How much does the pensioner S1 ‘entitlement’ cover?

It does if you’re an independent - one of the only real tax deductibles out there.

S1 entitles a Brit to the same cover as all French folk get… somewhere between 30% - 70% …

From our perspective, definitely worth it.

Both generally in good health and we are proactive in our healthcare.

we get annual blood tests, dental checks, annual mri scan for kidney and prostate, OH has two yearly smear and mammogram. OH is also asthmatic. I have had a lot for f dental work done this year which was fully covered.

So I guess over the period we have paid our mutuelle I can say we have had our “money’s worth” for want of a better expression.

We took a conscious decision to take out a mutuelle.

Takes the worry out of healthcare.

I would n’t wish these on my worst enemy.

Having previously suffered from these, I now take these every day - and have not had a re-occurrence since.

https://www.amazon.fr/gp/product/B01JSE9W2A/ref=ppx_yo_dt_b_asin_title_o01_s00?ie=UTF8&psc=1

So are we and we are careful what we eat. We use homeopathy, acupuncture, reflexology, cranial osteopathy, Alexander, take supplements. Paying directly for such support is a fraction of what we would be paying on monthly cover year in year out if we had a mid-range mutuelle

Yes - fellow patients have described terrifying levels of pain, but I have to say I’ve experienced little. They actually discovered the stones when investigating the cancer - I had no symptoms.

One of the stones was over an inch across, and that kidney completely atrophied - luckily the other kidney is fine. After several lithotrities only tiny fragments of the stones now remain. The affected kidney looks a shadow of the other one on the scans, but apparently is better than it was.

Thanks for the Chancapiedra link - I’m open to herbal and other alternative remedies, but slightly hesitant I must admit - I’ll definitely research it though.

Is this where the ‘top up’ comes into play?

Of course… and the amount of top-up you wish to receive… and thus the amount you are prepared to pay for Insurance costs… is what you have to decide …

Insurance is always a gamble… and it’s up to the individual to think it through and make a decision they can live with.

All of that is a given for anyone who has ever taken out any insurance for anything and considered the extras - new for old/NCB protected/electro-domesticos repairs/hazardous sports travel cover/vet fees…

Friends of mine have a dog which I say they are now renting because it has to have medication for the rest of its life but this was not covered in their pet ins.

I have consulted Fabian’s brochure, featured in another thread. What I do not know and is not explained there, is what the State pays for where there are Xs on the brochure. Without knowing what the policy does not cover which is included in the State health provision, it is not possible to make a definitive decision.

One does not want to pay for something provided under the State health system, nor fall into a hole not covered by a policy or the State.

Does having cover under S1 mean that one does have a FR social security number? It did in Spain.

Show me the bit of the ‘brochure’ you are talking about and I will explain.

The brochure link is in this [short] thread

I tried copying the actual brochure link but got a message telling me that it was not possible [for some tech reason]

You will see Fabian tells the O.P. “No need to go fishing. It’s all here” - link follows.

To answer my question as you have offered to do [thanks] you’ll have to pretend to be me for the purposes of ![]() …

…

Single. FR Social Security Number [assuming the S1 does include this] d.o.b. 20/08/1949.

The brochure then lists the ![]() and

and ![]()

The State will pay the set standard amount/percentage for each of those medical acts. So, for example, osteopathy is not covered by the state health cover so you will receive O% unless you have al all singing, all dancing mutuelle. For most things the state pays around 65%, and sometimes more, but other items down to 15%.

So you need to think about your own state of health.

This link will tell you about each item.

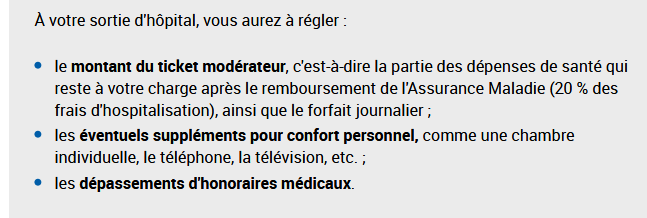

it’s also worth noting that Hospital is only paid 80% by the state… and the remaining 20% plus fees etc … is at the charge of the patient…

(which begins to explain to my why a friend was faced with a potentially horrendous bill, after suffering an unexpected accident… the EHIC did not cover it… and no travel insurance… aaargh )

just take a look and make a best decision…

I used to go to the USA twice a year on photo shoots, back in the 70’s/80’s. Never had any insurance and never asked whether I was covered on the job. I suspect not. Fortunately, the issue never arose.

Then, 25 years after my last visit, at +/- 65 I went to NYC. A tooth started giving me shooting pains at the sligtest pressure - hit the ceiling type pain - then, minutes later, I blacked out. I was gone. No amount of yelling in my ear by my friend had any result.

I came to, feeling groggy and took the advice of the ambulance crew to go to hospital - might have been a stroke. Trip in ambulance - 8 miles. Hospital, a very smart setup in Poughkeepsie, N.Y. a very well-to-do place.

Didn’t take long for the finance dept to get to me. Fortunately, for the first time ever, I had taken a Full Monty policy - as you should if going to the US at that age, with a touch of hyper-tension.

I never saw the bill for 3 1/2 days in I.C.U., having had every test known to man, including cardioscopy. I saw the ambulance bill - US$800.

My father never had a day’s illness beyound a cold all his life but keeled over and died age 77. My mother had a series of h.a.s - 4 or 5 - from her 60’s on. Finally one did for her, age 84.

It is a lottery, indeed.

Does the UK S.1. cover more than would be the case for a FR patient, bearing in mind that the UK NHS pays 100% and the S.1. scheme is a reimbursment procedure?

Stella answered your question above. Copying again in case you haven’t seen it.

Izzy x

Of course. In one ear, out the other …

I have looked at the link posted by Jane Jones. I don’t have any conditions that extend further than very light scrips for specs and statin/hypertension pills.

So it’s a weird, existential game of ‘choose your illness’ in advance. If, like my pa, I’d had no illnesses beyond a cold until cardiac arrest took him down, at 77, I could put money aside for good times or bad.

If, like my ma, I’d already had 3 M.I.s by the age I am now, I’d know which way the wind is blowing.

As it stands, I have no idea.