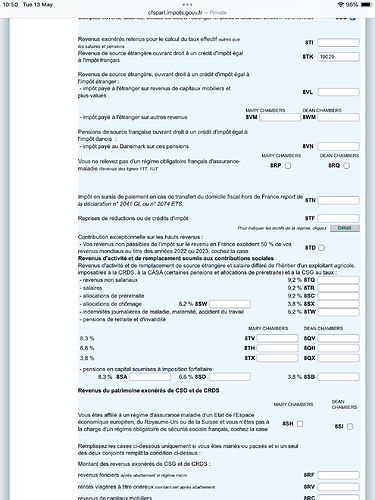

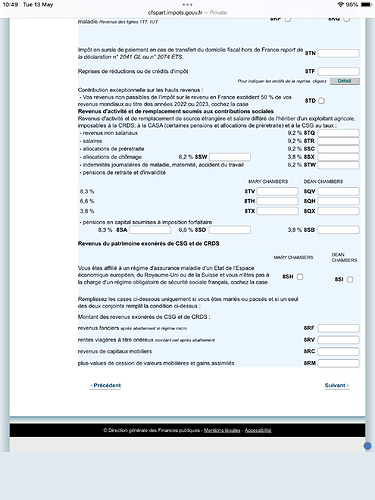

Bonjour everyone. I know everyone is stressed at this time of year so sorry for the post but I am really struggling with the online tax declaration. If anyone can help I’d be grateful. I only have a Teachers’ Pension (Govt) which I have put in 1AL. My husband has an Industrial Injuries Disability Benefit (IIDB Govt?) which I have put in 1BL. He also has a Mineworkers’ Pension (Private) which I have put in 1BM. We are both inactive early retirees, do not have S1s and are in the French health system. When I move on, I get this message and this is where I’m completely lost as to which figures to put where, even though I have tried to read 2041GG. (I have put the TP & IIDB in 8TK). I also don’t know whether I should have completed any other boxes where they have indicated our names. Maura ![]()

Maura,

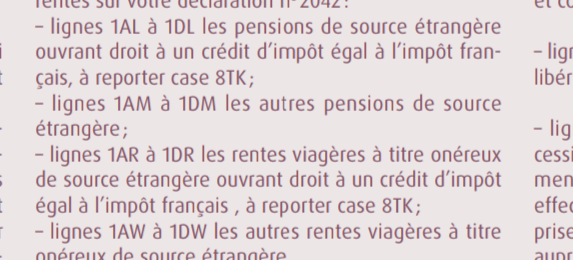

I think that the way you have reported the Teachers Pension and Mineworkers Pension is exactly in line with how France expects you to declare them, according to this extract from Impôts instructions.

I can’t tell from your screenshot etc whether you have also reported them on appendix 2047 for foreign income? If not, you should do so. Section 1,line 12 for both pensions, and section 6 for the Teachers Pension only.

Turning to the Industrial Injuries Disability Benefit, I would be inclined to exclude it from reporting in the various boxes on the return, and instead explain in the ‘Mentions expresses’ (or ‘any other information’ section) box at the end of your return that IIDP is a special, non UK taxable benefit received as a result of industrial injury. Refer to the amount in €. It is not impossible that the Impôts might treat it kindly, and exempt it, but either way by referring to it and the amount, you have discharged your obligations to report it. If the Impôts still consider it taxable in France, then they have the figures. I’ve looked at the tax treaty but it isn’t referenced as far as I can tell. Anecdotally on this forum, we have recently had experience of the Impôts exempting certain similar benefits.

I don’t pretend to understand how you would be expected to report the liability to social charges on pensions shown on your screenshots, but would hope that by reporting them in line with the Impôts recommendations, and by not ticking any of the boxes saying you have S1s etc, the way is open to them to charge you as appropriate. If others have experience of this, hopefully somebody will opine…

I hope this may help.

I concur with @george1 Industrial injuries benefits, as a benefit, may not be taxable in UK or France. There are disability pensions expressly mentioned in the France social security and tax codes.

I would also go further and suggest, as it (sounds like) an exportable benefit, and as he is in possession of it, it qualifies him (and you as partner) for a UK S1.

Also Maura / George, there is express mention of some benefits in the double tax treaty Article 19 / 4 and it may be that the disability benefit is covered by that - you’d need to check the references. (Apologies George if you’ve checked these and it doesn’t cover that!).

Notwithstanding any other provision of this Convention:

(a) the pensions referred to in paragraph (4) of Article 81 of the French

tax code (code général des impôts) shall be exempt from United

Kingdom tax, regardless of the nationality of the pensioner, so long

as they are exempt from French tax;

(b) the pensions referred to in section 641(1)(a) to (g) of the Income

Tax (Earnings and Pensions) Act 2003 and benefits paid by reason

of illness or injury following the termination of service in the

armed forces or reserve forces referred to in section 641(1)(h) of

the Income Tax (Earnings and Pensions) Act 2003 and injury and

disablement pensions payable under any scheme made under the

Personal Injuries (Emergency Provisions) Act 1939 shall be exempt

from French tax, regardless of the nationality of the pensioner, so

long as they are exempt from United Kingdom tax. However,

paragraph 2 shall apply to such part of any income from those

pensions as is not exempted from United Kingdom tax.

Thank you for taking the time to reply George ![]()

Thanks for that info ![]()

Thanks very much for your helpful comments. I had vaguely recalled there was mention of various benefits in the treaty, so had checked out the above references. In essence the only exempt benefits are either for disabilities caused by military wounds, or those civilians wounded as a result of air raids in WW2.

That still leaves scope for France to exempt the IIDB as being equivalent to benefits that may potentially be exempted in France.

Good luck Maura, and please let us know how you get on with this issue chez les Impôts…

Thanks George. I’ve decided to follow your advice regarding not entering but explaining and giving relevant figures via a message. I will let you know how it goes ![]()