Many thanks in advance

Welcome Marian. There are lots of Gite owners on here so hopefully some of them will see your post.

Best of luck with your new venture.

You have to register with the Marie in general in order to have a gîte. This is the form

https://www.formulaires.modernisation.gouv.fr/gf/cerfa_14004.do

For the taxe de sejour it’s usually best to talk to your local tourist office as in most places it’s them that coordinate this. If you aren’t classified you have to charge a standard percentage of the nightly rate, whereas if you are classified there are set amounts for each level (1 star, 2 star etc) which are usually less. Your tourist office can also advise you which local organisations offer classification services as they vary in price! This gives you an overview

https://www.classement.atout-france.fr/meubles

Being classified and submitting your income as micro-bic will give you an abattment of 71%. Ie you only pay tax on 29% of your turnover and don’t have to submit detailed accounts. You may also need to register for business tax, cotisation foncières d’entreprise, depending on whether this is more that an occasional income. And don’t forget to make sure your household insurers are aware of what you are doing.

We don’t do B&B so I can’t tell you much aboutchambre d’hôtes. I know there is a differemt form to register at the Marie…

Good luck and have fun…you can meet some lovely people.

Brilliant information, thank you very much!

You cannot offer breakfast, that would make you a Chambres d’ Hotes.

You cannot offer any personal services for a charge.

This is because the hotel lobby is so strong in France and has the ear of government.

When we have guests for two weeks we offer them clean linen, but they change their beds themselves.

You need to look at the consequences if you declare yourself as a business.

If you are retired and claim your health through CPAM, that could be affected. When we started we would have had to go to the not fit for purpose RSI.

It all depends how much you want to make from your gite and what your market is.

We’re retired and have healthcare through CPAM and it’s not an issue. What’s the potential problem?

If you want a star rating you have to pay for it and be in Gites de France.

If you declare yourself as a microentrepeneur you needed to change from CPAM to RSI.

As the RSI has changed and we are not microentrepreneurs I am not sure of the exact position nowadays.

You have to work out if you think it is worth it for the amount of business you are doing if you want to claim the higher rate of tax allowance.

We are in the same position as yourselves and declare our gite income on our annual tax return, so no problem there.

You don’t have to get your classification/star rating from gîtes de france - there are a number of other bodies who are authorised and who are generally a lot cheaper than GdF for the classification. I guess the only reason to use them is if you also advertise through them - which we don’t as we think they are too expensive.

It seems that there are different routes to achieve the same thing with many French procedures… we just submit micro-bic through our tax returns and tax office seems ok with it. Very sorry - I made a mistake in my first reply and wrote micro-entrepreneur, rather than micro-bic - whoops!

Goodness, a lot to think about! Thank you for the advice, we will have a good think.

Marian - go with the advice from Jane Jones - accurate and less complicated.

Offering food / drink in any form takes you into another ‘league’ which is much less straightforward that just offering accommodation. Stay away from Gites de France - rip off! As for being ‘classified’ - no big deal but you do need to weigh up if the costs of classification are worth the savings on any taxation for you, and taxe de séjour for your clients. Maybe consider that for your second ‘season’ after you’ve seen how things go?

It’s all doable (thousands do!) - just keep it simple - best of luck!

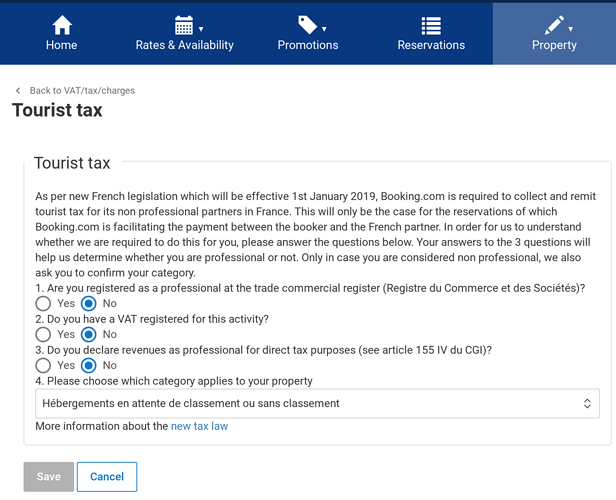

Marian, how have you set up the advert with Booking.com, do they charge, collect and pay over the TDS?

It is certainly something to be absolutely sure about… in case the Owner might find a whopping bill lands on the mat… Is that what you mean @tim17 ??

thanks everyone, I will check how I set up the advert with Booking dot com. I’m still a bit confused about the classification thing. I just registered with the official site for that, and could not create an account as we don’t have a SIRET number. Does the classification thing go along with being a micro-entrepreneur? We don’t expect to earn more than a couple of thousand euros per year if that, and it is less than 50% of our income, so it seems a bit OTT to have to do this. So if we stay unclassified and simply declare our earnings on our tax form, declare ourselves to the Mairie and pay the relevant level of tdS (either through the website our collect it ourselves), are we on the right side of the law?

As Simon has said depending on how your advert with the various on-line companies is set-up either they deal with the TDS or the owner does, in addition some companies will charge the TDS based on full occupancy even if the booking is only for say two people.

thanks Simon, I also filled in the form this same way and have emailed them to ask whether they will be collecting the tax on my behalf as it isn’t very clear!

No problem Marian. As for your SIRET - just fill in form P0i (to start an activity as a ‘personne physique’ i.e. not a company) and give it to your local tax office. They’ll register your activity and issue a SIRET which you’ll need for your annual tax declaration - essentially just adding your gite income onto all your other income. The rates of tax and allowances on your gites income will depend on how you’re set up - as already discussed.

In my opinion (!), based on your projected income - absolutely no need for a micro entrepreneur set-up (or classification!), just go with micro-bic (non-professional) as suggested by Jane Jones. All will become clear on the tax forms you’ll complete in Spring 2020 - no hurry!! Just get the SIRET sorted first.

thank you! It’s a minefield trying to read all the information online, and to have someone explain it simply in English is a godsend!

Agree that no need to become a micro-entrepreneur. You are a louer en meublé non professionnel, as long as your turnover is less than 23,000€, and you can just pop it into your tax return under the micro-bic regime.

I personally think its worth it to get classified. FIrst off the change in the way taxe de sejour is calculated now means that your clients might have to pay more in TdS than they would if you are classified. Also having a good rating helps your gîte jump out of the crowded waters. It’s by no means a primary criteria but if people are choosing between two similar gîtes the classification might sway the choice. I don’t recall having to give our siret number to register, but it was a while ago. We used the local tourist board who are authorised to inspect and classify meublés de tourisme, and it cost 135€ for a 5 year classification…so not a massive investment. Ask your tourist office who can do it in your patch.

However if you are only planning to earn a few thousand I think you should sit down and work through the figures to make sure it is worth your while. Presumably you have worked out what the going rate is in your area, so use that as a basis and then the number of weeks you reckon you’ll get. And then list all the costs! Not just water, heat and electricity, but all the maintenance, replacing bedlinen and equipment, cleaning amd office materials and additional insurance costs. Plus the income tax, CFE, social charges and tourist tax. Then your marketing costs, and so on. By the time we’ve paid for everything our actual profits are 55 - 65% of our turnover, and of course all our time & labour is not counted!

go to the nearest Tourist Office and ask about “classement”