No. Not for official purposes

This won’t apply to everyone but one thing we are doing is to put our new house in France in the names of our 4 children from separate marriages, whilst retaining a life (usufruit) interest. This saves any IHT problems on our death as it passes directly to our beneficiaries without tax. Apart from this the Assurance Vie is an amazing tax efficient investment and enables you to pass assets onto anyone you wish thereby avoiding the strict French succession laws.

Best done when buying a new vehicle which we did not do as never gave it a thought back then and OH was paying the finance monthly himself even though the car was for family use. Had to go to the prefecture and get a new CG after the death.

Thank you very much for sharing information about your plans.

I wondered though - wouldn’t this be potentially treated as multiple gifts (ie of the capital to buy the house) to your various children, and therefore,in principle, be subject to French gift tax (albeit with potential reliefs wholly or partly available?)

It may not (hopefully!) apply in your family, but there is also the possible risk of solving one problem and creating another. I’m aware of a property owned jointly by siblings and their other halves which has lead to years of disagreements over the suitability and necessity of ‘improvements’, whether or not to rent out the property as a holiday gite, who takes the rent in return for servicing the gite, and even a death amongst one of the co owners (leading to valuation ‘issues’). It’s not hard to see divisive issues arising around multiple co-owner siblings getting married, separating, divorcing, needing capital/wishing to seek up, dying etc.

I do agree about the tax efficiency of AVs, though as you’ll know, there are limits of 152.5k € per beneficiary to avoid French IHT (depending on the age of the AV investor when making the payments to the AV).

I would have thought so.

And equally agree that AVs are useful but do have limits. Unless one wants to manage many multiple ones. We have 4 and that’s enough.

We have taken advice from our notaire advice and ther would be no gift tax to pay as ther is no actual money being passed over at this stage, it is our money being paid for the property. We retain thé usufruit during our lifetime. If one of us dies the survivor can let the property and enjoy the income. In order to sell everyone would have to agree but we don’t see this ever happening as we also own a property in the UK.

Thanks for sharing the response…I have to say that if I was in your shoes and received advice like that from my notaire, I would be somewhat sceptical!. However I doubt you would want to prolong these exchanges, so I’ll let matters rest but of course would be happy to (briefly) expand on my concerns, if desired. Best of luck with the plans.

You might want to look at this

Well, thank you for your responses . What we are doing is common practice in France in order to avoid inheritance tax when we finally depart from this world. I have to say that I am not a lawyer but would prefer to take qualified advice from our Notaire who has served our family well in France for over 20 years rather than take advice from unqualified members on this forum. We are all fluent in French and quite able to decide for ourselves who to believe.

It’s good to have a Notaire you know well and in whom you can feel confident.

We’ll see you in the afterlife then, and find out who was wrong ![]()

Sorry for wasting your time… Oh er, as the notaire’s role is to collect certain taxes on behalf of the French government, if they’d told me what you believe they tolf you then my position would be exsctly the same as yours : I wouldn’t want to prolong that conversation either. And definitely wouldn’t want to repeat it with them. But for different reasons.

That’s a faire point KarenLot and I appreciate your input. I know of people who have received bad advice from Notaires but am quite confident about this.

Of course. But looking at official sources can still be useful, if only to spark questions. My experience here (25 + years) is that even a great notaire won’t necessarily provide all the info you need if you don’t explicitly ask.

Rules and laws can be changed by any new government. They are out to get more money these days anyway they can and inheritance taxes might come into question. Just saying never take anything for granted, it can change overnight.

I agree.

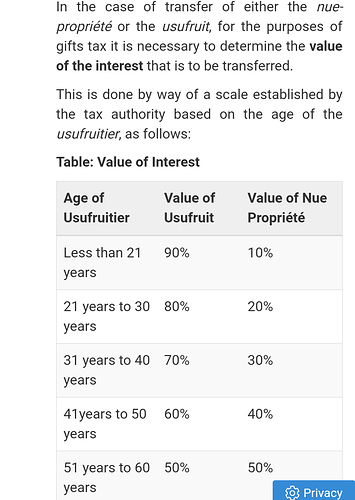

However for anyone else considering this approach, please be aware of the following (which is not at all controversial!). When the owner of a property transfers the reversionary interest (known as the nue-propriété) during their lifetime to their spouse, children etc, that is a taxable event for French gift tax purposes. Significant reliefs (abattements) may be available depending on the relationship of the recipient to the donor (who retains the life interest or usufruit). The taxable value, after reliefs, is based on a sliding scale linked to the age of the donor/usufruitier. The older the latter, the greater the taxable value for gift purposes of the reversionary interest/nue-propriété. You would then normally seek to confirm/establish the gift tax value with your notaire/professional adviser.

