I received a letter from AMELIE, an annual review of my circumstances it says.

Initially, when registering here , I was “inactive”. I have taken my pension early, receiving an income from an Assuranve Vie, it provides enough for us to be above the minimum required income.

Over th course of last year we have created an enterprise here, as an SAS.

My question relates to what AMELIE are asking me to send them, I am hoping my screen works, else the question is pointless…

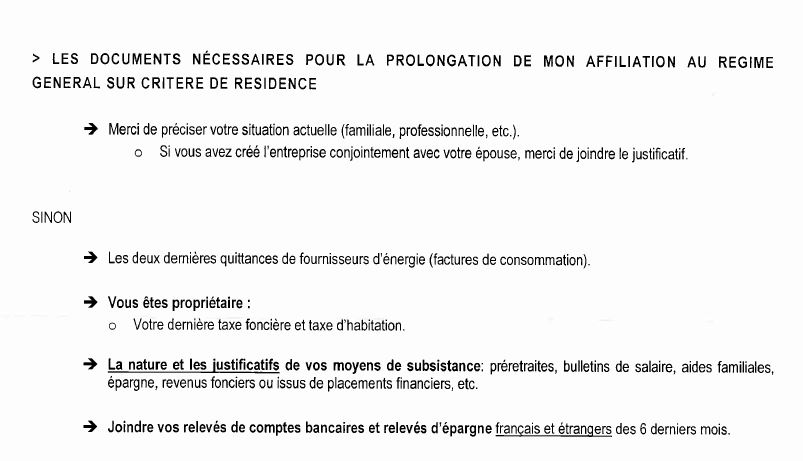

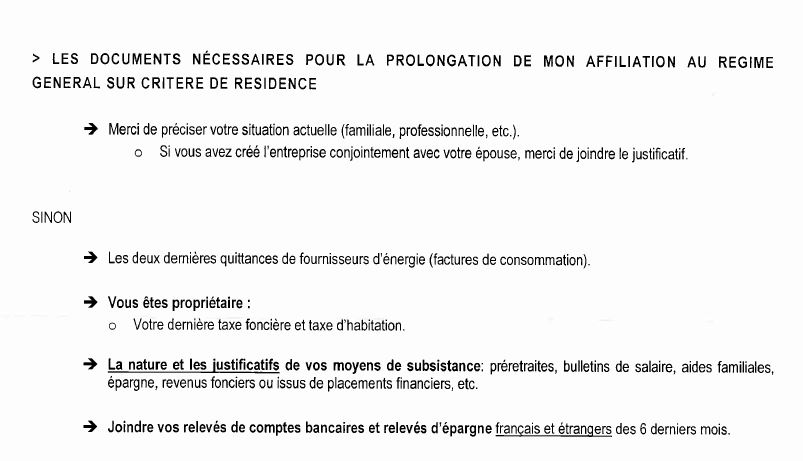

My first interpretation of what I need to supply is that I just need to send the “justificatif” of the enterprise. I have no idea what that is, I am assuming that means the “statuts”. Had I not created a business with my wife, then I would need to supply documents for the other 4 bullet points.

One thing I am learning is to respct official papers, and that such papers may not be entirely logical nor clear in their intent  Is my interpretation correct, or do I also need to supply my avis Taxes Foncieres and Habitation, proofs of income and bank account statements from here and the UK per bullet points 3, 4 and 5 with the company statutes?

Is my interpretation correct, or do I also need to supply my avis Taxes Foncieres and Habitation, proofs of income and bank account statements from here and the UK per bullet points 3, 4 and 5 with the company statutes?

Hi Martin,

My reading of this is that they want you to clarify your current situation relating to both your family, financial, and professional status. You could do this by sending a letter to confirm your personal details (including date and place of birth), marriage status (giving details of your spouse /partner), sources and amounts of income, and details of your ‘entreprise’.

IF you have created the ‘entreprise’ jointly with your spouse, then they want documentary proof of that.

ALTERNATIVELY, if you do not wish to do the above, or are unable for some reason to do so, THEN they want you to send;

- Your last two energy (electricity) bills.

- If you own your home then the most recent Avis d’Imposition documents for both Taxe Fonciere and Taxe d’Habitation.

- Documents proving all your sources and amounts of income from such things as property you rent out, any salary you receive, income from savings / investments, pensions, and state benefits.

- Statements covering both your current bank accounts, and savings accounts, whether they be in France or abroad, for the last 6 months.

I would suggest that the first option is probably the easiest, and that you should enclose copies of whatever paperwork you have that confirms the details you give them.

Drown them in paperwork and all should be fine.

Amelie are going through a process of checking the records to weed out those those who have been ‘flying under the radar’, so send them all the papers that prove you are a longtime and full time resident of France and all will be well.

I think your interpretation is entirely correct, AMELI simply wants to know your status. They need to know this because if your status changes (eg inactif to worker) then that changes the basis of your affiliation, it changes the cotisations you pay and it changes the way you’re charged. It’s in your own interests to make sure they have it right because if you’re paying cotisations via your SAS you don’t also want to receive an invoice for the full cotisations you would be liable for as an inactif.

I’ve never created a SAS but I would be surprised if you hadn’t received various papers along the way to confirm the creation of the business, from INSEE among others - SIREN, name of business owners, date created etc. If you don’t have anything, AMELI may accept an avis de situation which you can download and print off from INSEE at https://avis-situation-sirene.insee.fr/

(click on the orange Avis de Situation button on the first screen you get after you’ve entered your SIREN, and it will generate the Avis)

If you can’t find any of the official state documentation issued when you registered your SAS business, e.g. INSEE letter, URSSAF letter, tax registration letter, then you could at a minimum, order an Extrait K-bis from the Infogreffe website (you can pay by debit card). This document basically resumes when the business was registered, who are its directors, any registered auditors, address, etc, and it is recognised by the various administrative organisations such as the URSSAF.

Yep. I have all the company registration papers. None if those are called “justificatif”. The GREFFE papers and company statuts are what shows me as a director and Jackie as Madame La Presidente. I do not have any problems presenting them to Ameli, question us whether I need to also send the items lusted in the 3rd, 4th and 5th bullet points. That is where I am unclear.

No they wouldn’t be - a justificatif simply means a supporting document.

For instance when you apply for a carte de séjour, you submit your electricity bill / avis d’imposition etc as “justificatifs”.

If you are sending this then you don’t send the other documents.

2 Likes

Is my interpretation correct, or do I also need to supply my avis Taxes Foncieres and Habitation, proofs of income and bank account statements from here and the UK per bullet points 3, 4 and 5 with the company statutes?

Is my interpretation correct, or do I also need to supply my avis Taxes Foncieres and Habitation, proofs of income and bank account statements from here and the UK per bullet points 3, 4 and 5 with the company statutes?