Here is an extract from one of the better English language guides, together with a table showing the taxable value of the gift. The screenshot stops early - the full list of values can be found following the link that Jane posted above.

Well just to clarify things, this is a new purchase, not an existing transfer.

4 children would be the héritiers and each part is 26000€ thereby being well below the basic tax allowance of €100,000 per child, as I understand it, as per the excellent article provided by Jane.

This is incrediby long but better than just a link. All about Wills which shouldnt be left to the last minute:

In France, the law governing wills (testaments) is primarily outlined in the Code Civil. French inheritance law is quite structured, particularly in protecting heirs. Here’s an overview of how wills work in France:

1. Types of Wills in France

There are three main types of wills:

a. Holographic Will (Testament Olographe)

- The most common and simplest type.

- Must be handwritten entirely by the testator (the person making the will).

- Must be dated and signed.

- Does not require a notary but should ideally be registered with one to avoid disputes.

b. Notarial Will (Testament Authentique)

- Written by a notary (a legal professional).

- Requires two witnesses or a second notary.

- Dictated by the testator, ensuring legal clarity.

- More secure, as it is officially registered.

c. Secret Will (Testament Mystique)

- Written by the testator or a third party.

- Sealed in an envelope and handed to a notary in the presence of two witnesses.

- The contents remain secret until the testator’s death.

- Rarely used in practice.

2. Key Rules of French Inheritance Law

French law imposes forced heirship rules, meaning a portion of an estate is automatically reserved for children. This is called the réserve héréditaire:

- If the deceased has one child, the child must receive at least 50% of the estate.

- If there are two children, they must receive at least two-thirds (shared equally).

- If there are three or more children, they must receive at least three-quarters (shared equally).

- The remaining part (quotité disponible) can be freely distributed in the will.

3. Can You Disinherit Someone in France?

- Children cannot be completely disinherited due to forced heirship.

- If there are no children, a person can leave their entire estate to anyone.

- A spouse is protected by default but does not have a reserved share like children.

4. Registering a Will

Although a holographic will does not require registration, it is strongly recommended to have it registered with the Fichier Central des Dispositions de Dernières Volontés (FCDDV), the central will registry in France. A notary can do this.

5. What Happens If There Is No Will?

If a person dies intestate (without a will), the estate is distributed according to the French legal inheritance hierarchy:

- Children and descendants (if any).

- Spouse (if no children).

- Parents and siblings (if no spouse or children).

- Extended family (if no close relatives).

- The French state (if no heirs are found).

6. Wills and Foreigners in France

- Foreign residents in France can draft a French will.

- Under EU Regulation 650/2012, a foreigner can choose their national law for inheritance matters, but French forced heirship rules may still apply if the estate includes French property.

Going back to the subject of the original post, we have created an electronic file that contains all the relevant details of accounts, service providers such as utilities, house documents, and wills. Copies have been put onto memory sticks and given to our executors. We own our home as ‘Tontiniers’, so when the first one of us dies there won’t be any real change to worry about.

Our Notaire advised us to make wills in our own birth countries, signed and witnessed in our home countries, and appointing an executor residing in our home countries. The wills were made not only under the provision of the EU Regulation 650/2012, but also under the provisions of the Washington Convention of 1973, to which France is a ratified signatory.

When the second one of us dies, the Notaire will act purely as an agent under the instruction of the executor in the foreign land, and the estate will be handled as though the death had taken place in our home country.

Yes, it is a bit of a ‘work around’, but we are assured that it is legal in the same way that tax avoidance is OK but tax evasion isn’t.

Just a matter of the executor acting quickly in some respects, and taking their time with others.

My lovely lady passed away december 2012 aged 56. She always believed she would survive thanks to operations and chemo and her positivity gave her seven years of décent quality of life. When she turned yellowish a few weeks before passing away she knew that the end was close and so planned best possible her departure. She entered hospital (she could have had the bed set up at home but décides it was better for me that she ended her days in hospital) and prepared her plans. The cancer doc told her that he would commence the morphine treatment when decided the time was right.

She asked me to being a few files at a time to the hospital where we worked through the papers to make sure everything was in hand. Spécial attention was paid to the financial side ie Banks’ assurances vies etc.

When she was satisfied all was ok she asked the doctor to start the morphine. T’en days later she passed away very gently.

This system worked for us be cause we had time but I’m sure a more sudden death may have been more problématic.